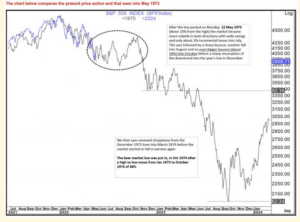

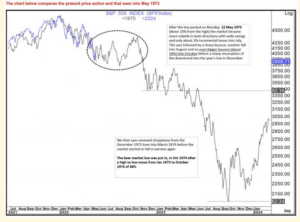

But It Fits For 1973

1973 had the Arab-Israeli war, the Oil shock and the Fed struggling with rising inflation.

S&P 500 (BLUE LINE) Mirroring 1973-1974

(BLACK LINE) Stock Market Collapse

We are doing exactly what we should be doing, especially with the QQQ’s down 10 pts. – almost 4%.

Even the shares are managing a small rally. NEM is leading, good sign.

Surprisingly Bitcoin is flat and not getting crushed.

I think I can I think I can …

Shares sure looking like crap with stronger gold and silver prices.

Is the SM dragging them down?

PM’s have decided to move a little higher despite the scum.

Shares not all that impressed though.

Veteran US statesman Henry Kissinger has urged the West to stop trying to inflict a crushing defeat on Russian forces in Ukraine, warning that it would have disastrous consequences for the long term stability of Europe.

The former US secretary of state and architect of the Cold War rapprochement between the US and China told a gathering in Davos that it would be fatal for the West to get swept up in the mood of the moment and forget the proper place of Russia in the European balance of power.

Dr Kissinger said the war must not be allowed to drag on for much longer, and came close to calling on the West to bully Ukraine into accepting negotiations on terms that fall very far short of its current war aims.

“Negotiations need to begin in the next two months before it creates upheavals and tensions that will not be easily overcome. Ideally, the dividing line should be a return to the status quo ante. Pursuing the war beyond that point would not be about the freedom of Ukraine, but a new war against Russia itself,” he said.

That was quick. Scum coming in to defend $1860? Really?

Oh well, it is what it is.

Benchmark Expands New Discovery Area with 77.00 Metres at 1.56 g/t Gold Equivalent of Gold-Silver Mineralization

https://finance.yahoo.com/news/benchmark-expands-discovery-area-77-070500057.html

GR Silver Continues to Deliver Wide, High-grade Drill Results at Plomosas: 6.5 m at 1,458 g/t Ag Including 0.9 m at 3,118 g/t Ag in PLIP22-013

https://finance.yahoo.com/news/gr-silver-continues-deliver-wide-100000772.html

i-80 Gold Drilling Expands High-Grade Mineralization in the South Pacific Zone at Granite Creek

https://finance.yahoo.com/news/80-gold-drilling-expands-high-100000735.html

Azimut and Mont Royal Commence Maiden Drilling Program at Wapatik

https://finance.yahoo.com/news/azimut-mont-royal-commence-maiden-103000783.html

Aroland First Nation, Animbiiggo Zaagi’gan Anishinaabek and Ginoogaming First Nation Enters into Exploration Agreement with Tombill Mines

https://finance.yahoo.com/news/aroland-first-nation-animbiiggo-zaagigan-120000360.html

Sullivan Mining District – High Grade Gold Mineralization Intersected on Strike of PJX Resources’ David Gold Zone

https://ceo.ca/@accesswire/sullivan-mining-district-high-grade-gold-mineralization

American Pacific Mining Reports High-Grade Samples up to 205 g/t Gold and 209 g/t Silver at the Tuscarora Project in Nevada, USA

https://ceo.ca/@nasdaq/american-pacific-mining-reports-high-grade-samples-43f08

Nullagine Gold Project Update

https://ceo.ca/@nasdaq/nullagine-gold-project-update-f1130

Sierra Madre Drilling Intersects 32 Metres of 1.05 G/T AuEq During Maiden Drilling Program at the La Tigra Project, Nayarit, Mexico

https://ceo.ca/@accesswire/sierra-madre-drilling-intersects-32-metres-of-105

ARTEMIS AWARDS MINING FLEET SUPPLY FOR BLACKWATER PROJECT, SECURES CREDIT-APPROVED COMMITMENT LETTER FOR EQUIPMENT LEASE FACILITY AND ESTABLISHES PATHWAY TO FLEET DECARBONIZATION

https://ceo.ca/@newswire/artemis-awards-mining-fleet-supply-for-blackwater-project

Aya Gold & Silver Completes Airborne Geophysics Survey and Launches Drill Exploration Program at Boumadine

https://ceo.ca/@newswire/aya-gold-silver-completes-airborne-geophysics-survey

Andean Precious Metals Reports First Quarter Results and Reiterates 2022 Guidance

https://ceo.ca/@newsfile/andean-precious-metals-reports-first-quarter-results

1911 Gold Provides Update on Q1-Q2 Exploration Drilling and 2022 Field Exploration Programs

https://ceo.ca/@newswire/1911-gold-provides-update-on-q1-q2-exploration-drilling

Silver Sands Resources Maintains Option Agreement with Mirasol Resources Ltd., Completes Phase IV at the Virginia Silver Project

https://ceo.ca/@newsfile/silver-sands-resources-maintains-option-agreement-with-042ba

Eric Sprott Announces Holdings in Silver Sands Resources Corp.

