https://www.zerohedge.com/geopolitical/sunni-muslims-applaud-soleimani-killing

Mr Copper—I am in Tarrytown

I am comfy where I am and love my life…my “escape plan”–if things go to smash, I just pop a cyanide tablet–no fuss no muss-

Richie re Where To Go In A Financial Collapse and Hyperinflation

I’m in NY, funny I always thought you were in Tarrytown. I was think the Maine coast where all the fishing boats are, there would be plenty of food, and most people hate the cold and would go south. Plenty of game too for food.

Re hyperinflation? Couple of thoughts. They say every hyperinflation always END with a Deflation. Note the 1913 Fed buffoons’ causing the roaring 20s inflation ending with deflation.

You COULD say the period after 1934 (gold banning confiscation) or even net back to 1913 until 2008 or now, has been an ongoing slow motion invisible hyperinflation. The US Dollar has lost 95% at least in value since. New cars were $500, $2.50 to $5 per day a livable wage. The Dollar only buys4 slices of bread, and its broken down into 100 parts, pennies.

If your grocery bill was rounded off up or down to nearest dollar, it would only be equal to, two slices of bread. A reversal from the past would suggest the dollar gaining value.

BUT! On the other hand, there are SO many people that have $5-$10 million and plus of unspent storage money? If they see prices going up too fast they may all panic and run to, like the story said, anything tangible. The Deflation in Wages precipitated the ’08 crash. My 1980 Newsletter, and myself predicted a deflation in labor costs due to using foreign labor.

Plus mainly the failure of Gov’t to calculate an accurate cost of living index. Or rather purposely under-stating cost of living for obvious reasons. Stupidity for one. Cheating or lying for another .

The deflation in labor income caused a net real deflation in tax revenue, note$22 trillion national debt. TPTB or debtors may not have any viable way to inflate out of debt, without inflation in profits and wages to match.

Buygold @ 11:54 re gold and silver bullion.

That market is also somewhat leverage related on the Futures Market when TPTB play games. Gold should be double what it is. In fact all metals are grossly under priced. I was in sheet metal fabrication for decades, always bought 4×8 sheets of cold rolled steel, galvanized steel, aluminum, sheet, plate, and diamond plate, stainless steel, copper etc etc.

It was always surprisingly cheap to me. Always saved my drop offs, scrap to turn in. The prices fluctuated but mostly are same today as in the later ’70s and ’80s. Its an eefin joke. I’ve seen 4×8 sheets on metal cheaper than 4×8 sheets of plywood. And plywood grows on TREES!!! Metals have to be separated from rocks! Lots of equipment and energy involved.

Naturally its for the Greater Good to suppress producers prices. Just like interest rates. Suppress the savers. Producers of raw materials, and savers are always screwed and should be tax exempt. Lower Gold and Silver is good for Jewelry fab and retail for example.

A ZH reader

With the federal reserve force feeding so much fiat, fake, fraud, fiction, fantasy, fractional-reserve debt-bits into the system at such a rate, how can those who receive them NOT misdirect a substantial percentage into the stock markets?

What is coming “this time” is what rational investors mistakenly thought would happen previously (based upon previously conventional behavior of central banks and governments pre-Greenspasm). Namely …

!!!!! HYPER-INFLATION !!!!!

As anyone who buys real products knows, it is not just stocks that are rising at 100x or 1000x the speed of the utterly false 2% inflation rate.

The predators-that-be need to vanquish into nothingness [a large portion of] the astronomical debt, and the way to do that is … you guessed it … turn the astronomical debt into a pittance. And the only way to do that is … hyper-inflation.

For those sane souls who imagine the stock markets will collapse, I have pity. They just can’t shake the notion that conventional behavior still exists.

!!!!! BUT IT DOESN’T !!!!!

… because …

!!!!!! IT CANNOT !!!!!

The predators-that-be will always save the predators-that-be … no matter how much that destroys every honest, ethical, productive, benevolent person on the planet.

While physical precious metals in your own possession (and VERY well hidden) isn’t the only protection, all reliable protections are in the form of real, physical goods and goodies that have lasting value (do not degrade, or degrade extremely slowly). A wide variety of weapons (and training if necessary) is good protection (can sell them if you don’t need them).

