Weekend listening…

From V the gorilla economist, interview with Veles.

All about the seeming changes in the direction and momentum of the Deep State Agenda.

I hope the link works, and does not take up all the space the last one did.

goldielocks @ 11:25

I think we should have shelters too. Although if there’s a full out nuclear exchange how many people will be alive in a year or two? Not many.

It really angers me that those in charge are flirting with nuclear war. It’s despicable!

Palestine Ohio

We have clueless people in office.

Oh we’re testing the wafer and soil it’s fine. That’s why animals died because it’s fine. Not to mention the air. Sure it is.

Totally useless.

Where were the air filters, water filters?

Keep their shoes outside their home or in a container. Why did they not remove top soil by people protected and respirators in all the areas exposed by the fall out? What have they done for them?

They’re not even prepared for isolated events.

Ipso

Since the idiots in the WH and now neocons who never actually do the fighting are thinking there being clever pushing us in war again, I somehow always go back to children.

We used to have drills at school, remember? That wasn’t even enough. If one did go off then what? Send them out in the fall out? Is there anyone at home?

They don’t even have school shelters for tornados.

Russia has shelters.

Buygold @ 9:2

Very possible the neocons want those few troops there to be a flashpoint. If they are seriously attacked by Iranian backed militia with Iranian missiles then Voila … we have a war with the Iranians!

… and “stealing their oil” Have we really come so low? What about the old days when we were the “good guys?” This may have not ever been strictly true but our actions seem to be getting worse with no benefits to any but the 1%.

Ipso – besides guarding an oil field and presumably stealing the oil, maybe this has something to do with troops.

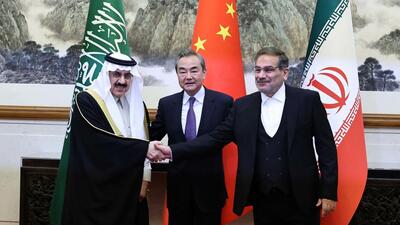

The Saudi’s have re-established relations with Syria and look to do business. We are very quickly finding ourselves on the outs in the M.E. That’s OK with me, bring all the troops back. Produce oil here, etc.

But we won’t…

The eruption of direct conflict has the potential to escalate tensions with the Syrian government and Iran, and the timing of the event is highly suspicious…

Some eco data next week

including the big “PCE Report” which is supposed to be the key indicator the Fed watches. That happens Friday, the last day of the month, and will likely matter to the markets. Fed speakers are plentiful, so we’ll probably react to every headline. Will be interesting to see if they continue to bark hawkish, even though the time for their hawkishness is over.

I don’t think $2K is going to be a super big battle, but since I’m thinking that, it will probably be a huge battle. ?

Still think silver is the key.

Gold’s Most Important Weekly Close Next Week.. Ever | Market Rundown (substack.com)

Gold:

“Having had a phenomenal last 2 days, due to the fear of banking contagion and alternatively, the perception those quite deflationary problems would be slowed by Fed Easing/Pivoting there really is no safe reason to be short Gold.

Natural selloffs will be from longs getting out now. We do not think the Bullion banks are playing short side at all other than in their market-maker duties. Therefore, if they do smack it down, know it is almost definitely with express permission/incentive of Gov’t officials.”

This is a good article. He doesn’t think the banksters are playing. I think most of us will know when the banksters aren’t playing. The COT’s would indicate they are still playing.

Is next week for all the marbles, or just another week in the journey?

How to pick the Best VPN for Smartphone and Computer

Whether most likely using a VPN with your phone or perhaps computer, you intend to make certain you’re finding the best program for your money. The suitable mobile VPN should be secure, easy to use and gives a great experience on any device.

A VPN’s main job is usually to protect the privacy on line, so you’ll need to be sure the service has solid encryption and a kill switch to shut down fields or downloads available if the iphone app stops operating. A portable iphone app should also contain a simple pair of controls and a quick-connect switch.

You’ll also desire to choose a VPN that has servers in lots of countries, as this helps maintain your connection increases and inhibits slowdowns due to heavy traffic. Hosting space that are near your home or perhaps office can certainly help alleviate pressure on mobile info connections, also.

Simultaneous Internet connections: Many VPN services limit the number of equipment you can connect with a single accounts, so it’s worth checking the terms and conditions before signing up.

