Juggernaut: (n) massive inexorable force, campaign, movement, or object that crushes whatever is in its path

This is how a Bernie gets to be president some day-America is doomed…I hate to say it but this article makes sense..

!!EAT MORE POSSUM!!

i saw a bald eagle today. our noble national bird has his ignoble moments. this one was dining on some roadkill (a possum, i think) beside state road 59 south of wacissa, florida.

a handsome bird, never the less.

(not my photo)

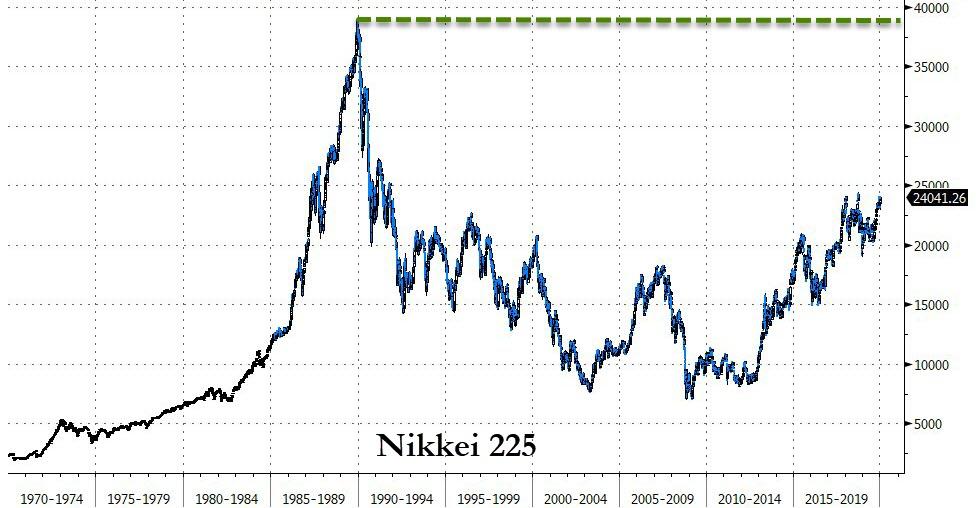

Couldn’t happen? Ask the Japanese…

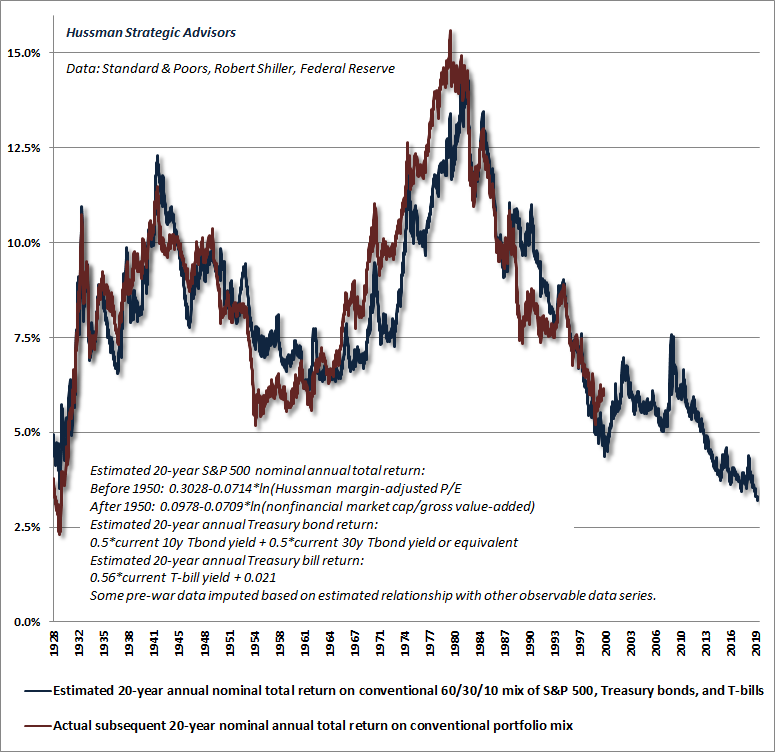

“Wait nearly 30 years, allowing both the U.S. economy and U.S. corporate revenues to grow at the same rate as the past two decades, while stock prices remain unchanged, with no intervening periods of recession or investor risk-aversion, or alternatively (and far more likely), watch the S&P 500 lose two-thirds of its value over the completion of this market cycle.”

https://www.zerohedge.com/markets/investors-face-grave-danger-wait-30-years-nothing-or-lose-67-now

@Richie re 0:39

I can respond to some of that.