My choice was unusual, but also works … move deep into the boonies somewhere NOT in the western nations and become as self-sufficient as possible. Now that I’ve done this and lived like this for a while (about 1 year), I can see this is by far the best approach. But few will do this, so do what you can given your own sensitivities.

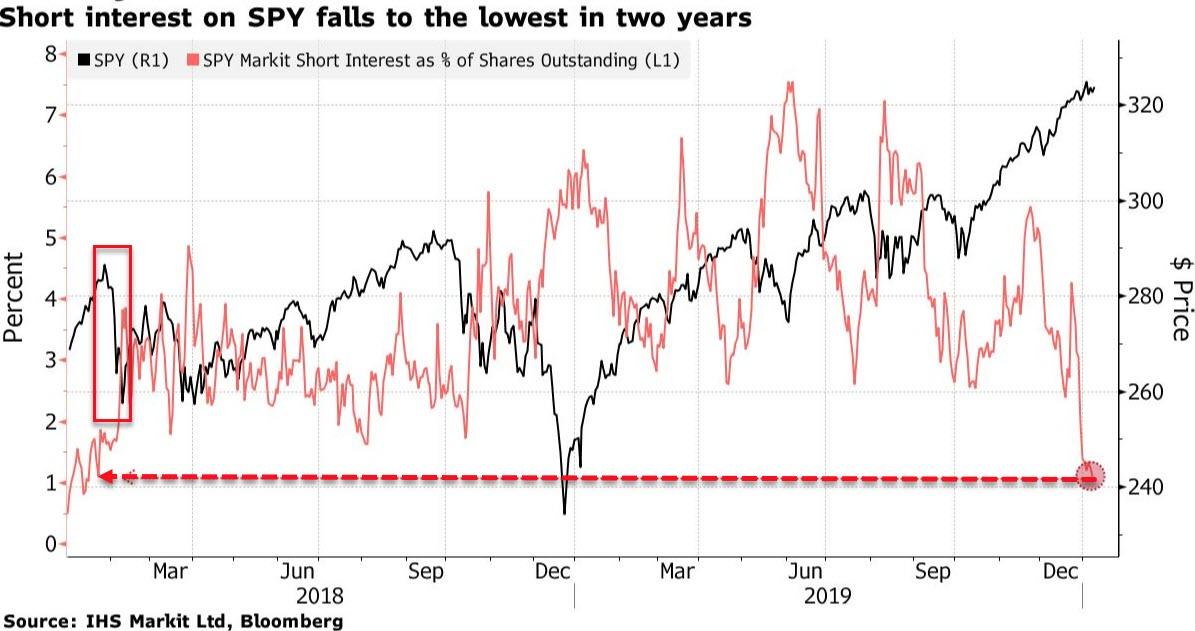

Got VIX-VXX?=Short sales in the SPDR S&P 500 ETF Trust=lowest level since 1/18 before the event known as “Volmageddon” sent stocks swooning.

Short sales in the SPDR S&P 500 ETF Trust, known by its ticker SPY, as a percentage of shares outstanding fell to 1.1% Tuesday, according to data from IHS Markit Ltd. That’s the lowest level since January 2018, before the event known as “Volmageddon” sent stocks swooning.

And Greed is at record highs…

Despite recent wobbles on geopolitical chaos, complacency is back at record highs…

The red flags continue to pile up.

https://www.zerohedge.com/markets/profoundly-dangerous-market-exposed-hedges-shorts-evaporate

News

Just said it is believed Iranian missiles shot down the plane. Guess they could warn Iraq but not close down air passenger planes. And they want to build nukes.

I got eyes…

Filled Sell to close 250 VXX Jan 17 2020 18.0 Call Limit 0.09——9:47:38 01/09/20

The “repo” market is sacred financial “plumbing”-Quite a squeeze unfolded.-TSLA) jumped 71% in 11 weeks. Advanced Micro Devices (NASDAQ:AMD) surged 62% to end 2019 with a 148% gain.

https://seekingalpha.com/article/4315251-weekly-commentary-2019-in-review

The “repo” market is sacred financial “plumbing”. It was, after all, the epicenter of 2008’s crisis eruption. Critical lessons were either never learned or conveniently forgotten. Building upon the dovish U-turn, the Powell Fed embraced “whatever it takes” to ensure liquidity was not an issue during the fourth quarter and especially for typical year-end funding pressures. Recalling Y2K, it was in the end a bogeyman that had the Fed pouring fuel on a raging speculative bubble. Powell’s “midcycle adjustment” was completely abandoned. There was for now and the foreseeable future one cycle: easy “money” – and the only uncertainty: How easy? The Ultimate Asymmetric Policy.

