(Natural News) There was a time when John McAfee of antivirus fame predicted that Bitcoin would reach $1 million by 2020. But he’s since changed his mind and decided that Bitcoin will eventually reach $0 because the cryptocurrency is based on “ancient” technology.

Part of McAfee’s former $1 million claim included a personal promise; if it didn’t “shoot the moon,” then McAfee was going to remove his genitalia. But now McAfee claims that this was all just a ploy for attention, and that he never actually intended to do this.

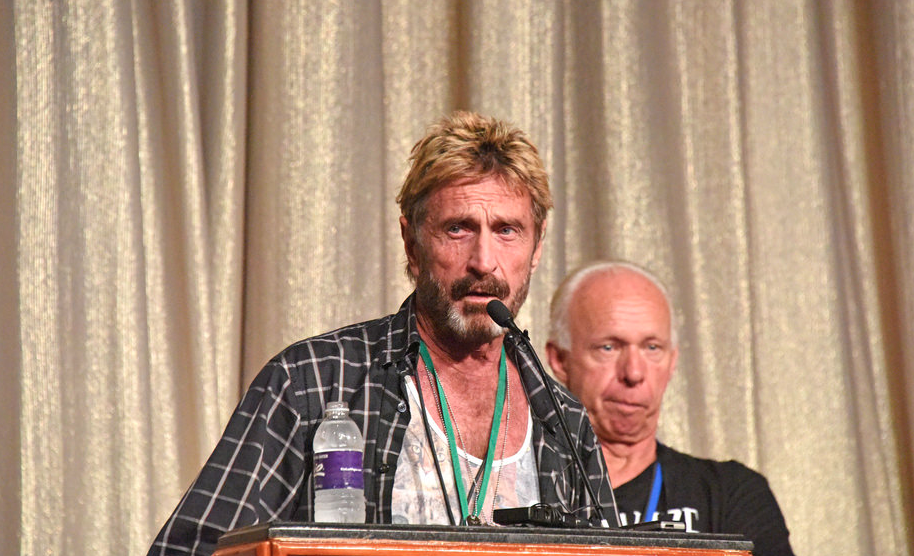

Though McAfee founded one of the largest cybersecurity firms back in 1987, he’s now on the run from authorities. And during a rare interview he gave from an anonymous location recently, McAfee told all about his “adventures,” as well as his newfound opinions on Bitcoin.

“Bitcoin was first,” McAfee wrote in a recent tweet disavowing the cryptocurrency that he once hailed. “It’s an ancient technology. All know it. Newer blockchains have privacy, smart contracts, distributed apps and more. Bitcoin is our future? Was the Model T the future of the automobile?”

Back in May, McAfee endorsed Dogecoin, a newer cryptocurrency that he likes because of its name, apparently. Just a few months later in August, McAfee warned his Twitter followers not to bail on Bitcoin because, “You know in your heart Bitcoin cannot lose.”

So, McAfee really is kind of all over the place when it comes to Bitcoin and the cryptosphere, endorsing one crypto one day and another the next. Reports indicate that he also has a history of accepting cash to pump altcoins, which one source indicates has given him an incentive to bash Bitcoin.