follows the GAP between Silver and crude we should get 10 point move to catch up to crude ……that would work for me !

Thats very white of me ..since its known as a wite metal !

follows the GAP between Silver and crude we should get 10 point move to catch up to crude ……that would work for me !

Thats very white of me ..since its known as a wite metal !

Although blacks aren’t the only ones that scream “racism”

We hear “anti-Semite” on a daily basis, right?

The reality is that the white race is the last race standing that can be criticized – especially white men.

FWIW,

I just read this on ZeroHedge:

Link:

As for your part “The public’s recourse is to DUMP all the Congress at the next election” my view is like the Boston Tea Party.

DUMP all the IMPORTS into San Francisco bay and New York Harbor. Tell China et al to SHOVE it. Those so called high quality cheap imports have ROBBED and Embezzled tons and tons of pure wealth away from the USA.

Now we have two salaries needed? 5-6 year car loans? Or leasing? $20 trillion debt? Unaffordable housing, unaffordable medical insurance? Traffic lights that send you a ticket if do don’t make a COMPLETE stop before turning on red? Money grab. Stealth tax.

Roger that Alex. Re military spending. Corporate welfare. Simply too many people slopping at the taxpayer/gov’t trough. (a long, narrow open container for animals to eat or drink out of) Nine eleven told me the military was useless. How many different shapes do we need for a fighter jet anyway?

A real eye opener. Besides that, its been used as the “free policeman” for useless foreign nation’s problems. So called allies. Only foreign nations have us as the ally. The USA has no allies. Just users. Ron Paul? I like him, but he never hits on the real causes of the problems.

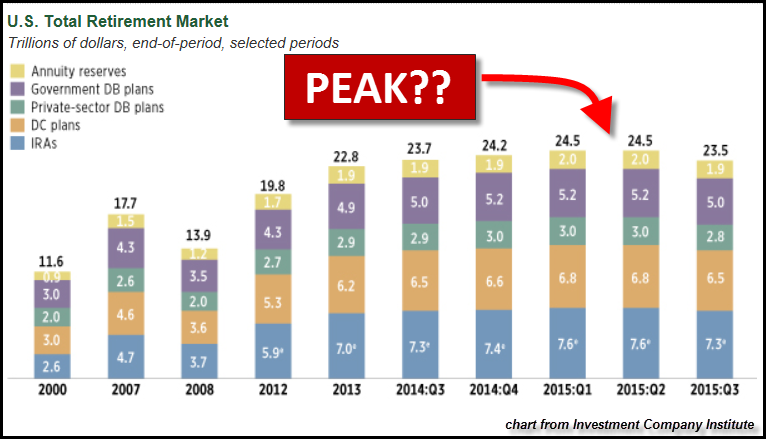

The biggest trade of a lifetime will occur when the value of silver switches from a mere commodity to a high-quality store of value. Actually, it’s not really a trade of a lifetime, but rather a fundamental repricing of real assets verses supposed assets. According to the Investment Company Institute, the supposed value of the total U.S. Retirement Market was $23.5 trillion in the third quarter of 2015:

As we can see, the value of the U.S. Retirement Market is down $1 trillion from its peak of $24.5 trillion in the previous two quarters. Could this be the peak of U.S. Retirement assets?? While the broader stock markets rebounded in the fourth quarter of 2015, they fell again during the first quarter of 2016.

If there are any investors who still believe the Fed and member banks aren’t propping up the markets, you need to get your head examined. We know many of the other Central Banks such as Japan and China have officially stated they were buying stocks, why wouldn’t the Fed and U.S. Govt?? Of course we are.

And it makes a lot of sense why they are doing it. The overwhelming majority of Americans that are invested in the markets are invested in the typical assets that comprise the U.S. Retirement Market. Only a tiny fraction of Americans are invested in physical precious metals. So, in order to keep “CALM” in the markets, the major indexes are not allowed to collapse…. well, for a while.

Look what happened to the Mainstream investor when the Dow Jones Index fell just 11% in the first two months of 2016… they moved into the Gold & Silver ETF’s and Funds in a major way. I discuss what is taking place in the Gold Market in detail in a new upcoming BULLET REPORT.

What on earth would happen to the Gold & Silver Markets if the Dow Jones Index was decimated by 30-50%?? I believe it would cause Mainstream investors to move into gold and silver in such a forceful way, that it would totally overwhelm the supply causing the prices to shoot up much higher. And the higher the price of gold and silver would go, the more Mainstream investors would pile in.

The Fed’s worst nightmare…..

