been encouraged by this–also the DOW opened way off its pre-mkt high…but no matter…buying came in on all the indexes…this has been the pattern for many months…an index has great trouble remaining red for over 5 or 10 minutes…Trannies are up 40 now…

FYI

FYI

Mr Copper

Yeah I remember the song. Think it got to the Mid East too lol except they would keep one religion in.

If people thought as say growing up around Christians as him and world peace it would be a nice dream even Buddhists and think Yoko could live in harmony.

Hunger can mean more than one thing. In Buddhism for example Satan can represent evil and evil can evolve from hunger and not just food. Hunger for other people’s stuff.

On the other end of that spectrum is hunger for knowledge, advancement in technology, medicine, quality in life.

Even with that the the other side can come around to use the work of others even medicine for the wrong reasons for power or profit.

In America the framers knew there was multi religions and even then one was a threat to them, the Muslims who were robbing people boats in trade. Instead of appeasing them though or paying for safe passage he “ Jefferson “ brought in the marines and hunted them down.

Aside from that why they put freedom of religion.

Now I’ve even seen talk about “ should people be able to own land.”

The young are being sidetracked our scare tactics right of their constitution.

They also haven’t learned especially with ID politics is attitude. Who wants to work with someone everyday who walks around with a chip on their shoulder or a constant whiner.

John didn’t have to work and if he had his way that pizza he orders wouldn’t never got there cuz everyone would of dropped out lol Thats how some took it, don’t feed into the system.

What he was saying was the ruling dictators and religious radicals has killed more people. That part hasn’t changed. We still need borders.

FYI

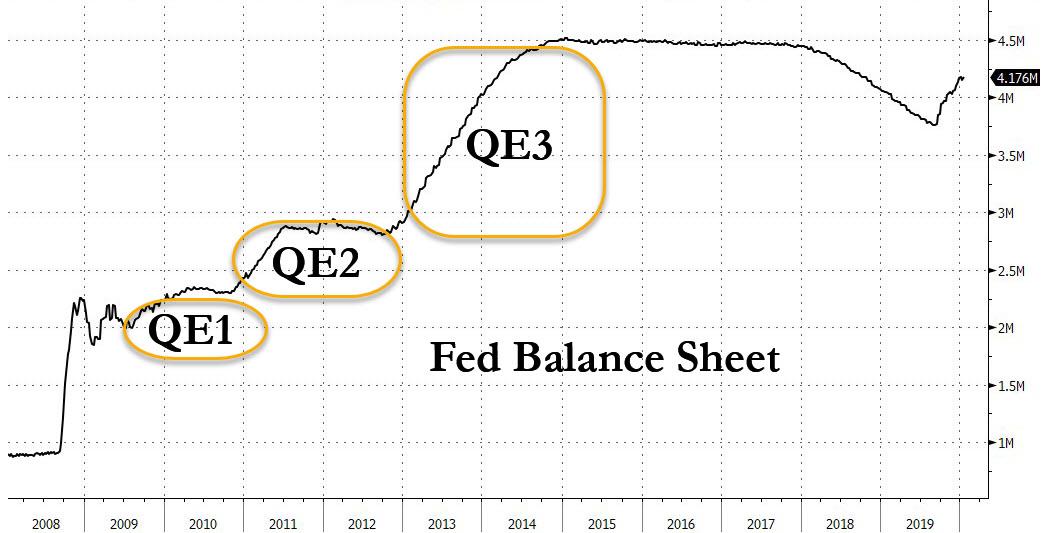

All that, dear Neel Kashkari, is how the record pace of expansion of your balance sheet, which is growing at a faster rate than during QE1, QE2 or QE3 … is sending stocks to new all time highs every single day.

For the Fed to end daily RP ops, they need outside cash to come back into the Repo market. For the Repo market to attract cash, Repo rates need to move higher. For rates to move higher, the Fed needs to stop RP ops.

Got this from A ZH reader

Platinum Palladium

Finally hitting the news this morning. I don’t like that. By the time the news announces something, and by the time public finds out something, its over, normally.

But this time might be TOTALLY different since so many things are reversing. Major reversal might be, no more manipulation of futures pricing allowed, or discouraged by less loans to producers who tend to over-borrow, and banks to over-loan, when prices are high.

