Posted by alf

@ 0:00 on June 17, 2022

When online dating in Chicken, there are a few things to keep in mind. To begin with, be well intentioned of other’s culture. Turkish men are often direct within their communication, so be sure to keep abuse to a minimum. When ever talking to these people, it is a good option to use a translator app. As well, be polite, mainly because this will head out quite a distance with these people.

Another essential tip is always to always be interested in the primary time frame. Turkish men are not simply because interested in initial dates and females should not seem uninterested or perhaps unenthused. Tinder, one turkish women for marriage of the best online dating apps obtainable in Turkey, is a popular choice amongst Turks currently in big places. The application is simple to operate and has a more casual mood than other sites.

Another important tip is to use a reputable translation tool. There are plenty of free and paid translating services available. Utilizing a trusted site is also the best way to avoid scams. Be sure to check out reputable dating sites, such https://www.thepioneerwoman.com/home-lifestyle/a77897/at-home-date-night-ideas/ as European or European dating sites. A dependable site should not only help you find a Turkish partner, but it will also furnish valuable information.

One of the most crucial safety tips once online dating in Turkey is to know the dimensions of the language. If you don’t understand Turkish, use a übersetzungsprogramm. While most European people are friendly, it is vital to avoid bothersome them. You don’t want to risk the partnership by aggravating someone. A translator can make it better to communicate and prevent arguments.

Posted by ipso facto

@ 23:03 on June 16, 2022

Haven’t seen you for a while. How’s life?

Posted by Blindrn

@ 21:28 on June 16, 2022

Posted by goldielocks

@ 20:10 on June 16, 2022

Not moi, I’m getting out the popcorn but there is possible plays. With the current demolition there’s plenty of time to get in once the dust settles but I think no I know the WH is gonna keep stirring it back up.

Posted by Richard640

@ 19:49 on June 16, 2022

1. One of the largest quad witching events tomorrow, >3.4 trillion in options

2. Powell speaks at 8:45 AM

3. $BTC.X nearing critical support — 20K being a major psychological level that could get broken overnight, and seems like funds are liquidating some positions AH in anticipation of tomorrow.

Who went YOLO calls or puts or commons for tomorrow?

Posted by ipso facto

@ 19:11 on June 16, 2022

Posted by Richard640

@ 18:11 on June 16, 2022

I agree with

, #Bitcoin is on sale. But I don’t agree that it’s a buy. The problem is that it’s a going-out-of-business sale. Early mark downs are nothing. Just wait until the blowout, final markdowns. The closeout sale will be epic. Be careful, all sales final. No returns.

This is the month the #Fed was supposed to starting shrinking its balance sheet. Imagine how much weaker the bond market would be if the Fed was selling instead of buying. Meanwhile, #Powell talks tough about fighting #inflation in public, yet continues to create more in private.

=

The political reality is that the U.S. economy will be in a severe recession during the midterm elections in Nov. and it will still be in the same recession during the general election in 2024. The main difference is that in 2024 #inflation and the #recession will be even worse!

Many people have finally gave up on the idea of a soft landing, and now expect a hard landing. But they still don’t get it. The only landing possible is a crash, where everyone on board dies. That’s why the #Fed won’t even attempt to land and give up its pretend #inflation fight.

Weekly jobless claims again exceeded expectations and will soon soar as consumers cut back on spending and businesses cut back on workers. June Philly Fed Mfg. fell to -3.3 and May housing starts and building permits collapsed. The home building industry is entering a depression!

Posted by Richard640

@ 18:08 on June 16, 2022

Peter Schiff

·

10h

With YoY consumer prices up 9% in the UK, the BOE’s 25 basis point rate hike today to 1.25% won’t provide any relief. Expect UK #inflation to get stronger as the economy gets weaker. Eventually the BOE must stop pretending it’s serious about fighting inflation and start fighting.

Posted by goldielocks

@ 17:43 on June 16, 2022

I have no hope for the left. They either don’t know what their doing or don’t care. They are full of self interest that see no benefit for them in doing the right thing.

They’ve gone rogue causing detriment even to their own party. Even the right per say low on staff that would find it beneficial go do the right thing,that seems the only thing that seems to motivate a politician expect better off then these radicals on the left.