Federal Reserve Credit expanded $395 billion in the final 16 weeks of year. Like rates, a year that began with expectations of Federal Reserve balance sheet “normalization” ended with aggressive quantitative easing operations. The Fed announced in October it would purchase $60 billion of T-bills monthly through at least the first-half of 2020, with Fed Credit ending 2019 at $4.121 TN (high since November 2018).

Goldman Sachs CDS ended 2019 at 52.39 bps, only a couple basis points from the low going all the way back to 2007. From a high of 465 on January 3rd, high-yield corporate CDS sank to lows since 2007 (ending 2019 at 280 bps). A notable 80 bps of the high-yield CDS decline ensued following the October announcement of the Fed’s balance sheet expansion strategy. And after trading to a high of 95.5 on December 24, 2018, investment-grade CDS closed out 2019 at 45.3, also near the lows since before the ’08 crisis.

The S&P 500 returned 10.4% in the 11 weeks following the Fed’s announcement. The Nasdaq 100 (NDX) returned 13.1%, while the Semiconductors (SOX) jumped 19.4%. The Banks (BKX) returned 17.9% and the Broker/Dealers (XBD) 17.3%. The small cap Russell 2000 returned 12.7% in 11 weeks. The NYSE Healthcare Index returned 14.9%, as the Biotechs (BTK) surged 21.7%.

Quite a squeeze unfolded. The Philadelphia Oil Services Index returned 26.2% between the Fed announcement and year-end. Tesla (NASDAQ:TSLA) jumped 71% in 11 weeks. Advanced Micro Devices (NASDAQ:AMD) surged 62% to end 2019 with a 148% gain. Target (NYSE:TGT) gained 94% for the year, outpacing Chipotle’s (NYSE:CMG) 93.9% and Lululemon’s (NASDAQ:LULU) 90.5%. Apple (NASDAQ:AAPL) rose 86.2%, trouncing Facebook (NASDAQ:FB) (56.6%), Microsoft (NASDAQ:MSFT) (55.3%), Adobe (NASDAQ:ADBE) (45.8%) and Google (NASDAQ:GOOG) (NASDAQ:GOOGL) (29.1%). Xerox (NYSE:XRX) jumped 86.6%. There were 56 stocks within the Nasdaq Composite that posted 2019 gains of better than 200% (174 at least doubled).

The announcement of a “phase one” U.S./China trade deal stoked the year-end rally. There is still little to indicate must substance in this agreement but, like with so many things, it doesn’t really matter. The geopolitical backdrop was fraught with great risk – that markets were content to ignore. Even Thursday night’s U.S. assassination of Iran’s Qassem Soleimani hit the S&P 500 for only 0.7% (Russell 2000 down 0.35%). As has become typical, safe haven assets seem more keenly focused. Ten-year Treasury yields sank nine bps Friday to 1.79%, with bunds down six bps to negative 0.29%. Riding blustery Monetary Disorder and geopolitical tailwinds, Gold surged $42 this week to a six-year high $1,552.

It was a year of excess too many to mention. Hedge fund billionaire paid a record $238 million for a central park apartment – followed by $122 million for a London mansion and $99 million for a property neighboring his oceanside Palm Beach estate. “Beauty mogul” Kylie Jenner becomes a billionaire at 22. Art and collectable markets continued to go bananas. From MarketWatch: “An Italian artist duct-taped a banana to a gallery wall in Miami as part of the Art Basel festival – and it sold for $120,000.”

Mr. Copper

Yeah. My gold and silver are tucked away so they don’t play with the emotions as much as the shares do. So they get my attention and are sort of a barometer. Pretty rare when they get overbought and stay overbought like regular stocks.

