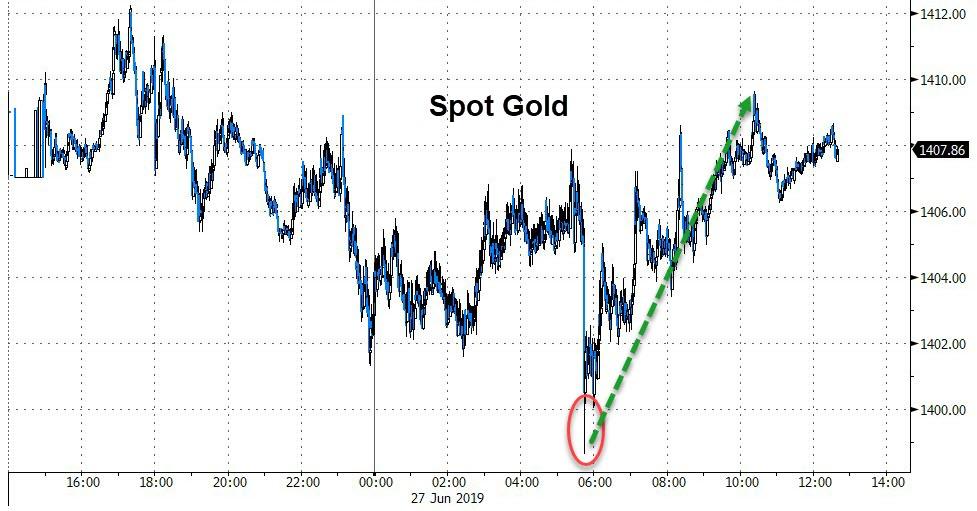

THE PROOF

Sunday night gold will be up strongly and by the end of the week gold will be over $1500

So tomorrow will be the last day to add on or take an initial positon in G&S.

My main problem to solve was would the XI-Trump meeting be a success–it won’t be a dramatic failure–Trump is not going to throw a banana creme pie in XIs’ face and storm out–there will be. some B.S. joint statement that will sound O.K. but accomplish nothing–they will agree to keep negociating–how do I know this?

From the action in bonds mainly…secondarily from the dollar and stocks…I got further confirmation for what. I was suspecting from this article=

Bonds & Stocks Bid On ‘Bad’ Macro/Trade News

Finally, as Bloomberg’s Ye Xie notes, the collapse in regional Fed surveys leaves the stock market vulnerable. With the Kansas City Manufacturing Activity Index posting a reading of zero, all five regional Fed surveys of business activity deteriorated this month. That points to the risk that the ISM manufacturing index next week may fall below 50, the dividing line between growth and contraction.