Involve in humane treatment to dogs and cats and rescues they use the same Quote but change the word person to the Dog or Cat you may be the whole world. It’s true though in both cases.

My niece put out something on my brother on Father’s Day. She lost her mother when she was young so he was all she had left. She has a couple brother but left the state. She said the Holidays will be the hardest. I told her he’s in her heart now. She will have to pick up the staff and try to keep the family together because when we’re gone they will only have each other left. He has a couple of kids. Her bother picked up one of his Harley’s and never rode one. His present wife also rides gave him some lessons first but hopefully he’ll go for the Harley safety course like he said, he’s got a baby on the way or should I say his wife.

SNG

…barely 1% of them are allocating anything to gold..

Among those consumers, “Americans with $1 million or more in investable assets are [now] bullish on stocks and the economy for the duration of 2019,” says CNBC, reporting its latest Millionaire Survey.

Polling a panel of 750 apparently “affluent individuals”, CNBC finds “market sentiment of the wealthy has improved since the last biannual survey in fall 2018.” These millionaires have in fact raised their outlook for the stock market, and barely 1% of them are allocating anything to gold.

Moggy

You bet! I was surprised to see that Aloe Vera can be taken internally, that’s the first I’ve heard of that.

Cheers

Ipso @ 11:14

Great article, thanks. Aloe Vera juice heals digestive ailments for anyone interested. The brand George’s is tasteless, something to be appreciated if you’ve ever tried the other brands, lol.

A note on using gold sites to monitor gold sentiment

Very interesting re: Hong Kong

How to keep a step ahead of the PRC goons …

silverngold @ 11:02

Sounds like truth to me.

Good Editorial worth reading and understanding

The 2018 Market Crash That ALMOST Was and How Fed Intervention Postponed the Inevitable

Alexander Trigaux, Editor, GoldSilver.com

JUN 17, 2019

At the end of last year, something scary started in the markets, for a brief moment.

For the casual investor, stocks and bonds both might have seemed a little shaky.

And, for those who watch the market more closely, it all seemed to be coming undone. Fast.

Maybe all the prognostications of the end to this historic bull market were finally coming to pass.

If you didn’t notice, we don’t blame you. If you did, and the market just seemed to magically reverse course without a clear explanation: ditto.

What happened in December 2018, however, is critically important to understand. The market was unwinding… until the Federal Reserve stepped in. This might sound familiar, but this time is different. Let me explain why.

It started with the sudden breakdown of one of those markets everyone is watching carefully for signs of a pin touching bubble: corporate credit, the constant stream of cheap-debt lighter fluid needed to keep the economy growing, was suddenly becoming difficult to come by.

This Reuters flash update from just pre-holidays tells the story well:

The “junk bond” market, where the riskiest of corporate debt for buyouts, startups, or hard-luck cases turn for cash, was frozen.

And when I say “frozen”, I mean not a single junk deal was executed for 40 consecutive days.

That is nothing less than the credit market seizing up. That is the beginning of the next major financial crisis.

December 2018’s total high-yield bond raise was the lowest since August 2008 — the prelude to the last great market crash. It ended the month with net sales of barely over half a billion dollars, having recently done $10 billion a month — a 95% decline.

Funds tied to the junk bond market? They were falling off the table:

And keep in mind that all this was transpiring with interest rates still at historic lows. The fed rate was (and remains) at a paltry 2.5%. Yet even this scant bit of interest was proving too onerous for America’s increasing horde of “zombie companies”.

The Fed to the Rescue

After a year of jawboning how important it was to get interest rates ‘normalized’ again, back up to the 5% (at least) area, Jerome Powell — faced with a meltdown in corporate debt, and we can only imagine what phone calls coming in from Wall Street — suddenly discarded everything he had been saying for a year, and put rate hikes on hiatus.

As the Fed raised rates by a mere quarter point in December 2018, it more importantly signaled that the expected three hikes in 2019 would likely be more like two. By March 2019, it was down to none.

The inevitable was forestalled. Debt payments weren’t going up as expected.

Wall Street calmed down. But why were they so panicked to begin with?

The Myth of the American “Free Market”

The reality of the matter is simple. In the US, “the economy” is, in large part, the output of the largest businesses in America. And fully 15% (and rising) of those companies are so operationally weak, they can’t even afford to pay the interest on their debt (let alone any of the principal).

They are zombie companies, feasting on cheap debt like brains.

The rise in rates the Fed was signaling would have burned through this group of companies like a poorly written Danerys Targaryen through a city of people not at all between her and newfound mortal enemy Cersei Lannister… (too soon?)

But instead of allowing the free markets to do what they do best and let failing companies fail (making way for stronger, leaner, more innovative recipients of capital investment), the Fed has decided to play zombie nursemaid… yet again.

Soon, I suspect, we will hear that not only are rate hikes on pause, but a fresh round of rate cuts seem to make a whole lot of sense. Anything to forestall the inevitable collapse. In fact, President Trump has recently begun beating this particular drum.

