Scrapmen 19:41 re Jobs.

(Mr.Copper) May 23, 21:39

Scrapman, your story about the employee on the forklift that did something stupid, reminded me of a story that was told to me.

My son’s friend Harold is over one night. He’s big strong and built like a bulldozer. Lifts weights all the time, mid 30’s age.

His father used to work for a plumbing company, pumping out cesspools, so Harold knew something about it, and after exaggerating his knowledge, he gets a job pumping cesspools.

He was very new on the job when they sent him to a fancy multi story office complex to pump out the pool. It was a big one.

Anyway, he sticks that big fat hose into the “stuff”, turns on the pump, and nothing is getting sucked up, stuff is too dense, so he goes full throttle on the pump and the suction is still not enough.

So he radios back to the office, tells them he’s having a problem, and he thinks they should send someone else with more experience.

The boss says….”It’s no problem. Just reverse the pump. Put some of the “stuff” that’s already in the truck, into the pool to soften it up, dilute it a little, jiggle the hose around, and THEN you can suck it out.

So Harold has the hose draped into the pool, and he’s near the truck, throws the pump into reverse, and he knew right away he made a mistake by the sound of the pump as it reversed, at full throttle.

He glances out towards the pool, about 50 feet away, and what does he see? The damn hose he said, came completely out of the pool, like a big fat snake, pointing into the air, and was whipping back and forth, and spewing nasty smelly “stuff” all over the place.

He panics, runs over, tackles the hose like he’s playing football, and manages to get it back into the pool, but he hasn’t got any more strength, and has to let it go.

Back up into the air again, throwing stuff all over the place. People are yelling at him out the windows. They’re cursing at him. The stuff is going all over everybody’s cars, and is four inches deep in the parking lot.

Can you imagine this? What about all the fresh air intakes on the cars. So he finally shuts down the pump. He was covered head to toe in stuff. It was even in the back of his hooded sweatshirt.

He removed all his clothing except his shorts, and drove back to the office. He told the boss. “You don’t have to fire me, I’ll quit.” 🙂

PS on the job story about Harold “The Landlord”

(Mr.Copper) May 23, 22:05

Geez I hope I don’t get in trouble about this. So anyway, I tell this story to Tommy the “body guy. (He’s the best auto body mechanic, looks like Willie Nelson, pig tail and all, neat guy, know him for decades)

He can’t stop laughing, and it reminds him of a story to tell me.

He used to rent a big huge three story Herman Munster type house back in the hippie days. It had a big barn in back, where he did body work.

He also used to rent out rooms to others to keep costs down. Seems that all the toilets are backed up, all THREE stories. He goes down into the cellar, and looks for a spot to snake it out.

He sees what looks like big threaded “end cap”. He puts a big wrench on it, and the second he gave it the slightest bit of a turn, the cap popped off,

and

SWOOOSH, right in his face. All three stories of you know what. He wore it. 🙂

Then he notices the cap wasn’t threaded at all. It was just a lead plug, and that’s why it popped right out. 🙂

Mr. Copper, that was a good story, thanks

(ez) May 23, 21:45

(Mr.Copper)….Harold.

(alaskan) May 23, 21:52

Harold will have a story to draw howls of laughter til the day he dies. It may even make it to the next generation..LOL

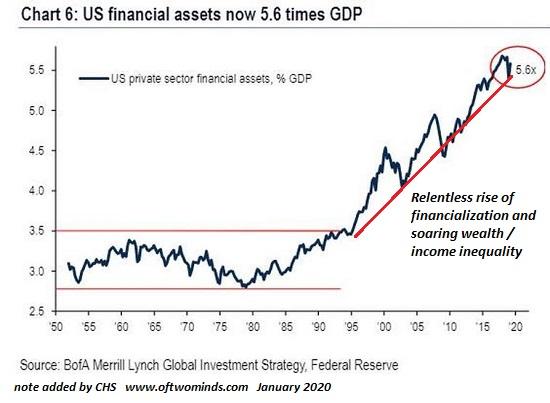

The greatest fairy tale of them all is the Fed has our back

The greatest fairy tale of them all is the Fed has our back