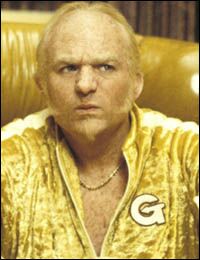

commish

Should have a warning on it. Could cause brain damage! 😉

Palladium up another $44 today

Unbelievable.

Would love to see those type of moves in gold in the near future.

WAF.V I was trying to sell this but I think I’ll just keep it even if they are only going to be listed in Australia

West African Resources intercepts 6.5m at 61.8 g/t Au including 3m at 132 g/t Au at M1 South

https://ceo.ca/@accesswire/west-african-resources-intercepts-65m-at-618-gt

goldielocks @ 11:26

Thanks!

Tumult in the gold market fer sure. Reminds me of the shenanigans 2005-2007. ABX has fired the starter pistol on a race to who knows what…

Boring is done though, so that is good.

Back in the day, ABX buys Placer dome for $10.4. Goldcorp gets crumbs in deal. Goldcorp buys Glamis pissing off McEwen. Uses G gold hoard as down payment, LBO using the acquired company hard currency to fund deal. Now G the sheep with two wolves voting on dinner. Serves them right!

Sumpin big dead ahead…

USD cruising higher

but shares seem to be holding up for the most part…

NEM coming back off the low of $35.44

Still can’t figure out where we’re headed, higher or lower? Shares appear to be following the SM a bit…

Hard to believe the SM is higher on no news, but it’s been higher almost everyday for the last nine years.

AG ripping higher on earnings. Pretty unusual but I’ll take it. Wish I had more…

First Majestic Silver Corp. Ordinary Shares (Canada) Q4 EPS $(0.05) Misses $0.01 Estimate, Sales $74.1M Up From $61.2M YoY

Yo MM3

“Maybe flak just to scuttle NEM-GG merger so ABX can take a proper run at Goldcorp? Or ABX wants all?

ABX throwing hail Mary’s all over the gold market. Portends continued banker suppression or gold to the moon.”

Interesting take. Maybe they are trying to scuttle the GG deal. I don’t trust ABX at all. Not sure I trust NEM a whole lot more. Regardless, an all stock deal sucks for everyone involved and almost sounds like a ruse.

Yeah BG, this NEM take under perplexes me as well. ABX short a couple of $billion on market cap on no skin-in-game share exchange?

$7 bil in synergies to boot? That is pie in the sky.

Maybe flak just to scuttle NEM-GG merger so ABX can take a proper run at Goldcorp? Or ABX wants all?

ABX throwing hail Mary’s all over the gold market. Portends continued banker suppression or gold to the moon.

Ken Starr who wrote Book that should be enlightening on Life Liberty and Levin. He got a lot of press even camping out at his house when dealing with Clintons and Levine noted none for Mueller. Also pointed out how FBI deserves better than the rogue leaders it had that pointed to a Coup against Trump. That Obama knew about Russian interference that had nothing to do with Trump but he didn’t do anything about it. That this Russian interference was to cause divide and questions should be made to that prior administration. That brought to mind for me if Hillary was actively working with Russians on s fake dossier and prior administration spying on Trump along with rogue Commey leaking information while actively campaigning that should be investigated. Also Obama was actively interfering with the Israel elections. No one to ask him where did he get off.

https://youtu.be/xxDkMEynMFs

Ipso

The last I checked which was a long long time ago it was 20 something to buy foreign stocks. Best to ask for a broker if you feel something’s off with who your talking to. Also best to check their form of Edgar that can pre warn you of a pending delisting and anything else going on if you have the time.

This is pretty damn sucky. So how do you trade Aussie stocks at Ameritrade? Gonna be a giant commission I’m sure.

West African Resources Limited (ASX and TSXV:WAF) (“WAF” or the “Company”) advises that it has applied for a voluntary de-listing of its ordinary shares (“shares”) from trading on the TSX Venture Exchange (“TSXV”).

TSXV has subsequently confirmed that the Company’s shares will be de-listed and therefore no longer traded on the TSXV after close of trading on Friday, 8 March 2019.

No change will occur to the quotation and trading of WAF shares on the Australian Securities Exchange (“ASX”) and its shares will remain available for trading on the ASX under the code WAF.

Hope these guys succeed. When new mines commence operations that seems to be a dangerous time. Sometimes it just doesn’t work out.

Victoria Gold: Eagle Mine Construction Update, Dublin Gulch, Yukon

https://finance.yahoo.com/news/victoria-gold-eagle-mine-construction-130000194.html

Metals and especially shares appear to be saying

the USD is about to roar back…

NEM and Barrick getting spanked a bit

HUI showing no signs of life. I guess I’ll be a buyer again around 165 HUI

Hard action to read these days…

Wolanchuk this a.m.

if it doesnt react off this area below 2820 things will get awfully bad for the bears …of course they are all cluttering up cyberspace with their inane blatherings since they missed it all…thats all they have to do with thieir time now…;”blah blah blah

It’s a world-wide Jihad to the upside-even Italian bonds…even the Rand & other. garbage-all paper assets…are going up…

Italy’s bonds rallied after Fitch Ratings kept the country’s credit rating unchanged, easing fears that it will be downgraded to junk anytime soon

Emerging-market currencies and shares advanced despite China’s state-run Xinhua news agency later publishing a commentary saying talks will be harder at the final stage. Treasuries and core European bonds slipped, while Italy’s securities advanced and the euro strengthened. Following Trump’s tweet, developing-nation equities headed for the longest rally in nine months. South Africa’s rand led currency gains, with its biggest advance this month, and Russia’s ruble was set to post its longest winning streak since April 2015. “Given this string of positive news, it is hard to see an inflection in the positive EM momentum today,” Guillaume Tresca, a Paris-based strategist at Credit Agricole SA, wrote in a report. “This could help to support EM sentiment, which has been fragile,” with emerging-market portfolio inflows decelerating in the past two weeks.

The official delay from the U.S. may give fresh impetus to extend a global rally in equities that was being tested amid an uncertain future on global trade and forecasts for global economic growth to ebb. Meanwhile, it is unlikely that the market euphoria will fizzle any time soon: Fed Chairman Jerome Powell, whose dovish capitulation has also helped to boost markets, will testify on U.S. monetary policy on Tuesday and Wednesday.

We fought off the first scum attack

and back on the good side of the tracks.

Someone riddle me this: Barrick is pursuing NEM, NEM is merging with GG

Why would a potential Barrick deal with NEM be negative for GG? It has been negative the last few days. Do the punters think that if NEM were to accept a Barrick deal the GG merger would go away??

All stock deal? I doubt that will fly

UPDATE: Newmont’s stock gains after Barrick Gold makes hostile buyout bid

Snow Train

Blowing out the great plains. Wanna snowball fight?

http://railpictures.net/photo/688619/

http://www.railpictures.net/photo/688620/