For some reason or another, Pot stocks are breaking out from EXTREME lows. For example, ACB+60%, TGODF+40%, HEXO+37%,MNEFF+29%, OGI+9%, APHA+7%, CRON+6%, CGC+5%.

For some reason or another, Pot stocks are breaking out from EXTREME lows. For example, ACB+60%, TGODF+40%, HEXO+37%,MNEFF+29%, OGI+9%, APHA+7%, CRON+6%, CGC+5%.

This time all Crimex…

for a minute any way.

Let’s see what the HUI does in response.

HUI bounced off 290, hoping that becomes support, although support is something that doesn’t usually hold in our small manipulated market.

Let’s see if we can get some dip buyers or short covering to come in and reverse things to the upside, at least we’re not seeing wave after wave of selling like we have in the past, and silver is still above $17

We’re under the cosh now. Effers!

Researchers say market manipulation is destroying traditional safe havens

The University of Sussex Business School released an analysis stating that widespread market turmoil caused by the covid-19 pandemic means regulators have so much on their plates right now that large-scale manipulation of the markets remains below their radar.

In the view of the researchers behind the study, this is the reason why prices of safe-haven assets such as gold and bitcoin are not surging.

By tracking trades on the markets in recent months, a team at the University’s CryptoMarketRisk project noticed huge sell orders on gold futures, massive pump and dump on copper futures and large spoofing orders on key crypto exchanges.

They say that some single trades on COMEX have been so large as to move prices, which is a clear contravention of US laws on market abuse.

Skeena flying today … also Pure Gold Mining

Doesn’t look like scum will allow $17 silver to stand.

Hard to see the shares holding up if this continues.

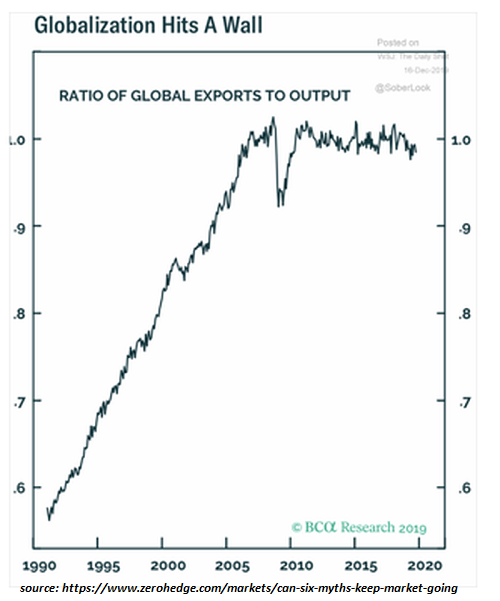

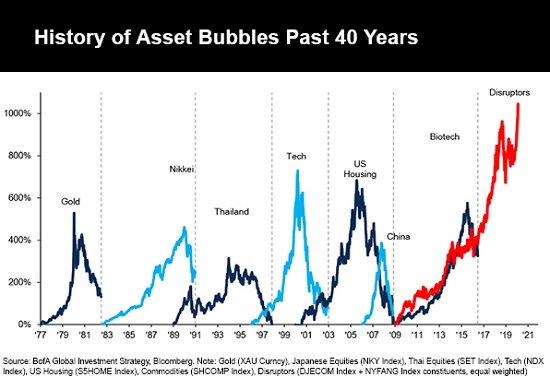

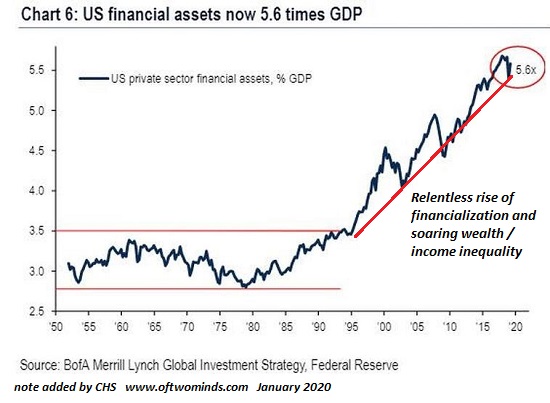

Financialization was never sustainable, and neither was the destructive globalization it enabled. Any system that depended on the ever-expanding exploitation of new resources, debtors and markets could never be anything but fragile. The ferociousness of its rapacity masked its inherent weakness, a weakness that is now exposed as fatal.

https://www.oftwominds.com/blogmay20/globalization-dead5-20.html

TSX closed today

Mkts have been bid all night and during Europe….so who other than the scum come and sell like this….just so blatant in in yr face..

What is also so insane, is the losses they are carrying are truly monstrous…who authorises that spending of taxpayer money ?????

the idea of 3 good days is total anethma….

Yep – scum has arrived, just before the Crimex open.

Was hoping we wouldn’t have to see more days like this, but here we are again.

I guess a round number of $1750 is round enough.

Moderna Spikes 20%, Dow Futs Soar On Promising Early COVID Vaccine Trial Data

“The researchers found that at two lower dose levels used in the study, levels of antibodies found after getting a second booster shot of the vaccine either equaled or exceeded the levels of antibodies found in patients who had recovered from the virus.”

https://www.zerohedge.com/markets/moderna-shares-spike-20-promising-early-trial-data

note how they leave Oil alone….why.

[high vol? up? down? He is not talking about just gold but mkts in general…anyone care to interpret what the “Great CRyptic Swami” is saying?]

Gold is facing a Panic Cycle this week which will begin a period of high volatility into June. We have closed with the highest weekly settlement so far for this rally. We see technical resistance at 1768 level and system resistance at the 1799-1805 level. Gold is starting to show that there is a great concern for the monetary system’s survival. I have previously warned that a summer high as possible going into May with a pullback into June/July. The next high period of volatility will be Jan/Feb 2021. A May close above this 1755 level will point to a June High at minimum. We still show the 2nd quarter as the high or at least the highest quarterly closing. Keep in mind we are doing battle with a Socialist coalition. They will not allow people to turn to gold to defeat their grand plan. There remains the risk of pushing gold underground into a black-market.

Is this follow thru sustainable?

or are we going to see what we’ve seen so many times before, a strong open that reverses and disappoints and marks some kind of short term high?

Nonetheless, it’s exciting to see silver up another 4% and at least premarket the shares seem to believe.

I think the SM is a euphoria rally on talk of Vaccine, end of lockdowns etc…..reality may hit later.