If they think socialism will save them from inflation they better take a look in the history books. “ All it’s gonna do is take their freedoms and human rights with it and will be too late” Also take a look at all the country’s who lost value of their dollar and see how much gold and silver or certain tangibles items would give them if they had it in that currency.

Posted by ipso facto

@ 16:39 on June 16, 2022

That’s a fact and incredibly irksome to all here!

Pray for sanity!

bbl

Posted by goldielocks

@ 16:28 on June 16, 2022

Hopefully see that the Fed is not only having to raise interest to battle run away inflation but the radical left WH is going to continue to cannibalize our economy and accrue more debt even detrimental to our interest. That little they gave they take back 100 fold in runaway inflation and call out the Fed to raise interest rates hurting businesses and then spend even more.

Posted by ipso facto

@ 16:27 on June 16, 2022

Posted by ipso facto

@ 16:08 on June 16, 2022

We have a long way to come back!

Posted by Richard640

@ 15:56 on June 16, 2022

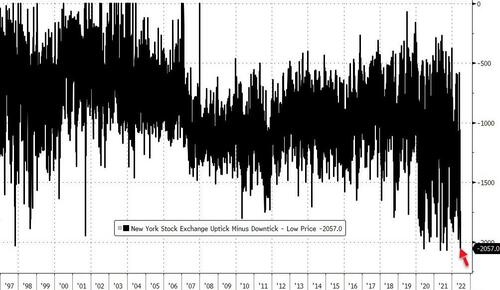

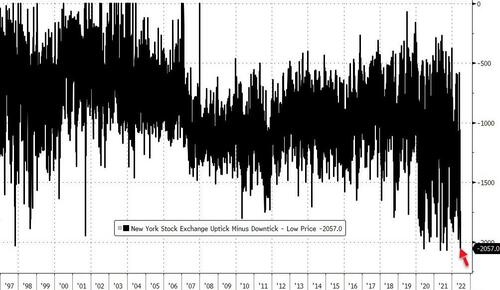

Capitulation? Stocks Hit With 4th Largest ‘Sell Program’ In History This Morning

The difference between upticks and downticks on the NYSE this morning hit a stunning -2,057. There have only been three other ‘sell programs’ of this size or larger in market history…

On the three prior events (6/11/20, 5/11/21, 9/20/21), the S&P bounced in the following days…

But, as the following chart shows, it’s different this time – The Fed Balance Sheet is shrinking!!

In case you think this is the ‘capitulation’ moment, BofA suggests no…

https://www.zerohedge.com/markets/capitulation-stocks-hit-4th-largest-sell-program-history-morning

Posted by goldielocks

@ 15:48 on June 16, 2022

Your not alone. People have to be wise to their diversion games and excuses they use with is nothing new just put another name on it that’s driving them down,

All they’ll do is bribe them too so the voters are subject to it too and when they drive their economy down it’s gonna not out of the elected pocket or their cohorts who somehow comes out richer but the people poorer and less free then they’ll just change hands and do it again.

They also need to stop letting them make decisions for them. Be personal freedoms or how much taxes they’re gonna pay or via inflation tax instead of letting them do whatever they want and bring a bunch of media out to sell it with some bleeding heart story because they’ll take every last penny.

It’s a political pandemic of the industrial countries right now.

Posted by goldielocks

@ 15:33 on June 16, 2022

I don’t do options but thinking about it and not just GS. Only thing holding me back is figuring out how to do it right and fast when the time to buy or sell but what else is new lol

If I were to do them I’d do leaps out a year and two years and stay in the money instead of short term AND make sure the volume amongst interest is good so you can sell them when your ready. You can sell any time so your not bound to that time frame like shorter term plays.

Posted by Maddog

@ 14:45 on June 16, 2022

https://www.breitbart.com/europe/2022/06/15/so-much-for-brexit-european-court-blocks-uk-from-deporting-illegals-to-rwanda/

What a farce…but that is our present government ….we need a clean hands government….hopefully people will vote for the smaller parties, until they do the Davos crew, will keep running us into the ground.

