Posted by Mr.Copper

@ 11:50 on July 13, 2023

I have in the past seen sudden big moves like 6 mos or more in the USD and in my view were not natural market forces. Simply change of gov’t policy. Higher USD helps the foreigners, and lower USD to help domestic USA and China. USD and Chinese Yuan are mostly pegged, allowed to fluctuate slightly for appearance sake.

That silly ass approximate 7 yuan to $1 exchange rate has been going on for decades. Or how else would big business move over there and survive over there since 1970 without a guaranteed peg? And we all know who the gov’t lacky is that does the big trades on command. If we REALLY want to decouple with China they NEED to LOWER the Peg down to 2 Yuan to the $1 just to be equal and fair.

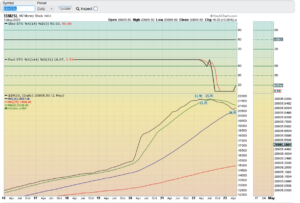

Below view the “pegged” Yuan to USD

Gold – Currency Charts (kitco.com)

Posted by Ororeef

@ 11:40 on July 13, 2023

Posted by Captain Hook

@ 11:20 on July 13, 2023

Players are in fact coming into the paper PM’s like never before as well.

BofA buys 1.2 million oz on the July contract for immediate delivery pushing new contracts since first notice day to a record 11.7% of registered silver. : SilverDegenClub (reddit.com)

Records are being set as we speak.

Only thing is one must be patient for the point where da boyz will inflate with abandon again, and step away from this constant shorting in futures.

And that will not happen until stocks are considerably lower.

I am not expecting a big sell-off in gold and silver going into the fall as the Fedsters are likely to start jawboning back towards a propensity to soften their stance beginning soon (next month at Jackson Hole?), but still, if recent actions are any indication, gold will trade in the $1800 before a sustainable rally should be anticipated – CBDC talk or not.

It could be argued the physical off-take at present (and futures buying) are anticipating the BRICs announcement, meaning it’s being factored into the trade now – leaving the door open for disappointment at the time.

Especially if the equity complex begins to struggle and liquidity dries up.

Cheers all

Posted by Buygold

@ 11:04 on July 13, 2023

No question the boys are cornered possibly like no time ever before. They will throw everything and the kitchen sink in terms of paper at gold for as long as they can eventually though the jig is up. If someone large comes in and demands delivery, they have real problems, but we’ve been saying that for over a decade so, as you say, we have to be weary of increasing volume at the Crimex.

Goldie, the Fed will raise, and they will raise again, and again, and again. This next wave of inflation will be dollar driven. I am stunned that the dollar is selling off as fast as it is right now we’ll see how the rest of the day goes but the shares have been mixed and they’ve got them pinned down as well. I all of a sudden though, silver is an absolute beast. I’m surprised that silver is not being pinned down like gold is.

Posted by Captain Hook

@ 10:01 on July 13, 2023

… another 20,000 contracts put on gold open interest at Comex bringing the total back over 500,000 on a measly $50 rally off recent lows.

Metals Daily Exchange Volume & Open Interest – CME Group

Wake up people.

Be careful as da boyz are cornered and are defending their empire like never before.

Cheers all

Posted by goldielocks

@ 9:20 on July 13, 2023

If the Fed doesn’t raise the rates there is hope as long as inflation keeps dropping otherwise he’s bent on 2 percent. He still can’t control fiscal spending and we have neocons with free rein. They’re predicted to spend 2 trillion a year for the next 10 years. Only a gold standard would stop them but they want to go the other way and go paperless. That promissory note must go. They’re trying to destroy the future every way they can. These characters going around who takes things too seriously “ about themselves” think the sun rises and falls around them aren’t any different than the others before them dead and buried. Just like they will be.

I think it will be good for Bitcoin as well as gold as people even now preparing to get out of the dollar. I just hope we’re have enough tough politicians including some woman I see that can rein them in.

Posted by Ororeef

@ 9:00 on July 13, 2023

but I think I tracked it down.I use two operating systems win 10 and Ubuntu on a laptop..Both are wired connections direct to router The windows desk top wouldent connect to internet,but the laptop did……so I swapped the cable of the desk top connection and viola ! that was the problem..a cable that connected when it felt like …Problem been going on for several weeks hopefully that was all of it..

Posted by Buygold

@ 8:34 on July 13, 2023

Should be a winner for us, but I have my doubts.

We’re still pretty flat.

Posted by goldielocks

@ 8:10 on July 13, 2023

Ameritrade was much easier and faster to trade. This one is particular or some stocks you can’t put good till canceled on.,Those are dropping a bit nearing sell signals but for longer term anyways and likely not act like PM stocks. They’re keeping me too busy right now. Sheesh

I hope Ipso is alright. This is a unusual time to take a break from the stocks.

Posted by goldielocks

@ 7:36 on July 13, 2023

I forgot about AG I’ll have to check that one,

I’m having trouble buying back a couple I sold the other day in another after stopping out.

ig you think their at support and moving above it and or breaking out of down trend and indicators look good best to buy early but I know what you mean especially if people are chasing it, those market makers can play games. Like high pressure sales. Maybe their forward running it.

now I have to get back and see what’s going on with those other two,

Posted by Ororeef

@ 7:28 on July 13, 2023

Posted by Buygold

@ 7:06 on July 13, 2023

If he posted that, I missed it.