Speeds: A lot of VPNs can have a negative influence on your interconnection speeds, especially if you’re linking to a hardware that’s a long way away from your home or office. However , most cellular apps come with some kind of “autoconnect” feature that tries to connect to the swiftest available server.

Encryption: AES 256-bit security is typical, but you may want to consider a protocol that offers faster speeds just like IKEv2. When you are using a VPN for mobile, it’s best to find one that has a protocol http://bestvpnforandroid.org/what-is-the-difference-between-mcafee-livesafe-and-mcafee-internet-security/ that supports both UDP and TCP.

Things are heating up in Syria. Tell me again why we are there?

Iran-Backed & US Occupation Forces Currently Battling In Eastern Syria, Reports Of Casualties

Gold & Silver are secondary metals to your survival….

The first is LEAD ,you must have sufficent stores of such to protect your Gold & Silver .The thing to remember is you must be prepared to SPEND it first ,the results will be it creates a fear complex that exceeds any physical restraint you can muster ..its a powerful metal .So get your metal priorities in order..Its has excellent trading possibilities ,you can trade it for just about anything in times of turmoil ..it will be a currency everyone will accept more than Gold & Silver when its needed..

Maddog @ 16:20…Just got back and saw your post, Yours too Buygold!

I think that proves my point. The published figures I’ve seen for the world Derivatives is over $600 TRILLION, which is many times greater than the whole world’s GDP…which means it is the equivalent of a HOLOGRAM image which doesn’t really exist….It’s pie in the sky or the equivalent of FOOLS GOLD. It looks pretty but only a fool would try to mine it thinking he had a fortune…because when he tries to sell it is when he finds out it is worthless…. always was and always will be!

The Derivatives are owned by the Casino, and you are the gambler playing the fools game in their rigged Derivatives Casino, and you are about to get fleeced when they turn off the lights and leave by the back door with all your money.

IMO there are only two things that have a chance to survive what is coming. One is SILVER and the other is GOLD….and if you can’t hold them in your hand, they’re worthless too.

Adios and all the Best to Everyone From Silverngold!

maddog

I saw Judy Shelton on Kudlow. I thought she mentioned DB had $80 Trillion in derivatives.

Course, my short term memory is not so good…

Interesting RSI on GLD got balanced out today with GDX and the HUI – all three have RSI’s at 64. Last couple days volume in most shares has been low. No clue what that means but up is good right?

We survived Tuesday’s drubbing and came back even stronger.

Will be interesting what rumors or even new banks that go belly up over the weekend.

COT Report – up to date now

The players aka banksters are still very active.

silverngold

That table is for US banks,,,,DB had $ 49 Trillion of derivatives at end 2020…I can’t find a more up to date number and it is late here,,,,,,they are similar to GS and JPM…..

Probably the same everywhere

“It’s Getting Real”: Unease Over Banking Sector Turmoil Spurs Huge Demand For Physical Precious Metals

Coin Heaven co-owner Gabe Wright saw precious metals demand rise to new heights during the pandemic, but nothing as spectacular as Silicon Valley Bank’s (SVB) collapse.

“It’s getting real,” Wright said, standing behind the glass showcase filled with various silver and gold bullion, coins, jewelry, and sterling in his busy Cottonwood, Arizona, shop on March 20.

“On a dime, it turned around—big time. It’s unprecedented,” he said. “We’ve seen the demand high, but not like this. Of course, SVB started this phase we’re in.”

Anyone remember the last time

the shares closed up with the metals down?

Me either. Bullish!

Credit Suisse’s $39 Trillion Derivative Debt Poses Significant Threat to US Financial System.

Here is what we will be getting into today:

- The Shadowy World of Derivative Debt: Why Credit Suisse’s Troubles Spell Disaster for US Banks.

- Navigating the Tensions: The Fed’s Approach to Addressing Inflation while Protecting the Banking System.

- Inflationary Pressures and the Looming Threat of a Hard Landing in the Global Financial System.

Let’s Dive In!

https://www.themacrolist.com/p/credit-suisses-39-trillion-derivative

Carpet bombed

scum showed up in the thinly traded after hours and dumped us back below $2K

Shares are trying to hold up but I don’t see how they can…

FJB

Appeals Court Blocks Biden Order Forcing Federal Employees To Get COVID-19 Vaccine

Gotta love the action in the shares

Good straight in a week Meadows market.