Note: On average everything costs 20 times more today than in 1971, the year gold backing was cut off from US Dollar. The TRUE inflation rate. Not too long ago, everything was 10-15 times more. So Dow at 631, in 1970, means, to keep even with the falling value of the Dollar needs Dow at 12,620 to break even. Constant dollar Dow. It 30,000, 47 times more. Forty Seven Times more instead of 20 times more. Is the Dow too high above inflation?? It went flat between ’68 and ’82. the invisible crash as per James Dines.

Part of link below:

Aided by this time machine, we put every dollar we had into the market on May 26, 1970, when the Dow closed at 631. What makes this day remarkable is that 631 is the lowest level the Dow index closed at between November 20, 1962 and September 12, 1974.

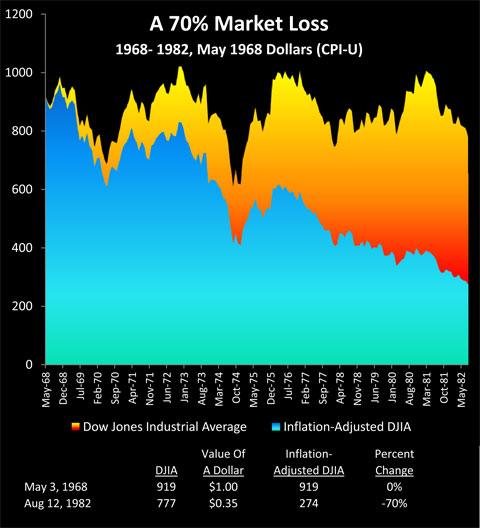

How Inflation Hid A 70% Market Loss: 1968-1982

History has already shown us what can happen to long term investment returns when persistent high inflation collides with stubborn high unemployment, resulting in stagflation. Consider the graph below. As shown in yellow, the Dow Jones Industrial Average reached 919 in May of 1968, and by August of 1982, had fallen to a level of 777, for a loss of 15%.

http://danielamerman.com/articles/2012/Dow36A.html

Dow Chart long term. That thing CAN go flat to lower again for the next ten years, exactly like the last time, as interest rates and gold climb together, as the Fed raises rates to calm Gold. But they never raised them high or fast enough (behind the curve) until rates hit 21% before they killed the gold peak in 1980.

Chart below shows the Dot com crash, the 2008 crash the blow off roll over top in 2015 into mid ’16 then the Trump Rally nd the Covid dip is clearly seen. NOW WHAT! What will the next crash be called?? The Biden Bust? The higher rates bust to kill $3,000 gold?

I kinda think they gave up on saving the Dollar with higher rates, and are trying to take advantage of a Dollar that is still accepted or still working, “So lets piss away as many as we can”. And in a sense the Dow SnP is a LOT of unused money supply just sitting there. If stock investors start cashing out??

Where is that money going to go?? Bank accounts and Bonds and drive rates to zero minus 10%?? 🙂 Or into Gold and Silver, that would be some sight to see. Real Estate?? Too many people already can’t afford houses and prefer renting. Or they buy and don’t make the payments for 6 years.