Three digits all week and then 99 down in 90s

People on edge about possible power outs.

Hard to conserve keeping cool. Not to bad here due to insulation despite 104 not to great either.

Hope not too many kids are forced to walk alone to summer school mostly for something to do in this heat due to gas prices that double in parents who both work and drive kids to school and back. I heard some people are having to walk to work. It’s not like back east where they have buses. I remember years ago my daughter found a kid cant remember 8 or 9 collapsed in the heat lying on the grass next to the side walk and brought him to me who was beyond heat exhaustion heading for heat stroke. They need to bring school buses back.

If Something Is Too Cheap, and Suddenly Goes Up, And “can’t get away with it anymore” We Have To Be Happy For What We Had

Many years ago, I had a landlord that was renting way below market, sold the places, and the new landlord doubled the rent. Even recently a renter friend had low rent, then Fairfield Properties bought the places and doubled his rent. He moved to Fla.

Gasoline was too cheap. Gov’t manipulation on futures markets? Airline tickets are STILL too cheap. Causing too much demand imbalance causing problems lately. The gov’t subsidized a lot of sectors to keep consumer and business prices lower than normal. In time the Gov’t itself “won’t get away with it” anymore. It meaning manipulating prices.

Its not an organic gold money capitalist economy anymore, its a man made hollow shell artificial economy, like the Twin Towers that were so cheaply built they just imploded. Before that day, firemen NEVER saw a high rise collapse because of a fire. Even the surrounding same construction buildings collapsed due to fire only.

The entire global economy and financial system aka globalization like the Trade Center buildings, was a very big cheap vulnerable thing the central planners “got away with” until open borders caused 9/11 and 2008, and then the Covid spread from all this global intermingling. The gov’t created frivolous and promiscuous vacation and business travel. Encouraged or subsidized by the central planners.

What ever was too expensive like stocks and real estate, same thing. Subsidized by the Feds low rates. When prices crash, we have to be happy that things were so good for so long. Meats must have been too cheap. Way up. Labor was too cheap also. No more cheap labor available. Businesses have to be happy they had good times.

My best friend had 8 stores making big money on 65 employees getting $7/hr. Its over for good. This labor shortage will probably get worse. So many people working for $15/hr, part time in super markets and with higher prices, they will have to figure out something else and another way to make money and quit. Like whats been going on.

I look at the economy like a mechanical thing that it totally out of balance needs to be redesigned. It was good a high quality “machine” after the Founding Fathers created it. After 1913 those highly educated people made a lot of changes especially after 1945 that were not good long term.

Fed again

The youngsters mentioned this, watch for volatility tomorrow morning.

Powell

https://www.banking.senate.gov/hearings/the-semiannual-monetary-policy-report-to-congress

Alex

It doesn’t give June’s price yet but appears to jumped up about a dollar or more depending , trying to triple what it cost then.

Even before Covid in Nov 2019 till now it’s more than doubled.

The lefts answer will go something like don’t believe everything you see.

Goldie – Thanks for that post confirming what I said .

On Nov. 10 2020 I put about 14 gallons in my van at a cost of $1.959 per gallon .

Last week I paid $5.299 for regular , not high test gas , at the same station .

Alex 10:39

Here’s a history of gas prices in your area.

The Ukraine conflict didn’t start until the Russian invasion/ reaction to Clause build back broke until the end of February 2022 and before gas sanctions which had little to nothing to do with our prices anyways but caused by Biden. It started consistently moving up the year before and just continued up and worse in Calif.

this was the argument after the elections by the Trump haters. That gas prices were down because of Covid, that there just going back to normal. They saw no consequences what the radical left would have on gas or the cost of living.

They were in total denial even when they thought do as he’s told Biden pretty much announced they were going to take a wrecking ball to the US before the elections. They fell for all the blame shifting and made up problems or expected

Trump to do everything by himself. Kinda a oxymoron, what did the left do but lie to them, even while being attacked Trump did more for this country than they’ll ever do it did do other than make a mess out of everything while following tyrants.

Gas prices were going up by the month since 21.