Right now the values of the major stock indexes are extremely overvalued. However, the market isn’t allowed to find their true fundamental value, but it will. This will likely happen when gold and silver switch from a commodity pricing mechanism to a high-quality store of value. Let me explain this in silver’s case.

Silver Trades As A Mere Commodity Due To The Oil Price

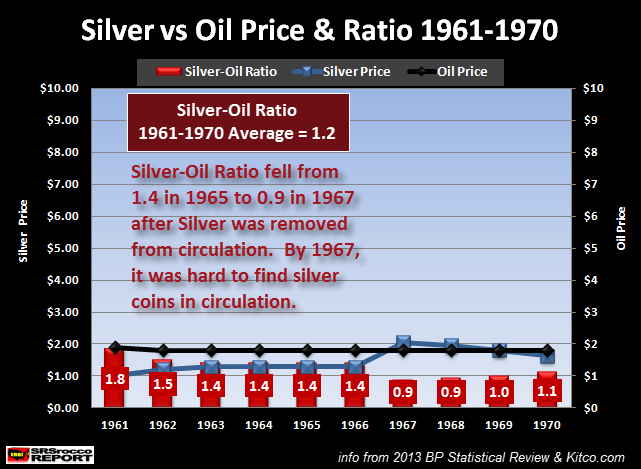

The value of silver has been tied to the price of oil for quite some time. While some analysts suggest this isn’t the case, the charts below provide ample evidence:

These charts were published in an article I wrote a couple of years ago. However, they still just as valid today. As we can see there was very little volatility in the price of oil and silver in the 1960’s. Why? Because the price of oil remained unchanged from 1962 to 1970 at $1.80. Can you imagine that? No change in the oil price for nearly a decade? Well, that all changed in 1970’s when the U.S. peaked in oil production and Nixon dropped the Dollar-Gold peg.

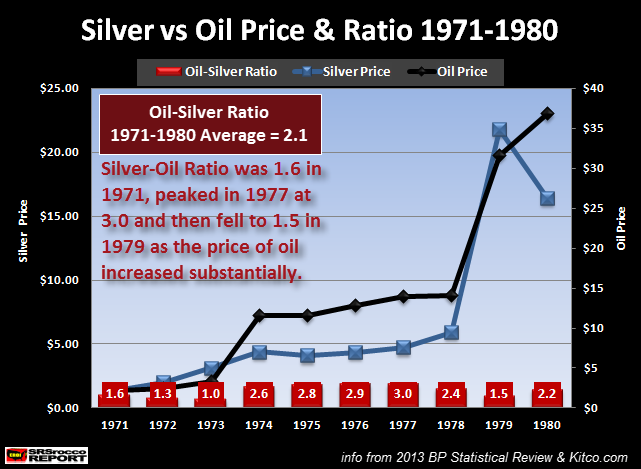

The next chart shows the change in the price of oil and silver due to two oil price shocks:

The price of oil jumped from $3.29 in 1973 to $11.58 in 1974 due to the Arab Oil Embargo. This impacted the value of silver as it increased from $1.98 in 1972 to $4.39 in 1974. Both the price of oil and silver increased slightly by 1978, but then jumped violently in 1979. This was due to the Iranian Revolution led by Ayatollah Khomeini which resulted in a huge reduction in the country’s total oil production. Total oil Iranian oil production fell from 5.3 million barrels per day (mbd) in 1978 to 1.5 mbd in 1980. This had a profound impact on the price of oil.

The price of oil jumped to $31 in 1979, up from $14 in 1978. Thus, the price of silver also skyrocketed to nearly $22 (average annual price), from $5.93 the previous year. Why did silver move up so high? Well, if silver mining costs were going to increase because of the jump in the price of oil, so would the price of silver. Of course, there was increased speculation as more investors piled into silver, but we can plainly see the rise in the price of oil was the underlying fundamental cause that impacted the silver price…. as well as gold.

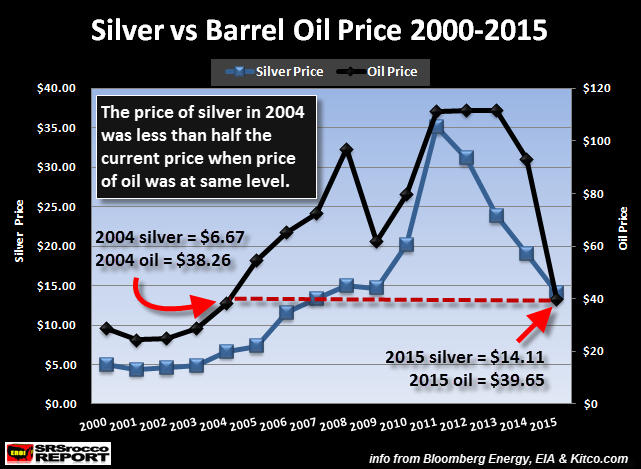

This the exact same thing that took place since 2000:

Again, the price silver moved up with the price of oil. And as we can see, it also fell with fall in the price of oil… even though prematurely. That is a discussion for another article.

