Don’t Be Dangerously Misled by the Rallies

Over the weekend, we learned enough about the virus to understand why things won’t be trending even remotely back to normal by Easter, as some may have hoped. Grave uncertainties will remain for possibly much longer, including whether spring break will turn out to be a devastating vector of contagion. In early January, a friend’s son, big (6’3″), strong and healthy, was among the first Americans to get what turned out to be coronavirus. He is a math student at a top university in Boston, and this was shortly after many of his Asian classmates returned to the U.S. after visiting their families over Christmas. Initially he experienced a sore throat and a 105 fever. Doctors were not looking for Covid-19 back then, and so it took ten days for them to order up a scan that revealed viral pneumonia. Thirty days later, he had not completely recovered, although the most debilitating symptoms had abated. He might just as easily have died. His mother, who lives in South Florida, is asthmatic and remains in a very strict state of self-quarantine. She does not leave her home for any reason, receives no callers, and scrupulously sanitizes any food or packages left at her door.

Over the weekend, we learned enough about the virus to understand why things won’t be trending even remotely back to normal by Easter, as some may have hoped. Grave uncertainties will remain for possibly much longer, including whether spring break will turn out to be a devastating vector of contagion. In early January, a friend’s son, big (6’3″), strong and healthy, was among the first Americans to get what turned out to be coronavirus. He is a math student at a top university in Boston, and this was shortly after many of his Asian classmates returned to the U.S. after visiting their families over Christmas. Initially he experienced a sore throat and a 105 fever. Doctors were not looking for Covid-19 back then, and so it took ten days for them to order up a scan that revealed viral pneumonia. Thirty days later, he had not completely recovered, although the most debilitating symptoms had abated. He might just as easily have died. His mother, who lives in South Florida, is asthmatic and remains in a very strict state of self-quarantine. She does not leave her home for any reason, receives no callers, and scrupulously sanitizes any food or packages left at her door.

An interesting side note is that the son had developed an algorithm for predicting the markets. When it went haywire just ahead of the signal plunge on Monday, February 24, he advised his mother and 95-year-old grandfather to sell everything. They did so, on Friday, February 21, sidestepping the market’s collapse.

Dow Headed Below 10,000

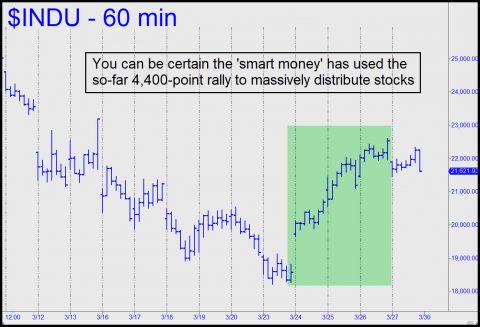

At Rick’s Picks, we continue to observe the pandemic’s effects mainly in the way it is affecting shares and commodities. Our analytical tools are purely technical, and they have proven useful in making tradeable sense of the violent price swings that have occurred this month. They have also kept us from becoming overly enthusiastic toward the rallies, which are driven by a combination of panicky short-covering and timely, supportive bids from institutional traders. The remarkable skill of the latter was on display last week in Boeing, which soared from a low of 89 a week ago to 186 on Friday. This is how the so-called smart-money will continue to profit mightily regardless of the trend. But make no mistake, stocks are ultimately going MUCH lower, and all rallies for the foreseeable future are destined to fail. I expect the Dow to trade below 10,000 before the bear market has run its course, and conceivably below 5000. Financial advisers will be telling clients to sit tight, and this will only make the coming economic depression even worse, especially for Baby Boomers whose retirement assets are about to be decimated. An item at Bloomberg,com crystallizes the bad advice that will help make this so: “Black Rock’s Larry Fink says now is the time to get back into equities.” Jim Grant, responding on LinkedIn, had but this to add: “Did he ever recommend getting out?”

Each of us can sense, in our own lives and in the lives of those close to us, the pandemic’s grave potential. Do not assume that “the market,” supposedly omniscient and infinitely wise, can somehow remain oblivious to threats that we as individuals perceive clearly and knowingly. In the weeks and months ahead, it cannot but further discount the radical changes that are occurring in our lives and the economy, many of which could persist for a long while.