2003 NA 1.458 1.507 1.600 1.625 1.521 1.482 1.480

2004 1.606 1.658 1.743 1.804 1.953 1.982 1.922 1.816 1.875 1.995 2.014 1.923

2005 1.883 1.931 2.100 2.270 2.190 2.163 2.275 2.482 2.882 2.825 2.371 2.218

2006 2.362 2.317 2.458 2.798 2.871 2.822 2.932 2.947 2.637 2.247 2.231 2.316

2007 2.270 2.251 2.558 2.836 3.035 2.991 2.908 2.739 2.775 2.826 3.104 3.062

2008 3.094 3.070 3.284 3.471 3.765 3.995 4.028 3.767 3.733 3.127 2.171 1.724

2009 1.813 1.959 1.983 2.084 2.249 2.605 2.536 2.570 2.469 2.510 2.678 2.633

2010 2.742 2.678 2.800 2.841 2.816 2.649 2.633 2.660 2.642 2.758 2.817 2.984

2011 3.092 3.182 3.544 3.752 3.832 3.582 3.589 3.598 3.521 3.378 3.348 3.255

2012 3.413 3.648 3.819 3.885 3.568 3.322 3.303 3.623 3.756 3.625 3.349 3.293

2013 3.402 3.697 3.708 3.490 3.433 3.454 3.502 3.499 3.441 3.272 3.260 3.401

2014 3.371 3.350 3.505 3.682 3.625 3.554 3.485 3.313 3.278 3.137 2.848 2.552

2015 2.141 2.186 2.424 2.458 2.574 2.653 2.578 2.346 2.125 2.122 2.079 1.993

2016 1.889 1.730 1.942 2.026 2.175 2.276 2.124 2.060 2.145 2.182 2.089 2.237

2017 2.335 2.223 2.231 2.384 2.303 2.256 2.145 2.247 2.673 2.417 2.430 2.342

2018 2.461 2.542 2.488 2.636 2.781 2.732 2.715 2.724 2.723 2.747 2.496 2.229

2019 2.146 2.242 2.504 2.697 2.635 2.468 2.568 2.376 2.398 2.384 2.351 2.421

2020 2.455 2.327 2.129 1.804 1.770 1.948 2.065 2.069 2.110 2.096 1.974 2.139

2021 2.266 2.440 2.759 2.787 2.816 2.886 2.952 2.945 3.006 3.141 3.268 3.194

2022 3.186 3.439 4.104 4.020 4.346

Florida Gas prices

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPMRU_PTE_SFL_DPG&f=M

Mr Cooper 12:37

People buy Bitcoin for different reasons initially a store of value like a digital gold, and or both away from the control and manipulation of other people. Also lack of trust that fiat is reliable. Not being able to dilute. Then with governments talk about eliminating cash basically people confiscating your money and privacy have a alternative away from their control and inevitable rising charges to hold it.

Rising interest rates may have something to do with following the money in the case the USD not caring too much yet for the other reasons then the selling may have cause panic selling. Others won’t be lured away, they’ll just buy more. Elon was accepting Bitcoin for cars but stoped after awhile.Eventually some of the get in cheap lure copycats or not trusted and secured or even coin or fiat related usefulness in trade off shoots would fail.

Some of the arguments are humorous. Like those who say the dollar is not backed by anything like gold, but either is Bitcoin and gold backs itself.

Gold is too expensive lol, That might have been true when Bitcoin was 3-10 dollars but now it’s the potential worth although you can’t take physical possession of it or prevent it from being hacked easily or easily exchange it and costs domestically or world wide like you can gold or if there is a power out you can’t use it. Some have both.

@ ipso facto I Agree 100%, Citizens of the world, and Think They Own The World

And they HATE pockets of independence, like Russia now, Iran, Cuba, N. Korea, even if its the Branch Davidians, or that family on Ruby Ridge.

Re Ten Year Bond Rate At 3.3%, Would Be Very Amusing If It Attracts Buyers

Think about it. Somebody with millions can lock in 3.3% for ten years. And as more and more people dive in, the the yield would drop, your Bond or your principal investment would climb while sitting on them. Bond traders made a lot of money as rates were dropping since 1982.

Ten year Bond Chart back to 1982 shows a general CLIMB. The climb reflects falling rates. The dips or corrections reflect climbing rates. Re the zig sags. Up is down rates and down is up rates. So what would chart readers or bond traders say about this chart? The dip is a buying opportunity, or a long term rotation back down, re higher rates. I report you decide.

I myself don’t think higher rates are going stop higher prices on important things in short supply like food or fuel that are constantly steadily used and needed. The Fed has to hope higher prices will encourage investment in higher production. But if I’m a producer, I’m already happy, why be greedy waste money and produce more?? Everything is too unstable and volatile.