The fact remains, that the cost to produce silver is based on the price of oil. This is called a “Commodity Price Mechanism.” Those folks who believe it will take a price of oil at $200 to see silver reach $50-$75, it’s likely not going to happen. Why? I don’t see a high price of oil as sustainable…. even if oil production starts to decline. That’s another topic for discussion in an upcoming report.

And decline it will. Especially, in the United States:

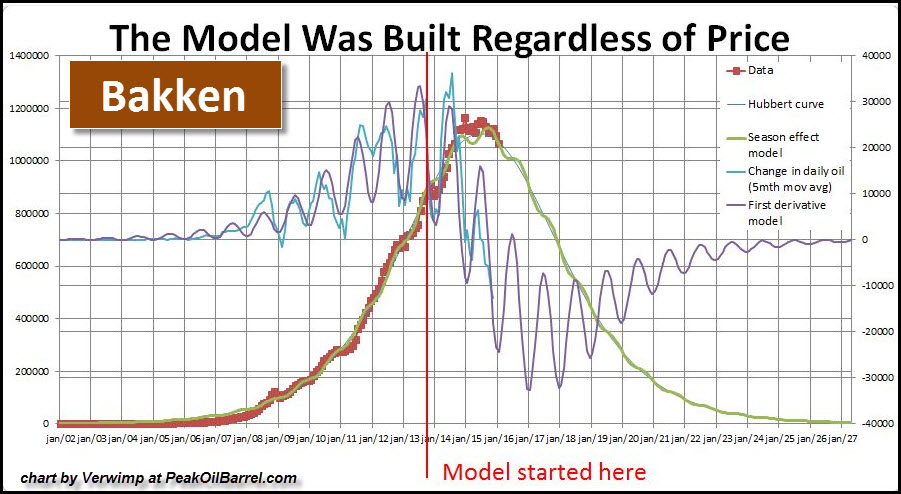

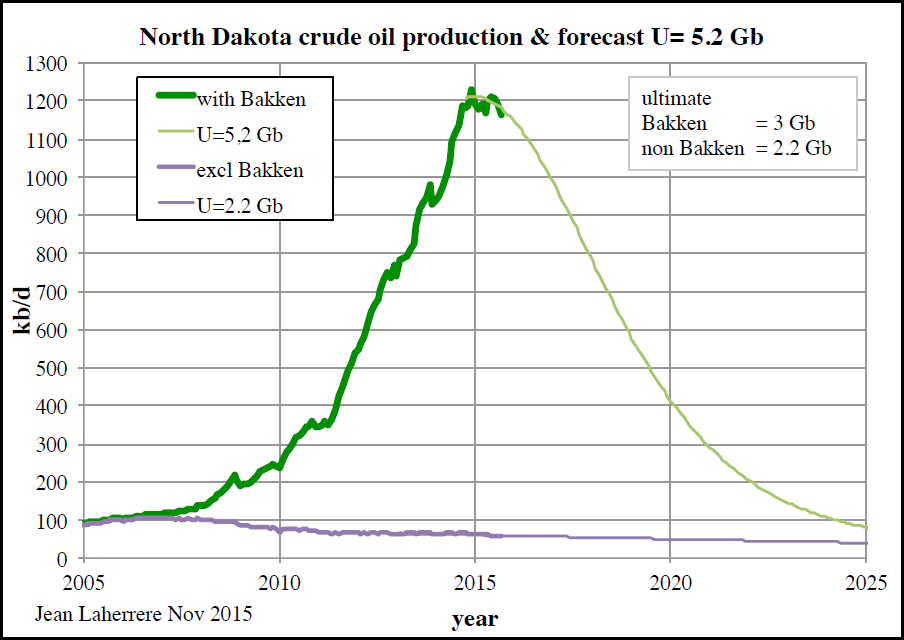

This chart is by one of the contributors (Verwimp) at the PeakOilBarrel.com website. This is an oil production profile of the Bakken, regardless of price. It has to do with the high decline rates and the amount of new wells. This isn’t the only person who believes the Bakken oil production is going to collapse. Jean Laherrere also arrives at the same production profile:

The Bakken is the second largest Shale oil field in the United States. The Eagle Ford Shale oil field is the largest, but it will suffer the same fate as the Bakken. With U.S. oil production to collapse over the next 5-10 years, this will have a profound impact on all paper assets including Stocks, Bonds and Retirement Accounts. Burning energy gives these paper assets their value. The collapse of this energy supply will cause a collapse of the paper assets.

