Author : Bill Holter

Published: January 19th, 2015For several years there has been talk of a financial and economic “re set” coming, this is no longer speculation as the reset has already begun! The Swiss have suppressed the price of their currency, the franc, since late 2011. They pegged the franc versus the euro with a “floor” versus the euro at 1.20. After confirming this floor publicly on Monday, they abandoned it Thursday only to see the euro depreciate through the par level. What you saw on Thursday and Friday was the work of Mother Nature as the Swiss decided they would be better served by no longer battling her.

The ramifications of this move by the Swiss are almost infinite when you consider the chain reactions they have now started. Several large FOREX firms including the largest retail firm in the U.S., FXCM, were rendered bankrupt overnight. Even Goldman Sachs and Citi admitted to being offside and sustained large losses. As of right now, we have no idea who “won” and who “lost”, nor do we know “how much?”. We heard almost nothing from Swiss or European banks on Friday, “who what and how much?” will begin to surface this coming week. As I have written for years now, if the loser goes bankrupt, the winner does not get paid…thus turning the winner into a loser. This is a very big problem the markets ignored on Friday but will not be able to ignore as the dead bodies begin to surface.

Think about this point very seriously, many investors (and firms) went to bed Wednesdayevening with no stress at all on their portfolios (or their business), in just five minutesThursday morning they were insolvent. Just FIVE MINUTES! We are only talking about “investments” here, how many other real businesses in the import and export area are now broke? Broke because they hold euros but need francs or they export from Switzerland or import to Europe and now their business model makes no sense? How is this even possible in just five minutes time?

Another aspect to what and how the Swiss moved on Thursday is that of “central banks” themselves. Did the Swiss not know they were going to float the franc on Monday when they confirmed the peg publicly? Did they or did they not inform the IMF prior their actions? What about the BIS which is headquartered within their borders in Basel, surely they tipped them off? Christine LaGarde claimed in an interview with CNBC that she had no prior notice, really? If this is true then it shows the Swiss central bank has moved in an “every man for himself” type of action. It also shows the “united front” of central banks is not so “united” anymore! If Ms. LaGarde is not telling the truth and in fact the IMF did have prior knowledge, what would this mean? It would mean the central banks are finally losing control of the rig. It would also mean the central banks have distorted currencies, interest rates etc. so badly that once Mother Nature takes over, we can expect repeat performances all over the world and amongst all assets and currencies. How can I say this? I would simply ask if it is “normal” for two trading currencies to revalue 30% in five minutes or if it is not normal, what was the cause? We of course know, the cause was the actions of the ECB and SNB over these last three+ years.

We have already speculated the Swiss made this move for one of two reasons. First, they may have decided the amount of euros necessary to purchase (and thus the amount of francs created) will go exponential this coming week when the ECB goes full on QE (printing). We also know that euros already make up more than half of their balance sheet. The other possibility is they know the Greek election is coming up, (the Greek banks are already experiencing bank runs) and they see the very real possibility of the Eurozone fracturing or even dissolving. Another possibility is maybe they just decided “their first loss is their best loss”? Maybe they have watched as the core of Europe has asked for their gold back and understand that “trust” amongst central bankers is waning? Maybe they simply decided to front run the obvious and necessary re set and do it on their own terms? It is very hard to say what exactly the motivation was, the important thing to understand is their action has started a re set in motion which will not be stopped! In plain English, the Swiss just yelled FIRE …while standing in the exit!

I have several other questions but first I want to point out the obvious. Oil was cut in more than half in dollars over 6 months, could you say the price of oil was “re set”? How about copper? How about other foreign currencies? Could the huge moves in so many assets qualify as being “re set”? The collapse in oil and copper prices are black swans pointing to a rapidly slowing global economy. The Swiss removing their currency peg is another black swan event and in reaction to the ECB moving toward hyperinflating their currency.

