The Potomac Eagle

https://railpictures.net/photo/800160/

I wasn’t far off with the zombie drink,

https://nypost.com/2022/09/03/top-doj-lawyer-is-ex-partner-of-hunter-bidens-attorney/amp/

That one looks to be accumulating slowly building momo.

I sold a tiny bit of a short to buy something else actually long and never seen a sale of that short or anything so fast before. It was like I was on level 1. Boom sold.

to S&P 4050 or so, that was Master Wu’s call–I am looking to add to my 20,000 UVXY

Definitely could go either way. As you said, a squeeze will come hard and fast.

Just hope gold goes up regardless.

There is some inflation data coming this week. CPI and PPI I think. If the inflation numbers continue to fall then you’ll get your rally.

to try to keep it from getting too outta hand.

So much for that infamous fist bump…

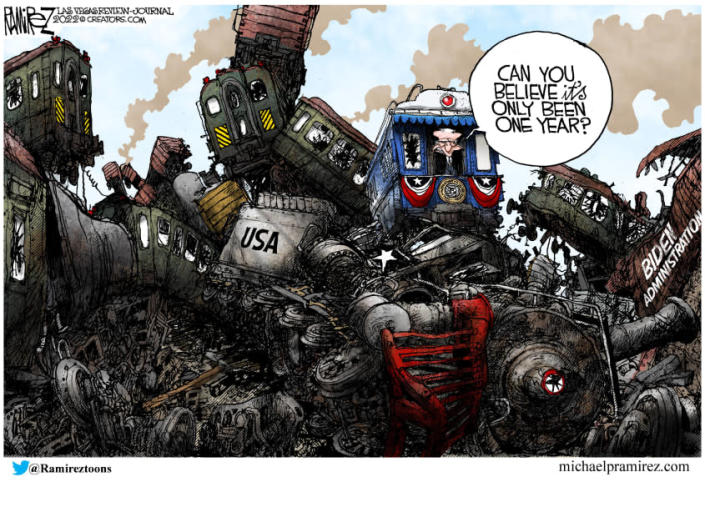

Michael Ramirez | Copyright 2022 Creators Syndicate

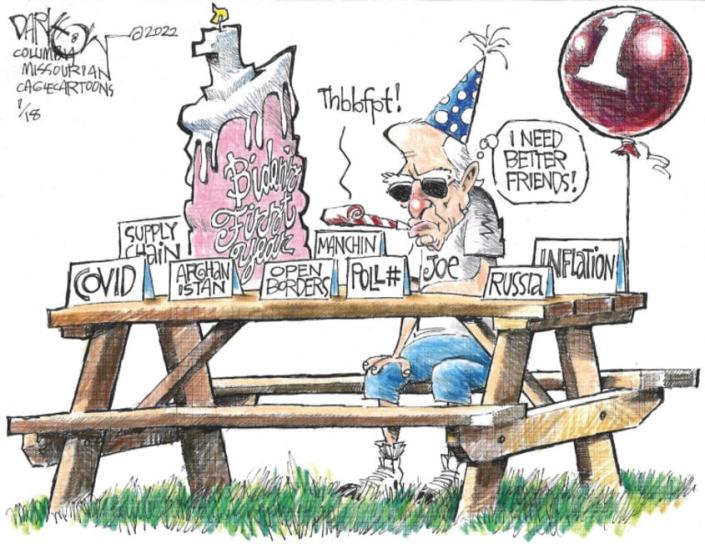

John Darkow | Copyright 2022 Cagle Cartoons

Gary Varvel | Copyright 2022 Creators Syndicate

Walt Handelsman | Copyright 2022 Tribune Content Agency

I am in the minority — by end of Friday, I was holding 9/9 calls, entered last 30-min of trading. Just curious to see, since when, 94% of traders

MASTER WU ON TWITTER==Grandma Crash & 1570-1750: (1) The Big Short just announced his target, 1900 for SPX in this ongoing “The mother of all crashes;” (2) MPW has had a lower target–1570-1750 and a long-standing nick name: “THE GRANDMA”. (check my tweets)

Chile: with 23% counted of a massive turnout, 63% for rejection of the new constitution and 37% for approval. Suggests a crushing defeat for Boric's government and for the far left. Chileans want a new constitution but not a bad one. Up to the politicians to provide a better one

— Michael Reid (@michaelreid52) September 4, 2022

Summing it up, there’s a strong case that global markets are at the cusp of succumbing to Crisis Dynamics, which will be especially difficult to shake this time around. The Super Credit Bubble is at the brink. Quoting Jeremy Grantham: “If history repeats, the play will once again be a Tragedy. We must hope this time for a minor one.” I’m holding out hope, but nothing I see points to “a minor one.”

“20 quid for a pint”

What a tragedy! Establishments that have been in business for many hundreds of years will have to close down because of some stupid political decisions. Europe is headed towards Clusterfuc* City this winter!

Doug Casey has the ring of truth in what he’s saying. There’s some ugly stuff coming down the pike!

Derivatives! Derivatives! We don’t need no stinkin derivatives!

A “perfect storm” of energy hyperinflation “will affect just about every pub out there.

OF FLIGHTS CANCELLED OVER THE WEEKEND IN THE U.S.—FETTERMAN AND BIDEN IN LABOR DAY PARADE!

But that’s irrelevant because they got to get something on him anyways.

Maybe Hunter got a hold of some of their weaponized zombie drugs from the NIH and passed them around at one of their parties.

https://www.newsmax.com/newsfront/documents-declassified-mar/2022/09/04/id/1085948/