Posted by Mr.Copper

@ 14:12 on June 16, 2022

So the old habits have created a very sick financial system, and Dr. Market says it has to quit and go cold turkey. So the market may see “people walking thru walls”.

Symptoms that occur when a financial system stops using bad ideas after a period of heavy printing of money can vary widely in severity. In severe cases, the condition can be life-threatening.

Symptoms may occur after 30 years of dropping interest rates and rates start rising or stopping the printing. They may include headaches, nausea, tremors, anxiety, hallucinations, and seizures in various markets.

In many cases, globalization withdrawal requires medical treatment and hospital admissions. Import tariffs and on shoring may be used to treat physical symptoms of supply chain problems, while the reality of negative results help with controlling printing behavior.

Posted by redneckokie1

@ 12:43 on June 16, 2022

Buy signal is close above high of low day. Be careful, many are stopped out on first attempt. Second attempt is much more reliable. Some of the stock averages have five point waves waiting for buy signal. Use caution.

Buy signal is close above high of low day. Be careful, many are stopped out on first attempt. Second attempt is much more reliable. Some of the stock averages have five point waves waiting for buy signal. Use caution.

Posted by Richard640

@ 12:41 on June 16, 2022

12:08=Did u see the $ collapsing despite high rates?? I’m all in BUT I refuse to bet any big money on near the money options because PMs are a recidivist and have always punked out..

HUI A BIG 10 PTS OF THE LOW

[$ INDEX HIT HARD]

I’m Not playing a laconic year long bull mkt in PMs…I’m playing that THIS MOMENT could be “IT” and PMs get explosive fulfilling gold aficionados.

Long held wet dreams—DID u see the range on the HUI so far?

The insane rally off the Biden election ignored the fact that an administration profoundly hostile to capitalism was running the country—maybe that realization plus

A trapped FED might be why it is “finally different this time“—if the FED does reverse course and starts to ease and do QE, then we might see an ole 2500-3500 gold

This moment could be historic for PMs and any PM devotee must step up to the plate today even though the charts say not to.

FilledBuy to Open9SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open4SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open30SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open50SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open8SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open1SLV Jul 15 2022 22.5 CallLimit0.13—-12:04:15 06/16/22

FilledBuy to Open12SLV Aug 19 2022 25.0 CallLimit0.13—-10:41:47 06/16/22

FilledBuy to Open6SLV Aug 19 2022 25.0 CallLimit0.13—-10:41:47 06/16/22

FilledBuy to Open5SLV Aug 19 2022 25.0 CallLimit0.13—-10:41:47 06/16/22

FilledBuy to Open107SLV Aug 19 2022 25.0 CallLimit0.13—-10:41:47 06/16/22

FilledBuy to Open70SLV Aug 19 2022 25.0 CallLimit0.13—-10:41:47 06/16/22

CanceledBuy to Open1SLV Aug 19 2022 25.0 CallLimit0.10–06/16/2210:34:00 06/16/22

FilledBuy to Open100SLV Aug 19 2022 25.0 CallLimit0.12—-10:11:52 06/16/22

Posted by goldielocks

@ 11:33 on June 16, 2022

If your quick you could make a lot of money off these insane Schwab monster puppets.

Posted by goldielocks

@ 11:31 on June 16, 2022

Maybe the Brits should remind them of the rights of the people in UK that they’re supposed to be watching first. They always use the same old tactics, humanitarian , chipping away little by little at your country and pocket book.

If it’s paperwork they better do their job better.

Posted by Buygold

@ 11:16 on June 16, 2022

there’s always miracles around, you just have to find them.

Posted by goldielocks

@ 11:08 on June 16, 2022

Was seeing if Dow or Sp would bounce first. The only bouncing it’s doing is off the ground. Could of done it early days and days ago so my loss for waiting.

Posted by Maddog

@ 11:05 on June 16, 2022

Buy signal is close above high of low day. Be careful, many are stopped out on first attempt. Second attempt is much more reliable. Some of the stock averages have five point waves waiting for buy signal. Use caution.

Buy signal is close above high of low day. Be careful, many are stopped out on first attempt. Second attempt is much more reliable. Some of the stock averages have five point waves waiting for buy signal. Use caution.