My biggest question now is this, what will happen when China allows their currency to float? The Swiss are one thing, China is whole different story! Think of the ramifications when it comes to trade? Another, maybe even more important question is what will happen when the Chinese “force” the price of gold and silver to trade freely? Let me explain this further. The Chinese know full well that gold IS money, otherwise they would not have spent the last several years buying almost every single ounce that came from the ground. They know it is artificially priced by New York and London. They can “float” gold in several manners. First, they can simply bust the COMEX and LBMA by bidding for and purchasing both their entire inventories within a 24 hour window. Another possibility would be to simply put out a “global bid” and state some price (much higher than current) they are willing to buy any and all gold, presto, COMEX and LBMA would be busted without them doing it directly!

I recently wrote of a “Global Margin Call” where because oil and other assets, currencies, etc. have moved so rapidly, many derivatives traders have surely been thrown “offside”. This move by the Swiss is nothing different except it was done “officially”. Actually, the funny thing is they moved to suspend what they were “officially” (and artificially!) doing. The move by the Swiss has only made the global margin call that much bigger! The global re set which was already in the works is now publicly and officially happening before your very eyes. You can close your eyes or not believe this fact, it will not make it go away, nor will it insulate you financially from what is coming.

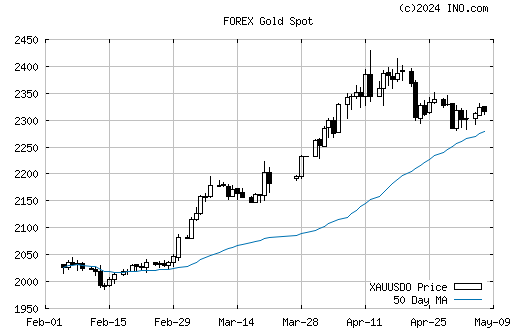

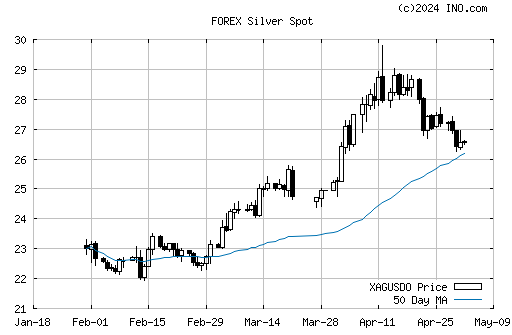

To finish, and I plan to follow up maybe even tomorrow, the most important re set will be that of gold and silver prices. I say “most important” because these are the only “tools” available to you as an individual to protect your wealth. If the Swiss franc and the euro can change in value by 30% within five minutes, what do you think the revaluation of gold and silver will be when the 100 ounces of “paper metal” come looking for the real thing? At what price will the market clear? Add a zero? Two zero’s? Please understand this, when the margin call is issued worldwide, there is only one money where the call will work in reverse, precious metals. The “call” will be for real, yet non existent metal. Gold had already sniffed this margin call and re set out a couple of months ago. No matter how much paper was thrown at it, it simply stopped going down. Even while the dollar strengthened synthetically, gold went higher versus the dollar. Gold has clearly been THE best money, what do you think will happen to real metal when it turns out that 99% of the supposed global supply is proven as counterfeit?

We will soon witness the greatest margin call in all of history. We will also witness the greatest transfer of wealth and re set in all of history! My only question is whether what so far has been “rolling re sets” becomes an official market/bank/finance closure and announced …or, do the markets continue to trade and force re sets in market after market.

As an additional note, we have one last question to ponder which may or may not be connected. Koos Jansen put forth a “mystery guests” theory that the Swiss went short gold in Sept. 2011 which marked the top in gold. He asks in the following link, “did Switzerland just cover their short“?

I believe there may be some credence to this theory but would go one step further. Zerohedge asks the question and speculates Japan may be the next “Switzerland” and pull the plug on Abenomics. Personally I see it a little differently, more importantly, what if the Chinese were to react to the coming QE4 by doing two things? What if China just walked away and sold their dollar holdings …and at the same time revoked their current peg of the yuan to the dollar? Will China some day ratio back their yuan with gold? I think this is likely. Would the dollar collapse 30% like the euro just did versus the franc or will the re set be much larger? Of course the next question would be “how high would gold be marked up”? An unpegging of the yuan by China would be more important and (current) system ending than nearly anything else I can imagine. For China to break their peg, the paper short positions in gold and silver would finally be exposed for what they are, counterfeits!

Regards, Bill Holter