For those who think the United States will just import more oil to make up the future shortfall… you are sadly mistaken. There is a reason why China and Russia are adding gold to the Official Reserves. They realize the value of the Dollar will be toast… and collapsing domestic oil production will be one of the leading causes.

Silver Investment To Become A High Quality Store Of Value

The collapse in U.S. oil production along with the disintegration in value of most paper assets will cause SILVER INVESTMENT to be finally based on its high quality store of value properties, not its historic commodity based mechanism. It will no longer matter what the price of oil is. The value of silver will rise as investors move into it to escape the ongoing collapse in paper assets values.

Some analysts like Jeff Christian of the CPM Group do not consider silver investment demand in their supply and demand figures. It seems as if Mr. Christian believes silver investment is just a mere store of silver supply ready to come on the market when it’s needed. Well, that may have been the case for the past fifty years, it will not be in the future.

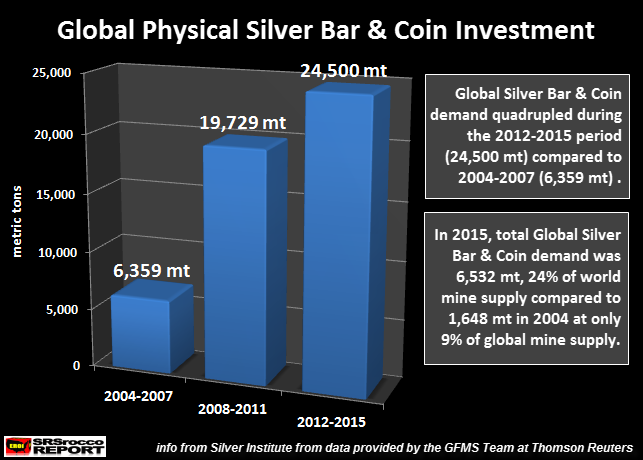

Investors have been acquiring record amounts of silver for the past eight years. Total cumulative Silver Bar & Coin demand 2004-2007 was 6,359 metric tons (mt). This equals 204 million oz (Moz). This nearly quadrupled to 24,500 mt (788 Moz) 2012-2015. I see no sign of this trend reversing as investors realize the U.S. financial system is much worse off than it was in 2008.

The notion that investors are going to dump silver on the market at much lower prices to supply the Industrial machine will no longer make sense in the future as global industrial demand will continue to fall along with U.S. and world oil production.

In the future, investors will be learning to PROTECT their wealth, rather than try make a yield or dividends. Gold and especially silver will become the go to HIGH QUALITY STORES OF WEALTH as the majority of most paper assets head down the toilet.

I will be soon releasing a new BULLET REPORT on the Gold Market. It provides charts and data on how the recent flows into setting up the Gold Market for a big move in the future.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below:

I posted on WPM about a week ago since it got my attention as it refused to get weak as others did. Its my second largest holding in value after TGLDX ….

Also like FNV another Streaming co ……but dont currently own it…

BTW there is a connection between OIL and SILVER ..they seem to run together ,so keep an eye on crude .

We will see . I tend to trust Ron Paul , because he was the one person in Congress that the lobbyists skipped , knowing that he could not be bought . Ron Paul reflects some of your concerns – the military in particular .

The house NOW wants to Phase in TAX cuts ,,,AND THAT IS A POLITICAL MOVE TO HAND TRUMP A DEFEAT because THAT will CRASH this Stock Market and Media will blame him …..The public’s recourse is to DUMP all the Congress at the next election ,that cant happen NOW….SO the Public and American people are at the mercy of the HOUSE who PUTS revenge above the Peoples needs…This is why BANNAN is correct in his assessment of defeating Republicans that dont support Trump,and find replacement Republicans that DO.

Your only security at this Point is GOLD & SILVER and I have included BIT COIN in my personal Portfolio since the DOLLAR is at risk should it collapse .

Dont underestimate BIT COINS importance in world currency markets ..Its the way to keep your independence from the predatory Banksters .Hundreds of billions are already there ,but you must educate yourself first as there are some thieves in that space .! Get educated ! now !

