QUESTION: Marty, well it looks like Socrates will be correct again with interest rates. But my question now is that after the election a 1.25% Quarter Bullish at the end of June, how far are rates going in the crazy world?

JW

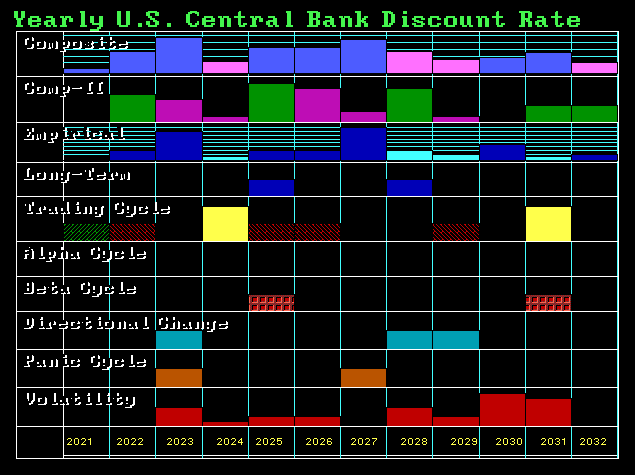

REPLY: The rate hike of 0.75%, at the conclusion of its two-day meeting, has indeed confirmed the bull market in rates. The hike moves the benchmark short-term rate to a range of 1.5% to 1.75%. Yes, we have a Quarterly Bullish Reversal at !.25%, but we have a Yearly Bullish Reversal at 1%. This is all confirming our model’s forecast and we expect volatility to rise during the next quarter. However, this is on track for 2023.

The year 2021 was THE low and we have not only a Directional Change in 2023, but we also have a Panic Cycle and a key turning point. We are expecting overall rates to rise into 2034. The year 2021 was the bottom in rates and the end of Keynesian economics.