The only benefit for higher rates would be to kill speculation on stocks and real estate bubbles. In the last cycle the speculation in the 1970s was Gold and Silver and collectibles everybody was dumping excess printed money.

untitled (mrci.com) ten year bond price.

Mr.Copper @ 12:29

It’s hard to tell who really runs the world. I’d guess it’s people who don’t have an allegiance to any country whatsoever. They are loyal to money and power and that’s about it.

Cheers

Re Bitcoin Dropping Because Rates Are Higher??? What’s With That??

Do people borrow money like a car or house loan to buy them? Or will higher rates make people sell them to put money in the bank? I think the whole thing was just another thing for people to gamble (another slot machine at Vegas) and or a trick to absorb excess paper money AWAY from gold and silver. That they bashed for decades. The real money. Versus Fed Notes.

@ ipso facto re Ukraine

I read most of the story, and every time I read the word “Ukraine” I thought of Europe and global powers. The same groups that has had negative influence on the USA for decades. Ukraine and a bunch of other nations of land were always part of Russia. And it seems Europe wants them.

The old post WW II system ran its course, it bankrupted the USA and made visible in the summer of 2008. And more so with Covid and the need to print money en mass with a $30 trillion national debt and fingers crossed. LOL.

If the USA ever declared its independence, like it almost did with Trump, “they” or “who” would come after us? Would they call our new gov’t a leftist dictatorship? Like they have in the past when a country throws out the status quo leader? Because their economy tanked like Venezuela did when Oil tanked from $145/bbl to $28/bbl. Oil was their bread and butter.

True Colors

Ukraine Bans Main Opposition Party, Seizes All Its Assets

Ukrainian authorities have banned the country’s main opposition party and seized all its assets, once again undermining the narrative that President Zelensky is presiding over a beacon of democracy.

https://www.zerohedge.com/geopolitical/ukraine-bans-main-opposition-party-seizes-all-its-assets

Silver has to be getting ready to bust higher

shares are doing pretty well relative to the metals. Problem is that the USD is down .5% and the metals are tame.

Thanks to all the Fed’s machinations and Biden’s blundering $ is sinking vs. the Ruble

May 10 ; 70.125 Rubles/US$

earlier this morning ; 54.375 Rubles/US$

…and gasoline over $5/gallon . Around election time 2020 I could get over 2-1/2 gallons for $5 !

Poll Results

Where will Bitcoin bottom?

Zero (26%, 10 Votes)

Less than $1,000 (24%, 9 Votes)

$5,000 to $10,000 (18%, 7 Votes)

$10,000 to $15,000 (11%, 4 Votes)

$1,000 to $5,000 (11%, 4 Votes)

$15,000 to $19,000 (8%, 3 Votes)

Close to where it is right now (3%, 1 Votes)

Total Voters: 38

Amex Reports Copper-Rich VMS Intercepts with Values of up to 2.86% CuEq over 6.40 m Including 4.81% CuEq over 1.60 m from QF Zone

https://finance.yahoo.com/news/amex-reports-copper-rich-vms-103000428.html

Goliath Drills Multiple Broad Intervals of Mineralization up to 95.5 Meters in First 2022 Hole on Golddigger, Golden Triangle B.C.

https://finance.yahoo.com/news/goliath-drills-multiple-broad-intervals-114500620.html

Maple Intersects New Styles of Gold Mineralization at Globex’s Eagle Mine Property

https://finance.yahoo.com/news/maple-intersects-styles-gold-mineralization-164800083.html

Cabral Gold Receives Excellent Column-Leach Test Results from MG Gold-in-Oxide Material, Cuiú Cuiú Gold District

https://finance.yahoo.com/news/cabral-gold-receives-excellent-column-103000705.html

Freegold Intersects 2.18 g/t Au over 190.2 m in GS2203 and 1.45 g/t Au over 207.2 m in GS2201 at Golden Summit

https://finance.yahoo.com/news/freegold-intersects-2-18-g-110000646.html

Mako Mining Intersects 42.91 g/t Au and 38.3 g/t Ag over 4.1m (Estimated True Width) in New Zone, 35.5m from Surface, 50m from Current Mining – Over 530m Strike Length, Open Along Strike and down Dip

https://finance.yahoo.com/news/mako-mining-intersects-42-91-110000841.html

Mandalay Resources Corporation Confirms Excellent Results From Its Björkdal Eastward Mine Extension Drilling and Reports Encouraging Results From the North Zone Drilling Program

https://finance.yahoo.com/news/mandalay-resources-corporation-confirms-excellent-113000448.html