This next crash may be like the 1970-1974 long slow crash that took 4 years to bottom out. I was out of stocks for that period as I was busy trying to get my business going and in January of 1975 I saw the end and went into my office to call my broker and before I could lift the phone off the hook IT RANG ! and There at the other end was my broker Wesley ..and all he said was Vincent do you see what I see ? I said “you are not going to believe this” ,but we both had the same thought at the same second even though we are 300 miles apart and hadent spoken for 6 months. He said I got some ideas…..and that was the beginning of my BULL run that lasted from Jan 1975 to 1987 …..I think we are near that long slow crash that eliminates all the excess built up in PAPER assets ..and thats why I am in Gold & Silver . Can Trump win the TAX debate despite the Political enemies ? MAYBE ,but Gold is my plan B ..

WPM looks to be breaking out of a significant wedge IMHO

Not likely to happen imo of course. Think of global PTBs’ like a husband and wife. Most of the time they get along fine. But sometimes they don’t agree at all, and leads to divorce. So in my view, PART of TPTB rebelled against the other part to win the election.

After 2008, (to 2016) they reversed everything. No more or less funding for military, and less siding with or catering to Israel. The “break away” group did not like those two things, and RECRUITED Trump, so as to continue the ORIGINAL past. Total support for Military and Israel.

They knew Trump, he’s well known, and allowed or promoted his long time rhetoric that would get votes like never before. Trump has some influence, but he’s not a dictator, and does have “superiors” obviously.

They, the “new” PTB, are reversing the reversal. Same ole same ole.

If he refuses to go after the corrupt doesn’t he become a accessory to corruption. We have three branches to balance corruption and all appear part of the same plantation.

Wanka gave it a hell of a fight and a heavy loss to us all. Even if we never met him in person we felt we knew him.

…and it drives me nuts that the globalists always get a pass .

I predict that if they succeed in impeaching Trump , they will get the civil war they want , to get the UN involved .

Uranium, missile technology for China, Hillary and many others that never go to jail. Because they are following orders by the new world order, president of the global community, and unknown superiors.

Royal Canadian Mint-stamped gold wafer appears to be fake

Mint investigating after piece purchased by Ottawa jeweller Oct. 18 at Royal Bank of Canada branch

The Royal Canadian Mint is investigating how a sealed, “pure gold” wafer with proper mint stampings may in fact be a fake.

The one-ounce gold piece, which was supposed to be 99.99 per cent pure, was purchased by an Ottawa jeweller on Oct. 18 at a Royal Bank of Canada branch. Yet tests of the bar show it may contain no gold at all.

When neither the mint nor RBC would take the bar back, jeweller Samuel Tang contacted CBC news.

cont. http://www.cbc.ca/beta/news/canada/ottawa/fake-gold-wafer-rbc-canadian-mint-1.4368801

“we’ll do whatever it takes. And believe me, it will be enough.”

The two most valuable sentences ever muttered in recent human history.

The only other sentence I can think of that single handedly changed human history more was:

“Father forgive them for they know not what they do.”

I’ve capitulated. I’m still stacking, I am also coming to terms with the fact this is the last bubble we’ll see in this financial system and it will be longer than any other one in human history as the powers that be have complete control over our financial system and will do “whatever it takes” to preserve their wealth and power. May God truly help us all when this comes unraveled.

You ever read “The Fourth Turning”? … worth your time.

“private sector”…LOL!!!!

Please, if there was a legitamate private sector then the world would have stopped socializing private losses with fucking BAILOUTS (1987, 2001, 2008) a long time ago you stupid fuck!

Return to sound money fuckers, then you might be able to say there is a private sector, in the meantime…

“Full Faith and Credit”

He brought class and insight. RIP

Former Trump campaign manager Paul Manafort surrendered to federal authorities on Monday as the first charges from the probe of possible Russian meddling in the 2016 U.S. presidential election are expected to be unsealed soon.

Manafort’s onetime business partner and protege Rick Gates has also been told to turn himself in.

The move represents a dramatic turn in special counsel Robert Mueller’s investigation. Manafort was seen leaving his home at 8:00 a.m. with his attorney and arrived at FBI headquarters less than 20 minutes later.

A federal grand jury approved the indictments on Friday and a judge ordered them sealed. A White House official told DailyMail.com on Monday that the administration may not comment at all on the arrests.

more http://www.dailymail.co.uk/news/article-5031419/Paul-Manafort-Rick-Gates-told-SURRENDER.html

To Understand the Ferguson Riots, Look to Africa

Jared Taylor, American Renaissance, August 20, 2014

The con works like this: Blacks claim racism. They scream and demonstrate. Their leaders fly in to pump up the excitement. The lickspittle press clucks about oppression. Lickspittle whites join the demonstrations. Eventually the facts come out, and they are nothing like what was initially claimed–but it makes no difference. Blacks are so drunk on indignation that facts don’t matter, and whites are so drunk on self righteousness they can’t see they were flimflammed.