The stock market is a humbug! [Scrooge McDuck]

As

Skyrm wrote, “it’s easy to see how the Repo market can get addicted to easy cash from the Fed when the stop-out rates for the RP operations are 1.55% – behind the offered side of the market.” But, as the repo strategist adds,

as the Fed keeps injecting cash, the market gets used to it. Which is great in the short-term as it sends risk assets soaring as hedge funds put on even more risk-chasing trades via repo, but becomes a major issue over the long-term: “The long-term problem is that the some investor cash (real money cash) that was once going into the Repo market is now going elsewhere”, Skyrm explains. Indeed, the problem is that repo rates are trading in the lower end of the fed funds target range. When GC rates were higher in the range, Repo general collateral, as an investment, was more competitive than other overnight rates. But now that cash has gone to other markets, meaning the Fed is trapped in providing liquidity in perpetuity unless it hikes rates which in turn will cause a market crash.

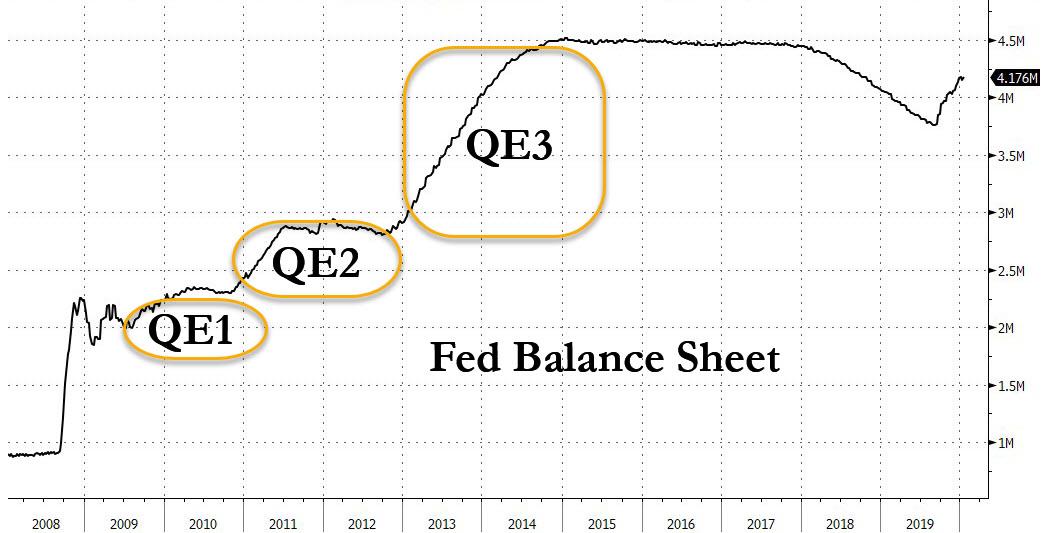

In short, just as the market got addicted to QE and the result was a 20% drop in the S&P in late 2018 when markets freaked out about Quantitative Tightening, the Fed’s shrinking balance sheet, and declining liquidity, Skyrm cautions that “it will take pain to wean the Repo market off of cheap Fed cash” since “it‘s a circle” which can be described as follows:

For the Fed to end daily RP ops, they need outside cash to come back into the Repo market. For the Repo market to attract cash, Repo rates need to move higher. For rates to move higher, the Fed needs to stop RP ops.

The problem is that stopping RP ops could spark another repo market crisis, especially with $230BN in liquidity still being pumped currently via Repo. It also means that the Fed is now unilaterally blowing a market bubble with its repo and “NOT QE” injections, and yet the longer it does so the more impossible it becomes for the Fed to extricate itself from the liquidity pathway without causing a crash.

Or stated simply, the longer the Fed avoids pulling the repo liquidity band-aid, the bigger the market fall when (if) it finally does. The question then becomes whether Powell can keep pushing on the repo string until the November election, because a market crash in the months preceding it, especially since it will be of the Fed’s own doing, will result in a very angry president.

Krishna Memani, former vice chairman of investments at Invesco, agrees: “Powell went out of his way to explain that it wasn’t QE, but it doesn’t really matter. The Fed is in a bind. Effectively with policy initiatives they have, they have to increase reserves, and investors are aware of that. They will be in that mode for the foreseeable future.”

* * *

… is sending stocks to new all time highs every single day.

https://www.zerohedge.com/markets/neel-kashkari-appeals-qe-conspiracists-show-me-how-fed-moving-stock-prices-so-here-it