$GOLD w

My long standing weekly roadmap is following my cup perfectly. Stretched the handle a bit as next 8 YCL will have pull by then. Added alternative route plus halfway pattern comment. Next 8 YCL is due 2023-24 but will probably come 2022-23. After that we will take off. pic.twitter.com/krJPOsaB0S— Graddhy – Commodities TA+Cycles (@graddhybpc) January 12, 2020

Graddhy

Ipso – Are they in Congress? :)

Looks like we got a bit of a battle today, the bums are coming after our $1550 and $18 that we’ve been fighting hard to maintain for the last week of so.

Hopefully the SM rolls over and we can fight back.

Buygold @ 7:29

I think I’ve know a few! 🙂

Buygold

I’m glad your petty officer kept you out of trouble and your instincts and training kept you alive although for so many that didn’t even help with the traps everywhere.

When a woman I know went there when

they were initially burning the oil fields the first thing she could see and smell they had a fit too. But in her case it was because she was a female and her head wasn’t covered lol She told me women came to them with their dead babies thinking they could make them alive again after the terrorist I’ll call them killed them in a nursery. Her brother a ranger was also over there and they wouldn’t let them go. That’s a long story. Luckily he came back too and doing things for the military like building houses etc.

Whether that person who shot down that plane that should of been canceled was a kid or not it seemed he would have to have permission by someone and still the fact that that missile was intended to kill Americans and Iraqis. Was he scared or were they hot heads?

Rick Ackerman

|

||

|

||

|

Buygold

No it just happened to be the chart I was looking at then. I do have a small position with a cost of 1.12. We had a very good year last year primarily because of the silver stocks which doubled.

I do like the mux chart but as with all our positions I will be very skittish. I am happy to leave gains to others but not happy to jeopardize last years gains.

aurum

Captain, R640

Captain – I do remember you saying it was a bargain down there – quite prophetic. If I didn’t already own so much I probably would have picked some up. Now I’m curious as to where it’s headed. Their last finance deal was done @ $1.32 a share which I would expect to be some resistance until the metal prices go a lot higher or they come out with some fantastic news. That being said, it’s hard to imagine their lenders being stupid. Hell, for all we know, McEwen could have been one of the financiers.

R640 – I think we had a 10-20% correction at the end of 2018? No doubt it can happen, timing it is tough though. Who knows, maybe the Middle East or a European Bank will flare up and help you out. At least your bets are relatively cheap. Low risk, big reward?

As for tonight, yeah I could see the DOW up a couple hundred and gold down $20. Nothing bad happened this weekend, at least that we know about, unless there’s some surprise Repo action.

Mind the Gap

Buygold–Good to know I have company-no, it’s not Goldmans or JPMs chief strategist…but I’ll take it

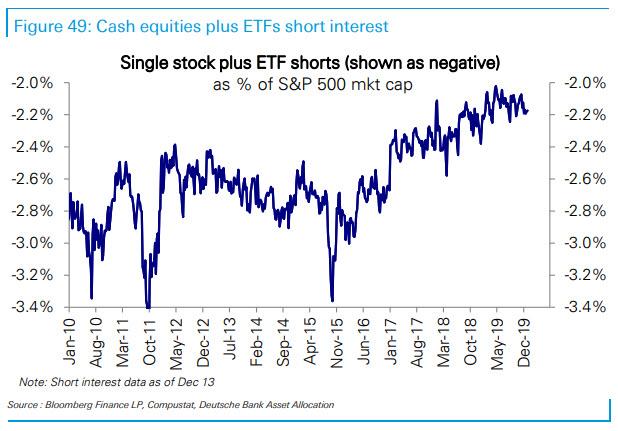

“This Is Nuts” – Why One Asset Manager Reduced Risk On Friday

Buygold–I would be very satisfied with a mere 10%-20% correction–I’m not expecting a 2008 collapse–when a market

as tightly wound as our stock market starts a serious correction–much of the downside-30%-40% of it-can occur in the first 3 to 5 days–the fear generated would cause a huge spike in volatility–which I’m hoping to catch–so I don’t mind taking stabs–what else can I do to make serious coin? Buy a 1000 shares of Amazon or Tesla-?

I think gold would have a huge spike too–I have said for years that gold will not repeat its 2008 performance even in a repeat of same.

Buygold @ 9:41

You might remember that was my call at the time (at the lows) on minor execution issues.

MUX could keep cruising here no matter what now as those issues are rectified and the good drilling results keep rolling in.

Not to mention the present market cap is only valuing one of its five world class projects.

Let the good times roll.

Cheers

Good morning aurum

Long time no see.

