Where are you

at the acme grocery…

They had a big X at the grocery that said “stand here.” I’ve seen too many Road Runner episodes to fall for that.

Was Fridays NAZ performance a Vesuvian tremor? The Trannies and Russell were very strong all day…hard to say…

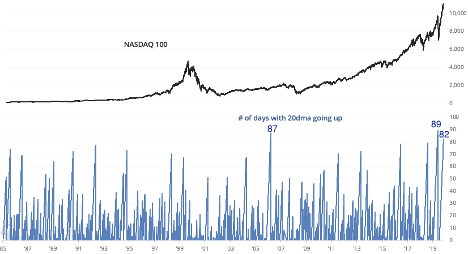

Record levels are being approached. NASDAQ’s 20 day moving average is now up 82 consecutive days! This is the 3rd longest streak EVER. Historically this led to a pullback in the NASDAQ and S&P over the next 2 months.

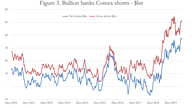

USD, GLD, SLV – worked exactly as advertised

The concern of course is that USD is still oversold, and G & S still overbought, so if we’re correcting it could get pretty ugly. OTOH, if we’re in unique times, maybe the corrections are short and sweet. HUI is not really overbought, so hopefully when the shares turn up we’ll know the correction in the metals is over.

Commish – I concur with Ipso’s sentiments!

If you’re out there, please check back in!

Miss the funny pics and one-liners

Mr.Copper – I’m still pickin’…..

After all these years, I’m still pickin’ copper cents out of my change. I can spot ’em by the depth of the strike, and the uniform brown of the copper. Few and far between now. But I have several large jars full & still collecting. 🙂