MMT–Modern Monetary Theory

[For those to who don’t know MMT, the basic idea: we don’t need to “raise money” to pay for government spending, since we can’t go broke or default on our debts, since we can issue the currency. The main (perhaps only) constraint on spending is inflation, which you manage through taxation (i.e. taking money out of circulation).]

Well, what is Trump saying about quantitative tightening?

Why, that it’s terrible of course and should be stopped immediately.

So let’s think about this. If Trump is pushing for the Federal Reserve to not wind down their previous quantitative easing (balance sheet expansion) then isn’t he advocating for a permanent expansion of the balance sheet? And if so, isn’t this the same as the government spending while monetizing it?

Again, it sure sounds an awful lot like MMT.

When you combine this balance sheet pressure with Trump’s complaining about interest rate increases, it is clear that Trump wants fiscal expansion (through tax cuts) along with low interest rates and a permanently large Federal Reserve balance sheet.

I am going to say something that will offend both sides of this debate, but Trump is the most MMT-like-President ever elected.

Yup. I said it. The real question is what does it mean?

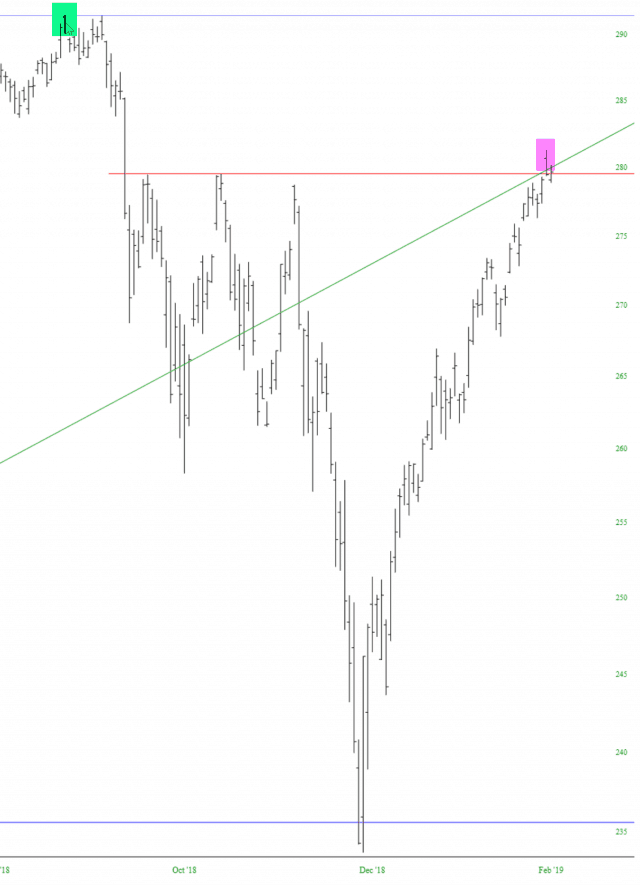

Well, I am going to include a chart from my good buddy Brent Johnson from Santiago Capital who will be horrified that I am including him in this piece that will surely irritate both the left and right, but nonetheless – here I go – it’s simply too good a chart.

The Federal Reserve has effectively been neutered with Jay Powell’s recent flip-flopping because of Presidential and Wall Street pressure. So the Fed is now in line. And as the chart shows, a lot of the fiscal stimulus is still ahead of us.

A Central Bank that is facilitating aggressive fiscal stimulus irrespective of the stage of the business cycle sure sounds like an MMT’er’s dream.