If not, I need to check in on him.

Posted by Buygold

@ 7:04 on July 13, 2023

RSI’s already up in the 60’s – I’d like to see them up in the 80’s and stay there for awhile like all these ridiculous tech stocks.

Both of them have been beaten silly, so a hard bounce shouldn’t surprise. I’m hoping it’s not just a bounce tho.

Posted by Buygold

@ 6:18 on July 13, 2023

Kind of flat here early on, with spot up $1.70 and $.10 respectively. The USD is down another .25%, not too far from breaking the 1.00 level. Hoping for a continuation myself.

The other metals are all higher. RIO and BHP very strong in the premarket.

10 yr. is down 4 bips to 3.81% – didn’t hold 4% very long. Oil flat. Bitcoin up about 200 points. (eff Bitcoin too!) 🙂

I believe we have some eco news today that includes the PPI, which will be the big number. Should follow the CPI lower as well, but ya never know which numbers they’ll want us to see.

I suppose if this is the real deal rally, we’ll keep going. By “real deal” I mean the beginning of the pre BRICS currency rally and dollar collapse.

The HUI is sitting at the 50 dma. T/A types might sell it – or not.

Yesterday was wonderful!

Posted by Buygold

@ 5:51 on July 13, 2023

Whenever I’ve bought the premarket, I’ve usually not done well. We had been up 3 straight days already and yesterday gold and silver weren’t up that much in the premarket if I remember right, so that took some cajónes. Pretty rare we’re ever up 4 days in a row.

Posted by Maya

@ 2:15 on July 13, 2023

Posted by goldielocks

@ 19:40 on July 12, 2023

I got in early in PMs before it opened this morning at 4 am since were 3 hrs behind here. I had to watch some stocks to topping and saw some PMs hopefully braking out so got in early before open after I sold. By open, buying was busy and already up. Hopefully it will continue till around when the Fed speaks. Hopefully a 25 won’t upset the market too much but Dow seems to want to turn for now.

Nevertheless I grabbed a little in of Botz for down the road so I don’t forget about it with some of what I sold.

Posted by Buygold

@ 18:40 on July 12, 2023

You’re right, there’s not a real good correlation. This the 4th straight up day for the shares, but the metals didn’t do much but churn for the first 3 days. The shares usually lead if the metals are going to turn higher.

If you look at a chart of the HUI, the pattern is identical to the bottom around March 6th. If it plays out, that is great news, and we should rally all the way to 320 or so.

We stopped right at the 50 dma, maybe we have a pause here, maybe not. The big difference is the downward momentum of the USD, it looks to me to be in some serious trouble.

Course all this could change tomorrow and they can take us back down hard. Doesn’t feel like it though. All hard assets rallied, and the big copper shares RIO and BHP rallied hard.

Posted by Maddog

@ 15:56 on July 12, 2023

Good calls …tks

U have that wonderful gift of ‘smell’…..a priceless gift.

Posted by Ororeef

@ 12:56 on July 12, 2023

other days like today Gold is up 1.3% and my stock is up 4.4 % ..Its like theirs no connection ? The same stock comparison… So who makes the stock move ? the question is WHO not what ?

Posted by Mr.Copper

@ 12:36 on July 12, 2023

Back in the 1970s higher rates were affordable for Americans. Living standards were high and low end pay were a lot higher, more buying power. So now 53 years later, the whole country is broke with a high national debt.

Defending the US Dollar against other countries would just make things worse for the US economy, so they have to make the USA more profitable, (with a lower Dollar) at foreign countries expense. Its really pretty simple.

They have to build us back up. We can’t go any lower. The past ways are all in reverse. Who really cares about if the general Stock Market declines? Its already been too high for too long. But the PMs are historically cheap.

By the way, property taxes in my area double every ten years. Thats 7% per year the true inflation rate, pretty much for decades, 7%/yr.

Posted by Buygold

@ 11:45 on July 12, 2023

So far you’ve called this one too.

We have a long way to go and the HUI needs to get back above 280 and keep going, biut this is a good start.

The big boys know this, but what happens to the SM when it realizes the Fed is raising rates to defend the dollar?

Posted by Mr.Copper

@ 11:19 on July 12, 2023

I called that freak $1060 bottom in late 2015 early 2016. And that recent $1600 low in Sept I called that one too. And that recent dip that went slightly below $1900 during the day, in late June, I called that one too. I’m pretty confident tptb are in loser mode for a long time. They can’t win. They may disrupt us occasionally, but they simply can’t win anymore.

https://finviz.com/futures_charts.ashx?t=GC&p=m

Posted by Buygold

@ 10:17 on July 12, 2023

Let’s hope this sticks. We’re finally getting a day like we should have. Silver busting a nut so far. Would love to see gold finish up $40, but that’s a heavy lift.

Posted by goldielocks

@ 10:16 on July 12, 2023

Here’s one

Toyota Mirai hydrogen fuel-cell car goes 845 miles between fills—driven very slowly.