After that? QE4, QE5. Those negative interest rates many market pundits thought were out-and-out impossibilities? There is now $10 trillion invested in them worldwide. And while it remains to be seen whether negative nominal rates will make their debut in the US, know that if the Fed thinks they can forestall the coming collapse, they won’t hesitate.

Allowing failure and all the negative, pain-in-real-time consequences in a market is what makes a free market. Success is rewarded and failure is punished. A market in which success is rewarded and failure is also rewarded is not free. It’s a faint shadow of pure capitalism. It is the last stages of crony capitalism at its worst.

And it is completely unsustainable.

So while it is frustrating to see precious metals prices stalled out due to the manipulations and machinations of the Fed that keep all these fragile plates spinning, we will wait for them to (again, inevitably) fall.

The longer the Fed manages to forestall the eventual collapse of this walking-dead system, the more staggering and total the devastation will be.

British naval historian C. Northcote Parkinson said it best: “Delay is the deadliest form of denial.”

When the reckoning arrives, we’ll be so grateful we had so much time to accumulate gold and silver at what will someday feel like true bargain prices. Because when the unprepared 99% all rush to buy the scarce precious-metal money that we already own, we will see a modern day sea change in the way the world’s population views, respects, and prices gold and silver.

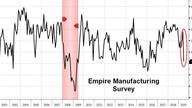

Hmmmm- the Empire State…

Isn’t that the Cuomo/Bloomberg state , where more taxation is the answer to all societal ills , and where life can be terminated at the moment of birth ?

Morning Buygold @ 9:12….Yes, no better feeling in this world

Another one hanging on our fridge which gives pause for thought: TO THE WORLD YOU MAY BE ONE PERSON,

BUT TO ONE PERSON YOU MAY BE THE WORLD!

All the best from Silverngold!

Rick Ackerman

Smelling a Fiscal Blowout, Gold Starts to Warm

There was good news for gold bugs last week in The Wall Street Journal, even if it threatens a day of reckoning for everyone. Although Friday’s front-page story had nothing to do with bullion, the headline tells us why sunnier days are likely for anyone invested in precious metals over the next few years: Washington Puts Aside Fears And Embraces Debt. It is the word ’embrace’ that holds such promise — and menace — since it implicitly acknowledges that regardless of who wins in 2020, there will be no serious political opposition to the fiscal orgy brewing on Capitol Hill. The mountain of bogus money needed to stoke the revelry cannot but put upward pressure on inflation hedges, particularly gold and silver. That is why the rally in precious metals begun two weeks ago should be taken seriously.

Nightmare Society

The prisoner was brought in, tied hand and foot, but very much alive. The army doctor in charge sliced him open from chest to belly button and exposed his two kidneys. “Cut the veins and arteries,” he told his shocked intern.

George did as he was told. Blood spurted everywhere.

The kidneys were placed in an organ-transplant container.

Then the doctor ordered George to remove the man’s eyeballs. Hearing that, the dying prisoner gave him a look of sheer terror, and George froze.

“I can’t do it,” he told the doctor, who then quickly scooped out the man’s eyeballs himself.

“Chinese dissidents are being executed for their organs, former hospital worker says” by Stephen W. Mosher for The New York Post

Morning Silverngold

There’s nothing quite as gratifying in life as that note you received from your daughter.

Priceless.

8:46 am–Big turn in G&S-this is the most bullish kind of set up: open down and buyers rush in…

Ballinger today=Weekend reading survey: Five gold commentary websites, 22 articles on gold and silver ALL BULLISH; no bears to be found anywhere.–[ Note to Mike=there comes a “recognition time” when the bulls are finally right and the “too many bulls and the overbought/oversold games are suspended][P.S.–Ballinger is G*D when it comes to trading with and around the PPT/Bullion banks-so no disrespect mean’t but there are rare exceptions…and there are recognition times-I dunno if that is the case now but we shall see, soon]

FYI

Happy Fathers Day

To all the dads by blood or not.

Gold Train

It’s Monday. All aboard for another week of fun! The Rio Grande Zephyr departs Denver, followed closely by the ski train to Winter Park.

https://railpictures.net/photo/699937/

Can a father get a better gift than this for Fathers Day? I don’t think so!! Better than Silverngold!

Hi daddy,

Happy Father’s Day! Sorry I won’t be around to spend it with you but I’ll be home tomorrow to celebrate it with you!

Thank you for being such an inspiring, cheerful, and kind hearted individual in my life and for raising me to be the person that I am today. Hoping your day is as wonderful as you are <3

Love you,

Angelic

Lots of talk over weekend in all papers that situation between Iran and US v dangerous

so u just knew that the Sunday night mkts would have solid Dollar, lower Oil and PM, rates reversing and strong SM……

These ain’t mkts, they are managed perceptions.

david gilmour podcast series

other episodes on the right

norm winksi’s astro forecast

38 mins in

Coincidence?

Argentina and Uruguay left without power in massive outage

https://news.sky.com/story/argentina-and-uruguay-left-without-power-in-massive-outage-11742818