Where else do you spot opportunities?

Check out Water Companies, in clear uptrends, and absolutely NOTHING about it in Gov’t Media. AWK, WTR, AWR, NEE, MSEX.

Gold is inversely correlated with either near zero rates, zero rates, or negative rates which makes it an ideal investment.

Not always. From around 1971 to 1980 Gold went from $140 to $800. At the exact same time, Paul Volker raised interest rates, they went UP. From around 6% to 21%. How could that David Rosenberg not KNOW that?? He must be very young.

RE HELICOPTER MONEY?? We’ve had plenty of that since the dot com bust, 9/11 and the real estate crash in 2008. But it didn’t land in the right hands. It went to people that didn’t NEED it. That helicopter money should have been given to the 18 to 25 year old private sector non union employees. Even if they were NOT employed if they wanted to see some action.

They did give helicopter money to them (under paid people) in the form of real estate and home equity loans. That many could not pay back. They screwed themselves, the bankers. I’m sure that back room story was…”hell no don’t give them higher minimum wage, they’ll just spend it, give them loans” 🙂

This debt morass (Gov’t Borrowing?) has been the result of tax receipts not keeping up with inflation, was the result of private sector non union wages not keeping up with inflation. The water company, the electric company, your school taxes, teachers cops etc etc all keep up with inflation by simply raising bills or tax rates. They don’t even have to ASK. EVERYTHING has to go up in unison. But, but.

But the common working people CAN’T just raise their wage in unison to the employer. Each household is like a business that has overhead. Many are supported by taxes, of the people who can’t afford to pay taxes, so budget deficits or public debt gets bigger.

Why is nobody talking like this on CNBC?? Are they THAT stupid? Or just won’t admit it? Re they are talking about a virus from China. I think TPTB need to stop supporting these artificially cheap airline tickets cause massive numbers of unneeded frivolous international travel.

Definitely Gold and most other metals are going much higher, and NOT necessarily from inflation. Water too, a most important product was always very cheap. Palladium platinum, watch Copper and aluminum too, all under priced, like airline tickets and unskilled labor.

Rosenberg

Well $3K would be nice if it happened by the end of this year. 🙂

ZH had an article about how the Fed had created an “everything bubble”. I just haven’t seen the “bubble” created in pm’s just yet, in fact the bubble seems to have been in creating the amount of short contracts they’ve thrown at our metals on the Crimex.

I’m really hoping for the type of bubble that takes gold to $5-10K before this is over but I guess that would mean they’ve lost control of the currency markets.

David Rosenberg interview= Gold demand is predicated on the final act which is going to be right-out debt monetization.

Gold is inversely correlated with either near zero rates, zero rates, or negative rates which makes it an ideal investment. Mark Twain coined the phrase “Lies, damned lies, and statistics”. But the thing about charts is that they don’t lie. Gold went through a long-term, multi-year basing period. Now, it has broken out and the chart looks fantastic. Also, gold is no country’s liability. For example, in the United States M2 growth is running at double digits. So when you compare the new supply of gold against the supply of money coming into the system from Central Banks, to me it’s a very clear cut case that you want to have very high exposure to bullion.

It’s just a matter of when, not if.==When we get to the lows of the next recession, we’re going to find that these Central Banks that already have been extremely aggressive are going to engage in what is otherwise known as the “debt jubilee” or a right-out debt monetization which was actually the final chapter of the Bernanke playbook. Remember, Ben Bernanke got his nickname “Helicopter Ben” because in a speech in 2002 he suggested that helicopter money could always be used to prevent deflation. So we’re going to have helicopter money.

Would you ever have thought that, at or near the peak of this cycle interest rates would be at the lowest level since the 1500s? Just imagine what happens to monetary policy in the next downturn.

This debt morass has been the principal reason why – notwithstanding how wonderful the stock market has done – this has been the weakest global expansion on record. What happens in the next recession is that the cash flows to service that debt are going to become significantly impaired and we’re going to get a destabilizing default and delinquency cycle. I know, that sounds absolutely horrible, but we’ve hit the end of the road on negative interest rates, and we’ve really hit the end of the road on quantitative easing. So the Central Banks are going to go into a new, non-conventional toolkit called debt monetization. They will lose control of the monetary base and then we will go into a situation where, even with technology and with aging demographics in the industrialized world, we will be talking about inflation again. That might come in the next 18 to 24 months, and gold is going to skyrocket.