https://ceo.ca/@newsfile/eric-sprott-announces-holdings-in-silver-sands-resources

Eric Sprott Announces Holdings in Mistango River Resources Inc.

https://ceo.ca/@newsfile/eric-sprott-announces-holdings-in-mistango-river-resources-b873e

Golden Sun Mining Announces Reverse Takeover and Commencement of Public Trading on the Canadian Securities Exchange

https://ceo.ca/@nasdaq/golden-sun-mining-announces-reverse-takeover-and-commencement

79North Discovers New Gold Occurrence and Additional Drilling Target With Grab Samples Up to 15.51 Grams Gold Per Tonne at the Nassau Project, Suriname

https://ceo.ca/@nasdaq/79north-discovers-new-gold-occurrence-and-additional

Tombstone Exploration Corporation Announces Results of Carbon Shipment Carrying Gold and Silver Have Been Processed and Refined –Third Delivery in 2022

https://ceo.ca/@nasdaq/tombstone-exploration-corporation-announces-results-6e888

Rates down, USD down, SM down.

Apparently gold needs all 3 if we are to have a chance – so we try again today.

All 16 runners who collapsed at the Brooklyn Half Marathon on Saturday said they were 'fully vaccinated.'https://t.co/6ppyeZvDrd

— Kyle Becker (@kylenabecker) May 23, 2022

,everyone wants to tear it apart and grab its resources ..all of Europe ,NATO,China covet Russias resources ..They may have poisoned Putin ..he might make it ,or not….Its going to be a feeding frenzy if he dies….

and when THEY think THEY got 90 % of whats available ..they gonna reverse coarse and take it down with help from the Media using their facilities to control public opinion and create the fear thats going to scare the hell out of the public and create panic selling at the end …in meantime they take down selected areas because that keeps the rest in the market intact until they are ready to take them down too ..

Buy Gold and HOLD ON its going to be a BUMPY ride but its going to last a long time because theres a lot of money to be had and their greedy hands cant hold it all at once .TWO-Three years down …if they control the decent ..!

Stumbled across this montage from the doomed Biden ‘88 campaign and I’m crying at the McLaughlin Group reactions at the end. pic.twitter.com/A9etqn8J4H

— Jimmy (@JimmyPrinceton) May 23, 2022

I can’t disagree with any of that.

The US is burdened by a traitorous elite that are only interested in gaining more power and feathering their own nest and the public be damned. and that is the least of it!

Good posts. I had no idea the Ruble is up 7% today, with the USD down 1%…hmm

So, demand for Rubles is up because Russia will only take rubles for oil and they’re sticking to their guns. Also sending a message to the rest of the world by cutting off Finland from Nat Gas.

There’s just this feeling to me that the way things will happen is we’ll wake up one day and gold will be up $200 and go massively volatile from there. It will be hard to hold our positions.

I’ll be the first one to admit that honest news is hard to come by – just like honest politics, precious metals markets (actually most markets), and covid treatments.

Actually, if Russia or the US were weak, China would take advantage. To me, Russia appears to be getting stronger, and the US weaker.

Russia is defending its borders, unlike the US.

Cheers!

Russia winning, not winning … I dunno.

I thought the idea of the appearance that they are not winning could tempt the Chinese re: Siberia was an interesting idea.

Cheers

“Russia’s spectacular failure in Ukraine has…”

Really?? Russia is winning. Check out The Duran

Look at the Ruble, much higher now than before the conflict – up over 7% today!

Saudi Arabia has signalled it will stand by Russia as a member of the Opec+ group of oil producers despite tightening western sanctions on Moscow and a potential EU ban on Russian oil imports.

Prince Abdulaziz bin Salman, the energy minister, told the Financial Times that Riyadh was hoping “to work out an agreement with Opec+ . . . which includes Russia”, insisting the “world should appreciate the value” of the alliance of producers.

Saudi Arabia signals support for Russia’s role in Opec+ as sanctions pressure mounts

But It Fits For 1973

1973 had the Arab-Israeli war, the Oil shock and the Fed struggling with rising inflation.

S&P 500 (BLUE LINE) Mirroring 1973-1974

(BLACK LINE) Stock Market Collapse

Could Siberia be a Greater Prize than the South China Sea for China?

Washington DC 16 May 2022

Russia’s spectacular failure in Ukraine has transformed China’s strategic options, for the better. Whereas Xi appeared ready to tandem-invade Taiwan just as soon as the olympics and party congress were out of the way, opening a second front in a new global war that Washington would have struggled to resist, Xi now has some important lessons from which to draw in reassessing his next moves. Why grasp at a porcupine when a big fat much despised sloth has fallen asleep on your doorstep? Unlike Taiwan, Siberia is not protected by a moat, is no longer protected by a major military force, is not likely to gain much international sympathy if attacked (smart balancers might even encourage/support such a move, or at a minimum look away), is vastly superior to Taiwan in terms of resources, is population scarce, already infiltrated by significant numbers of loyal Han Chinese, and the PRC arguably has as much claim to sovereignty over Siberia as it does over the South China Sea. Compared to Taiwan, Siberia is fecund, plump, low hanging strategic fruit.

more https://thirdoffset.substack.com/p/could-siberia-be-a-greater-prize?s=r