World financial markets are like a pie crust stretched across the roof of a volcano.

Is the Corporate-Debt Bubble Ripe Yet?

by Wolf Richter • Dec 12, 2019 • 75 Comments

The Fed is a superb example. In its most recent “Financial Stability Report,” released in November, the Fed warns about the historic record-breaking pileup of business debts in the US, as a consequence of low interest rates, and it considers this business debt the biggest risk to financial stability in the US.

But this warning came after the Fed had just cut its policy interest rates three times, and after it had begun to bail out the repo market with over $200 billion so far, and after it had begun buying $60 billion a month in T-bills, in total printing over $300 billion in less than three months, to repress short term rates in the repo market and to bail out its crybaby-cronies on Wall Street – and not necessarily banks – that had become hooked on these low interest rates.

https://wolfstreet.com/2019/12/12/is-the-corporate-debt-bubble-ripe-yet/

R640 – Good luck with that trade – I like it

You also have Zoltan on your side. This was a weird day today in the market, not as much fear as maybe there should have been.

I liked your VIX play, we’ll see if fear comes back in on Monday or if everyone has been headed back to the Hamptons.

One thing though, if they left, did they turn their algo’s off?

Buygold–Not jugs up yet–maybe on Monday-

I bought 200 VXX Dec 20th $20 calls for 7 cents near the close–not a frightening amount of risk for me and I love a long shot–besides I haven’t traded for a while…and I sure as sh*t ain’t going heavy long at this stage…that said, the mkt looks bulletproof…but maybe we can finally get a 5% or more corection–that would do the trick and casuse blind panic–…bullish sentiment is historically high…and that “no more risk” call by that former sceptic analyst really struck me as a possible bell ringer…although not down much, I consider today as very negative…especially the last minute fade by the DOW…I’d like to see the DOW open up a 100 Sunday nite then be down a 100 or more by monday open

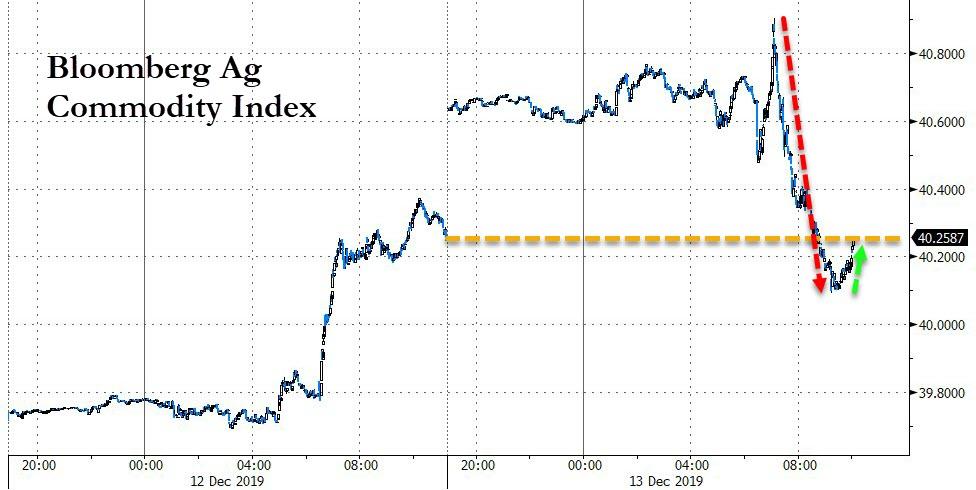

50 Billion in AG

China has a swine fever epidemic this year killing and culling millions of pigs.

They also don’t treat live stock well even horses.

Maybe more refs needed on that too.

WASHINGTON (Reuters) – China will likely hit $50 billion in purchases of U.S. agricultural products, U.S. President Donald Trump said on Friday after earlier announcing that he would roll back scheduled tariffs on Chinese imports as Washington and Beijing finalized an initial trade deal.

Trump, speaking to reporters at the White House, said his administration would leverage the remaining U.S. tariffs on imported Chinese goods as it seeks to negotiate a phase two trade deal with Beijing.

He added that China wanted to start talks on the deal’s second phase right away, a timeline he said he supported.