Maya @ 1:08 Wheels…Thanks!!

One of my all time favorites I’ve played for years. Loved the train pictures too. Another Silverngold Thank You!

FYI BLOZF Cannabix Technologies Inc Popped Up 20% On My Watch Lists

They are developing a cannabis breathalyzer for cops.

https://finance.yahoo.com/quote/BLOZF?p=BLOZF&.tsrc=fin-srch

Buygold Yes Good Point

I was strictly referencing gold bullion the metal itself. When we buy shares we are actually buying on margin which is generally frowned upon. More volatile. Because the investment in the shares we are betting on massive amounts of gold under the ground. That’s why the shares out perform the metal % up and down.

The big fund managers aren’t in our sand box yet, but if gold keeps climbing they will crowd in later. A guy on CNBC mentioned that NEM SnP 500 raised its dividend, and will attract fund managers, and a good place to invest rather if you don’t want the bullion itself.

I know non of us ever liked NEM being such a slug.

part: NEM has recently declared plans to hike its quarterly dividend to 25 cents per share or an expected annual dividend of $1 per share 79%.

he latest hike, which will be effective upon the approval and declaration of its first-quarter dividend in April 2020, represents 79% increase from quarterly dividend of 14 cents per share declared in October 2019. The dividend hike is in line with the company’s disciplined approach to capital allocation strategy and supports its industry leading return profile.

https://finance.yahoo.com/news/newmont-nem-unveils-plan-hike-135501791.html

Mr. Copper

We’ve had this discussion before about picking selective snapshots in time. What has the HUI or GDX done since their highs in 2016? With gold at a lower price?

I’d venture a guess they are down 30+%

I’m not at my computer so I can’t tell you exactly.

Buygold re your “but the pressure is relentless”

Since Late 2015 @ $1,060 and early 2016 to today @ $1,548, that’s 46%. I think we need more pressure. 🙂 There is bound to be another correction that could last months. But we can handle it, we’re MEN! 🙂

Maddog

Yep, and if pm’s were to skyrocket and the SM to sink because of something financial people would start asking questions about what was wrong with the system. Can’t have that.

Thought we might have a chance to recover a bit today, but the pressure is relentless. Bummer.

Re Higher Gold Production Because Of Higher Price

Supply and demand or production versus consumption used to establish a logical price. Unfortunately, we have a fake man made economy, and its the tail wagging the dog. The PRICE establishes or modifies, the supply and demand.

This is simple stuff not taught in Harvard or Yale YET.

Buygold

Re Repo’s

A problem at year end was not likely to be serious, however did they ‘hide’ the real problem, by including the problem in their guestimate for yr end and now year end is done, the problem is out in the open again.

Something is very wrong …but PM’s may not react, as so far no-one has said what is really wrong and those that know are probably short upto their eyeballs, in PM’s.

A few of the shares are green

Even with the metals showing no signs of life.

Mirage?

Top China Expert Has Doubts Over Trade Deal As Tensions Are “Getting Worse”

The South China Morning Post (SCMP) is reporting that Jia Qingguo, a top foreign policy expert in China and professor of international studies at Peking University, said the “phase one” trade deal with the U.S. and China wouldn’t lead to “phase two” trade deal because “excessive” demands by Washington have left Chinese officials feeling “useless” to engage.

“Despite the recent announcement that we are going to have the first phase agreement, [the] relationship between China and the U.S. is still in deep trouble and is heading south rather than north. It is getting worse,” the SCMP cited Jia at the Regional Outlook Forum 2020 hosted by the ISEAS Yusof Ishak Institute in Singapore on Thursday.

See if silver can re-capture $18

Always hope to start the day…..

$183 Billion in liquidity is a lot excess usd’s

Money Machine

Kirkland Lake Gold Announces Record Quarterly and Full-Year Production

https://finance.yahoo.com/news/kirkland-lake-gold-announces-record-110010465.html

Buygold

“Brexit”

I’m building a hole under my house to hide in!

Good on the Brits! Now they won’t have that particular boot on their neck.

Maybe now they’ll be able to fix their own toaster or change the oil in their car themselves. 🙂

Ipso

Wasn’t Brexit supposed to be the end of the world?

Fed injects another 83 BN