Then prices drop and make the loans risky for banks. Less CAPEX I heard has been going on. Remember Oil? $145/bbl? $58 today? Bank loans?

Lucky me I see PLG + 25% I just added to that one and SBGL on the 15th. I’m hold on.

there’s some friggin’ in the riggin’

metal prices moderately up,

miners down?

even the pussycat’s got a hairball today.

goldielocks It all Started with Yoko Ono, Influenced John Lennon’s “Imagine” Song

It isn’t hard to do

Nothing to kill or die for

And no religion, too

Living life in peace

But I’m not the only one

I hope someday you will join us

And the world will be as one

I wonder if you can

No need for greed or hunger

A brotherhood of man

Sharing all the world

But I’m not the only one

I hope someday you will join us

And the world will live as one

Ipso

Why these road blockers are not getting tickets I don’t know. Plus these workers could sue them for loss of wages. What they’re doing doesn’t make any sense to other citizens.. for doing the same thing as them no less.

The propaganda of socialism, communism, the Gov. will take care of you so you don’t have to work or pay back your student loans pandering, open boarders, hate your neighbor, “ oxymoron” sex with anyone male of female, resulting teen pregnancy’s or diseases, lowering of testing and even talk of taking math out because it’s racist, what could go wrong.

He disappeared! Who could have known? :-)

Police launch manhunt after India’s infamous ‘Doctor Bomb’ disappears day before his parole ends

A convicted terrorist known in India as “Doctor Bomb” has vanished, after being temporarily released on parole. Jalees Ansari was serving a life sentence for his alleged role in bomb attacks across India.

The 68-year-old was reported missing by his family shortly before his 21-day parole was scheduled to end. Ansari had been ordered to report to Mumbai police every day, but failed to turn up on Thursday. His son later came to the police and explained that his father had woken up early and left their home – and hasn’t been seen since.

https://www.rt.com/news/478472-india-doctor-bomb-parole-escape/

Buygold @ 9:56

I’m not wild about some of their locations but you can’t argue with results!

There’s a lot of gold in West Africa … and a few Jihadis as well.

Morning Ipso – BTG

BTG’s chart sure represents that of a steady, solid performer.

B2Gold achieves record production for 11th year in a row

B2Gold (TSX: BTO) (NYSE AMERICAN: BTG) reported a record annual consolidated gold production of 969,495 ounces in 2019, including 118,379 ounces from discontinued operations.

The 2019 figures exceeded the upper end of the company’s guidance, which was set between 935,000 and 975,000 ounces. The numbers also mark the eleventh consecutive year that B2Gold achieved record annual consolidated gold production.

Maybe I spoke too soon

They’re chipping away at our gains on the back of a stronger USD, SM and higher rates.

Looks like it’s going to be an uphill battle after all.

treefrog

GPL is on the move again this am – looking good into the open.

goldielocks @ 3:58

Good video. It’s amazing the arrogance of those lefties. I’m sure they would have been outraged if someone blocked THEM from getting to their protest.

Alex Valdor @ 21:45

Thanks for your knowledgeable response. I have heard of schemes to harvest that methane gas which is trapped under the ocean but haven’t heard of anyone succeeding at it.

It’s a shame about the leftist indoctrination of students. It’s a real thing and dangerous to property rights and your other rights as well. At some point the sluggards will sit down and say: Take care of me …. and no one will do it.

Today’s the day?- you too Maya

$1550, $18, 235 HUI all going to be in the rear view mirror for good?

I like the way we’re starting off!

Maya – no laughing from me buddy! 🙂 Clear a few rocks and built a nice 1 bedroom concrete block flat with a patio on the roof to soak up rays. What could be better? 🙂

Ipso

Here’s the video. They were telling people to walk to work. Climate change. I wonder if they all walked there?

https://youtu.be/kXpEfWq8I_I

Ipso 14:43

If this were the early 1900s or beyond there would be no violence in the streets. They’d just take these communist traitors out and hang them.

The funniest thing I saw most likely coming from the right was not cowardly attacking like the left but fed up with their illegal road blocks. When some people were blocking a road and all these people needed to go to work in their cars they just stood there. This guy got out of his car grabbed their signs and threw them off the side walk. When one of the women tried to get into it with him probably threatening to call the police and where were they, he grabbed her cell phone and threw it then proceeded to where ever he was going. End of road block.