Rick Ackerman February 9, 2020 5:30 pm

Could it possibly get any better? Trump has shrugged off impeachment and taken a well-earned victory lap, the Democrats are headed for a landslide loss in November, and the U.S. consumer economy is hitting on all twelve cylinders, powered by shop-till-you-drop exuberance that has made even the ongoing, trillion dollar writedown of shopping malls a relatively niggling concern. There are job opportunities for every American who wants to work, and real wages are rising for blue collar jobs. As for the stock market, it is not merely at a permanently high plateau, as it was famously described in the halcyon days of the Jazz Era; it continues to rampage skyward without ever selling off for more than two consecutive days. Third-day bets on the pass line haven’t enjoyed such surefire odds since Secretariat bolted out of the gate in the 1973 Belmont.

Could it possibly get any better? Trump has shrugged off impeachment and taken a well-earned victory lap, the Democrats are headed for a landslide loss in November, and the U.S. consumer economy is hitting on all twelve cylinders, powered by shop-till-you-drop exuberance that has made even the ongoing, trillion dollar writedown of shopping malls a relatively niggling concern. There are job opportunities for every American who wants to work, and real wages are rising for blue collar jobs. As for the stock market, it is not merely at a permanently high plateau, as it was famously described in the halcyon days of the Jazz Era; it continues to rampage skyward without ever selling off for more than two consecutive days. Third-day bets on the pass line haven’t enjoyed such surefire odds since Secretariat bolted out of the gate in the 1973 Belmont.

A Bull’s Checklist

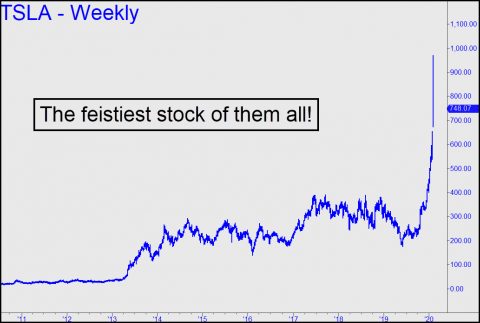

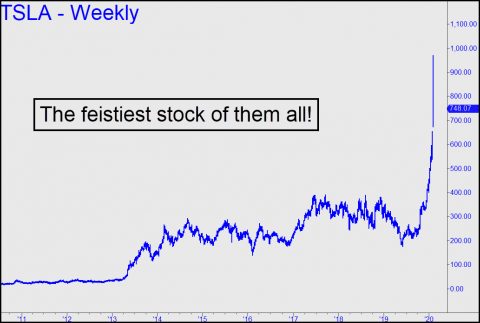

Just look at Tesla, the feistiest stock of them all. The price of a single share recently came within an inch of $1,000 (shades of RCA, aka ‘Radio’!) after nearly quadrupling since October. Some analysts are saying the stock eventually could hit $6,000. Need more reasons to be crazy-bullish? Here’s a checklist from John Jay, who posts regularly in the Rick’s Picks forum: 1) easy access to low interest car loans — “No job, No credit, No problem!”; 2) a vast ‘off the books’ business universe; 3) 22 million people working for some level of government, almost twice the number working in manufacturing; 4) God-knows-how-many-people from #3 above now retired with great pensions/healthcare + COLAs; 5) the “Port Royal” effect, as buccaneers from all over the globe come here to buy mansions and kick back; 6) easy access to HELOCs for those home equity to burn; and, 7) Silicon Valley-types cashing in on stocks, options, IPOs from their cash-burning, publicly traded corporations.

Contrarian Alert!

All of which has led me to recommend, in contrary fashion, that subscribers sell the S&P 500 index short if it falls from last week’s record peak at 3348 to a certain price not far below. That would trigger an ‘rABC’ sell signal, according to the proprietary rules of the Hidden Pivot Method, generating a position with the potential to make money even if the S&Ps eventually go on to achieve new record highs. The signal works more or less mechanically, but in this case I’ve added a smidgen of instinct in order to go gently against my own rules.

My concerns about coronavirus played a role in this recommendation, since the potential of the disease to put the global economy in recession is, in my opinion, being seriously underestimated. Even if I am wrong and the spread of the virus is checked, we won’t know it for probably another month or two. Under the circumstances, the stock market, priced for perfection at these levels, seems like a risky place to be. Bear markets do happen, and they usually seem to come out of nowhere. If one were to kick in now, queering Trump’s sunny re-election odds, the Dow could find itself at 10,000 not long after some rancid flavor of Socialist takes the oath of office on January 20.