Washington and Beijing announced the tariff rollback earlier on Friday, weeks after both sides in October said they had reached an agreement on the “phase one” trade deal.

https://www.reuters.com/article/us-usa-trade-china-negotiations-idUSKBN1YH20C

Looks like the shorts got snickered in the SM

They may end up regretting not having held over the weekend.

Besides – R640 is tits up on the VIX and I tend to agree with that move.

We’ll see what happens.

COT’s – Moving in the right direction

Especially in silver.

R640

I think you’re on the right track with the VIX, or at least have a fair shot at making some bank on some cheap short term calls.

The SM sure seems to be ignoring the idea that the Fed is dumping $500 Billion into the Repo market or have been buying 90% of treasuries since September.

I guess as long as they keep gold in check they can keep the appearance that there’s nothing wrong.

That being said, why are Goldman’s wealthy clients worried enough to be hoarding physical gold?

And neither are stocks, yuan, or copper, as investors appear to be discounting the rising probability of the Phase One Deal being busted within a few months

US payment of $1.7 billion to Iran made entirely in cash

WASHINGTON — The Obama administration is acknowledging its transfer of $1.7 billion to Iran earlier this year was made entirely in cash, using non-U.S. currency, as Republican critics of the transaction continued to denounce the payments.

Treasury Department spokeswoman Dawn Selak said in a statement late Tuesday that the cash payments were necessary because of the “effectiveness of U.S. and international sanctions,” which isolated Iran from the international finance system.

The $1.7 billion was the settlement of a decades-old arbitration claim between the U.S. and Iran. An initial $400 million of euros, Swiss francs and other foreign currency was delivered on pallets Jan. 17, the same day Tehran agreed to release four American prisoners.

The Obama administration had claimed the events were separate, but recently acknowledged the cash was used as leverage until the Americans were allowed to leave Iran. The remaining $1.3 billion represented estimated interest on the Iranian cash the U.S. had held since the 1970s. The administration had previously declined to say if the interest was delivered to Iran in physical cash, as with the principal, or via a more regular banking mechanism. Read more

Buygold @ 11:28

“RT Reporting”

They sure do scoop the MSM on lots of stories. Probably the MSM is so focused on impeaching Trump they miss a lot of stuff. 🙂

@Richie, 12:56 re Fed’s balance sheet all time high of $4.5 trillion

Does that mean the US taxpayers are paying interest on that?? I assume the Fed is buying Bonds to keep interest rates low.

Maddog @ 12:22

Glad to hear it. I’m sure the people in GB will appreciate Brexit when it comes and the cessation of all the BS rules and irrational crap that went with it. Let my people go!

Buygold–keep on posting, brother!—CRASH CITY? SWAMI ZOLTAN? Confusing, what?

https://futures.tradingcharts.com/marketquotes/ZB.html

Got a couple winners

and I’m sticking with them for now. NEM and FSM. On the fence with KGC and want to pick up some more but holding pat.

If it weren’t for the PPT I’d be all over USLV but I digress…

ipsofacto

Tks…I think there will be ab explosion of activity in the UK….loads of people were holding back, because of Brexit and Corbyn, everywhere u went, if u asked how biz was, it was all shite, because etc…..so lots of pent up demand will come out.

Hmm…

Doesn’t look like a whole bunch of traders/stock market players want to be caught long over the weekend.

They don’t appear to be afraid to hold gold or even bonds though.

Works for me.

Ipso, silverngold

Ipso – very cool pic. Funny how we have to get that stuff from RT

silverngold – thanks, I’ll watch that video too. I’ve seen that Dr. in several videos and in the National Press Conference.

Positive reconciliation for Osisko’s Windfall bulk sample

Bulk sample processing results from Osisko Mining’s Windfall Lake project came in ahead of company expectations with average head grades of 17.8 g/t gold exceeding the 9.4 g/t predicted by infill drilling.

“The significant grade increase from the block model appears to correspond well with the very regular visible gold observed in Lynx drilling. The bulk sampling work is greatly helping to build our confidence in the continuity, grade, recoveries and the predictability of the mineralized zones at Windfall,” John Burzynski, Osisko Mining president and CEO said in the media release.

cont. https://www.mining.com/positive-reconciliation-for-osiskos-windfall-bulk-sample/