VIZSLA SILVER DRILLS 1,030 G/T AGEQ OVER 20.45 METRES AT COPALA – EXPANDS MINERALIZED ZONE TO 600M BY 400M

https://finance.yahoo.com/news/vizsla-silver-drills-1-030-120000817.html

Alamos Gold Announces Completion of Construction and Initial Production at La Yaqui Grande

https://finance.yahoo.com/news/alamos-gold-announces-completion-construction-105500664.html

AGNICO EAGLE PUBLISHES 2021 SUSTAINABILITY REPORT

https://finance.yahoo.com/news/agnico-eagle-publishes-2021-sustainability-130000119.html

Kinross to provide update on Great Bear and U.S. projects

https://finance.yahoo.com/news/kinross-great-bear-u-projects-210000443.html

Fortuna provides construction update at its Séguéla gold Project in Côte d´Ivoire

https://finance.yahoo.com/news/fortuna-provides-construction-gu-la-090000911.html

White Metal Resources Corp. Announces That Dr. Elliot Strashin Has Acquired More than 12% of the Outstanding Common Shares

https://ceo.ca/@newsfile/white-metal-resources-corp-announces-that-dr-elliot

New Style of Gold Mineralization Encountered at Malmsbury Project, Victoria, Australia

https://ceo.ca/@nasdaq/new-style-of-gold-mineralization-encountered-at-malmsbury

ST. JAMES GOLD CORP. (TSXV: LORD) SOIL SAMPLING 2021 CAMPAIGN ENLARGES EXTENT OF SURFACE GOLD IN SOIL ANOMALIES AT THE FLORIN PROJECT, YUKON TERRITORY, CANADA

https://ceo.ca/@nasdaq/st-james-gold-corp-tsxv-lord-soil-sampling-2021

Yawn

Everything got fixed over the weekend. Bitcoin back up, SM futures on a tear.

PM’s meh…..

Larry Summers

Said the interest rates will have to go above 5 percent to get a handle on shrink flation like it’s as simple as that with the far left in control.

Then Biden said he talked to Larry Summers and said he didn’t say it would cause a recession lol

June Gloom turns to JULY High

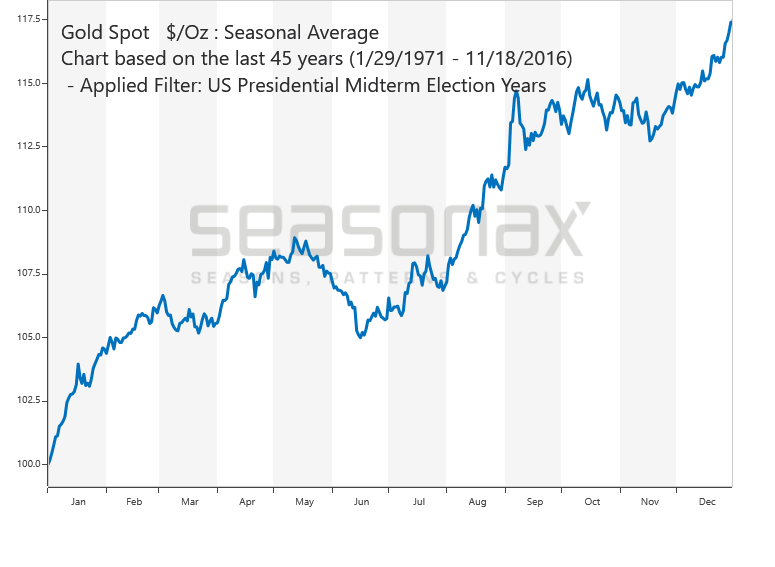

Gold Midterm Years |

Maya

I think Bitcoin is going to be a distraction because it’s going to look like a safe haven to other currency’s and maybe stocks down the road maybe GS safe haven too.

Remember or did you notice when interest rates fell so low money moved from interest baring accounts like CDs to stocks that paid more dividends than interest. It drove the stocks up. If they keep taking interest rates higher than dividends and no growth stocks with a recession I’m guessing it will pull money out of stocks to interest baring accounts putting more downward pressure on stocks.

So when is it safe to get back in the water? Only the Fed knows.

BTC to Zero?

George Ure at UrbanSurvival.com makes an Elliot Wave case for Bitcoin going to zero.

https://urbansurvival.com/bitcoin-decline-for-idiots-why-teenth/