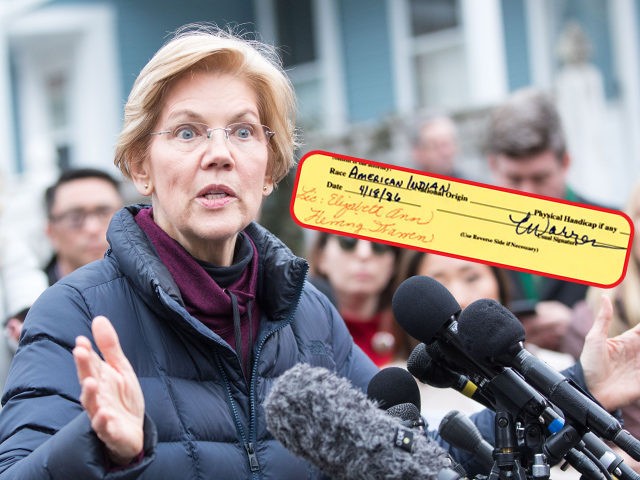

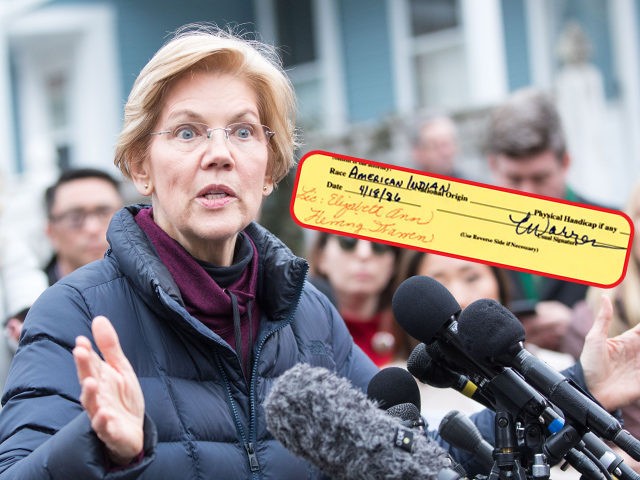

Elizabeth Warren Hints at Other Documents Claiming Native American Heritage

21. Okay, so thieves, Smithsonian curators, reporters, limo drivers, kids, all these people loved Mr. Rogers, but someone has to hate him, right? Well, LSU professor Don Chance certainly doesn’t love his legacy: He believes that Mr. Rogers created a, “culture of excessive doting” which resulted in generations of lazy, entitled college students… and that makes sense, because generally the deterioration of culture can be traced back to a single public television program.

WOW! that is amazing. Thanks Italy! I love my President! pic.twitter.com/jrBspn0n4G

— FindingTheTruth🇺🇸🇺🇸🇺🇸 (@DebbieRebG) February 10, 2019

11.44 minutes of well rounded valuable info and ending with good advice.

Why have safe haven assets performed so well in the face of surging equities and corporate debt? Because current Market Structure is inherently unstable and increasingly prone to an accident. Today’s buyers of Treasuries, bunds and JGBs are less concerned with January/Q1 equities and junk bond returns, keenly focused instead on acute global market instabilities and the inevitability of a systemic market liquidity event. I would further argue that this dysfunctional market dynamic recalls the destabilizing rally in Treasuries and agency securities in 2007 and well into 2008. This market anomaly stoked end-of-cycle speculative Bubble excess and exacerbated systemic fragilities.

When risk markets advance, news and analysis invariably focus on the positives – an expanding U.S. economy, prospects for a trade deal with China, buoyant profits, a backdrop of ongoing exciting technological advancements, perpetual low interest rates, endless loose financial conditions, etc. With markets advancing, mounting risks are easily disregarded. “Deficits don’t matter.” Debt concerns are archaic. Market Structure is a nothing burger. Best to ignore escalating social, political and geopolitical risks. The unfolding clash between the U.S. and the rising China superpower – it’s nothing. An increasingly fragmented and combative world – ditto.

As we saw in December, sinking markets direct attention to an expanding list of troubling developments. Years of inflating securities prices seemed to demonstrate that so many of the old worries were unjustified – none really mattered. The problem is that many do matter – and some tremendously. The current extraordinary backdrop has all the makings for a decisive bearish turn in market sentiment that would create a problematic feedback loop within the real economy – domestically and globally.

I’ll highlight an issue that has come to be easily dismissed – yet matters tremendously. Zero rates and QE were a policy experiment. The consensus view holds that the great success of this monetary exercise ensures that QE is now a permanent fixture in the central banking “tool kit”. The original premise of this experiment rested on the supposition that a temporary boost of liquidity would stimulate higher risk market prices and risk-taking with resulting wealth effects that would loosen financial conditions while stimulating investment, spending and income growth throughout the real economy. The expectation was that a shot of stimulus would return the real economy back to its long-term trajectory.

History teaches us that monetary inflations are rarely temporary. Travel down that road and it’s nearly impossible to get off. Dr. Bernanke, the Federal Reserve and global central bankers never contemplated what a decade of unending monetary stimulus would do to Market and Financial Structure. Most – in policy circles and the marketplace – believe beyond a doubt that monetary stimulus was hugely successful in resuscitating economic growth dynamics.

http://creditbubblebulletin.blogspot.com/2019/02/weekly-commentary-delusional.html

With “risk on” back on track, why then would “safe haven” bonds be attracting such keen interest? German 10-year bund yields sank eight bps this week to nine bps (0.09%), the low going back to October 2016. Two-year German yields were little changed at negative 0.58%. Ten-year Treasury yields declined five bps this week to 2.64%, only nine bps above the panic low yields from January 3rd. Japanese 10-year yields declined another basis point this week to negative three bps (negative 0.03%), only about a basis point above January 3rd lows. Swiss 10-year yields declined six bps this week to negative 0.33% – the low since October 2016.

So, who’s got this right – risk assets or the safe havens? Why can’t they both be “right” – or wrong? There is much discussion of a confused marketplace: extraordinary cross-currents leaving traders confounded. In search of an explanation, I’ll point to the consequences of Monetary Disorder.

It has now been a full decade of near zero interest rates globally. Trillions (estimates of around $16 TN) of new central bank “money” were injected into global securities markets. What’s more, global central banks have repeatedly intervened to buttress global markets – from 2008/09 crisis measures; to 2012’s “whatever it takes”; to 2016’s “whatever it takes to support a faltering Chinese Bubble”; to last month’s Powell U-turn. The combination of a decade of artificially low rates, an unfathomable amount of new market liquidity and an unprecedented degree of central bank market support have fostered momentous market structural maladjustment. We’re living with the consequences.

It is certainly not easy to craft an explanation for today’s aberrant market behavior. I would start by positing that a massive pool of speculative finance has accumulated over this protracted cycle. There is at the same time liquidity excess, excessive leverage and the proliferation of derivatives strategies (speculation and hedging). In short, there is trend-following and performance chasing finance like never before – keenly fixated on global monetary policies. Illiquidity lies in wait.

When this mercurial finance is flowing readily into inflating securities markets, the resulting conspicuous speculative excess pressures central bankers to move forward with “normalization” (Powell October 3rd). At the same time, this edifice of speculative finance is innately fragile.

http://creditbubblebulletin.blogspot.com/2019/02/weekly-commentary-delusional.html

I watched a vid of 5 helos landing kitty corner to a Wells building and exfil of soldiers carrying heavy stuff.

You know how much these simulations happen around real FF.