What’s your chart telling you about MUX? It had a good day yesterday, albeit on lighter than average volume, but looks like that $1.05 level was the bottom for awhile.

R640 – Good Research

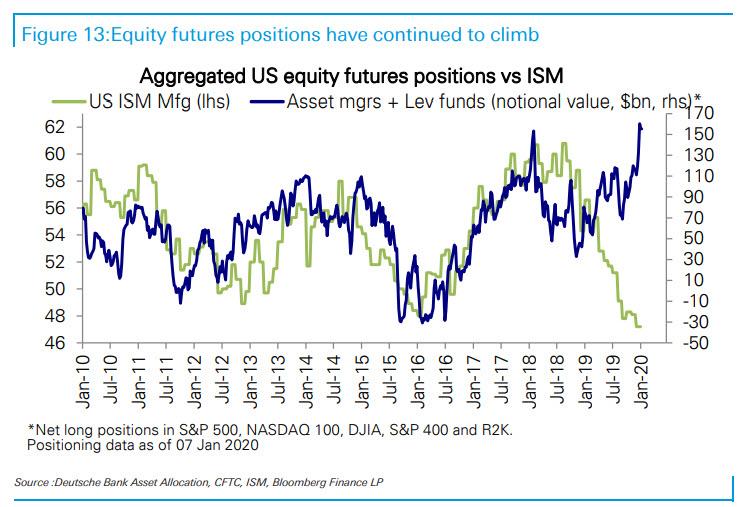

You really seem convinced that a SM correction is on the way, both by the articles you post and the VIX bets you’ve been making of late.

Why is this time different than anything we’ve seen over the last decade? The nature of your bets are pretty short term and I guess you’re looking for a pretty violent move down. What does gold do in your scenario?

TIA

The only question is how much longer can Jerome Powell continue “pushing on a string.”

Think “Lehman crisis” multiplied by a factor of four.

U.S. Treasuries are the most rehypothecated asset in financial markets, and the big banks know this. [They] are the core asset used by every financial institution to satisfy its capital and liquidity requirements, which means that no one really knows how big the hole is at a system-wide level.This is the real reason why the repo market periodically seizes up. It’s akin to musical chairs – no one knows how many players will be without a chair until the music stops.

“Some hedge funds take the Treasury security they have just bought and use it to secure cash loans in the repo market. They then use this fresh cash to increase the size of the trade, repeating the process over and over and ratcheting up the potential returns.”

“The repo-funded [arbitrage] was (ab)used by most multi-strat funds, and the Federal Reserve was suddenly facing multiple LTCM (Long-Term Capital Management) blow-ups which could have started an avalanche. Such would have resulted in trillions of assets being forcefully liquidated as a tsunami of margin calls hit the hedge funds world.”

Bernie for Prez in 2020-!!! Soak the rich!!

“The financialized economy – including stocks, corporate bonds and real estate – is now booming. Meanwhile, the bulk of the population struggles to meet daily expenses. The world’s 500 richest people got $12 trillion richer in 2019, while 45% of Americans have no savings, and nearly 70% could not come up with $1,000 in an emergency without borrowing.This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending.”

“The financialized economy – including stocks, corporate bonds and real estate – is now booming. Meanwhile, the bulk of the population struggles to meet daily expenses. The world’s 500 richest people got $12 trillion richer in 2019, while 45% of Americans have no savings, and nearly 70% could not come up with $1,000 in an emergency without borrowing.

We’re merely citing this as an example of how quickly financial markets can go from full functioning to complete breakdown.

Financial Markets Don’t Have The Faintest Inkling Of Potential Geopolitical Risk

“Every generation suffers its particular fantasies. So it was a century ago. Investors had grown so immune to the consequences of war that bond markets from London to Vienna didn’t flinch after the assassination that provoked World War I.“Three weeks later, in the summer of 1914, the fear premium amounted to a total of one basis point. Then, in quick order, European markets ceased to function. A notable feature of this paralysis is that nothing of substance had changed – war had not been declared by any of the parties, but by now, minds were hyperventilating.”

Geopolitical Shocks and Financial Markets

VXX doesn’t need a 2000 or 2008-it is $14-in the Dec. 2018 sell off it was $46-[no splits since 2017]-even half of that would be a good trade

Mux

Just looking at charts

Thank God for my Petty Officer 1st Class (SGT) who I’m still in contact with 40 years later. I would killed that soldier who was just another kid, likely being told what to do by someone higher up in an effort to impress US Spec Forces. Unfortunately in Iran, whoever fired that missile, may lose his head over it, but he was likely just a kid thinking he was protecting his country against “The Great Satan” and scared out of his wits.

Can’t think what to say about that except it is so true. Too bad we can’t make everyone understand.