[OK Doofus, if you say so]In order to get a better understanding of what was going on, in last week’s report, we took a closer look at the main drivers of gold prices, which we had identified in our gold price framework (Gold Price Framework Vol. 1: Price Model, 8 October 2015).What we foundwas that a sharp spike in real-interest rate expectations was mostly responsible for the move from $1700 to $1450.As we noted in our March 20 report:

this guy twists himself into a pretzel explaining why gold hasn’t performed but he won’t mention the cartel

GORO getting hit this am – more supply coming off the market in Mexico

Mexico Ministry of Health Orders Thirty-Day Suspension of All Non-Essential Business Including Mining

Gold Resource Corporation is in the process of furloughing its Oaxaca Mining Unit workforce, none of whom have been diagnosed with the virus. A limited operational staff will maintain safety and environmental systems at the Oaxaca Mining Unit along with performing care and maintenance with a goal to return to production as quickly as possible once the thirty-day suspension is lifted. Due to this mandated shutdown the Company suspends its 2020 production outlook.

The Company’s Nevada Mining Unit is currently operating while taking numerous precautionary measures to keep its employees safe. As this unprecedented situation continues to evolve on often an hourly basis, we appreciate our shareholders’ support as we navigate the impacts of the COVID-19 pandemic on the business world.

R640, Maddog

R640 – that’s right, sorry I forgot you only track the futures which show G & S up a lot more this am than spot. The scum is keeping gold below $1600 in the spot market.

Maddog – I did think about Putin as a potential challenger to the Crimex, but he would have to do it through some financial intermediary right? He did stop buying phyzz this month for the first time in three years, so maybe he’s trying to stack via the Crimex but I’d think that’s a longshot.

Eeos

I agree dumping in ocean being trash or sewer has to stop globally.

That has nothing to do with the people it has to do with waste management world wide.

That’s okay others will help those passengers.

It just shows the farce behind the green new deal. They could care less about the ecosystem. Only green is to line their pockets.

In Wisconsin back in the 90s people were being poisoned on land because of poor planning.

They made their sewer system go out into the lake upstream from the drinking water system going in. As the population grew the sewer water got into the drinking water.

Meanwhile in Colorado in a million years all that will be left is garbage.

https://denverite.com/2018/01/31/million-years-denvers-garbage-thats-left-us/

5:00 am–june comex gold up 10.20—silver up 32….the u.s. dollar was down .180, now unch

https://futures.tradingcharts.com/marketquotes/GC_.html

https://futures.tradingcharts.com/marketquotes/CL_.html

Here we go again…for another try–gold opened down last nite–got spanked and is trying agin…oddly, may crude oil is up 1.60…the putin-trump phone call and promised settlement of the price war?

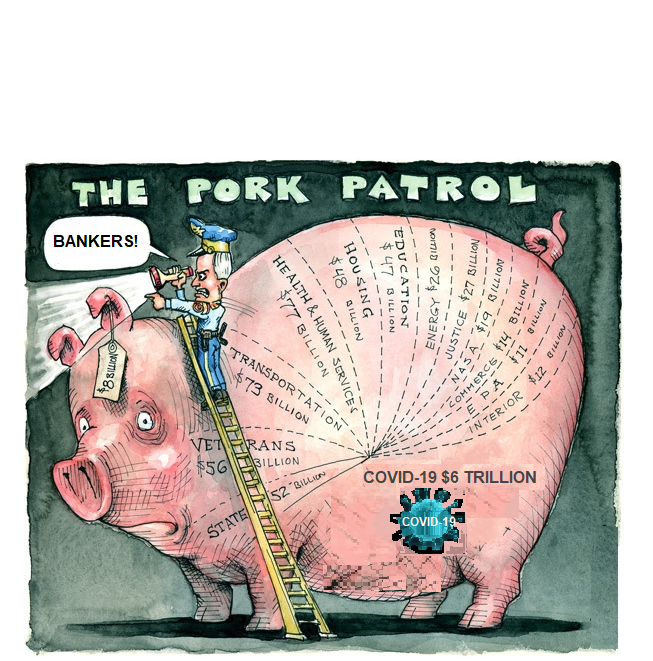

In the meantime debt monetization proceeds at full speed ahead=

Meanwhile, in the Islands petri dish…

Latest Stats from HDOH:

Total cases: 258 (34 new)

Hawai’i County: 18 (3)

Honolulu County: 182 (25)

Kaua’i County: 12 (0)

Maui County: 26 (1)

Pending: 18 (5)

Residents diagnosed outside of Hawai‘i: 2 (0)

Required Hospitalization: 15 (2)

Hawaii deaths: 1 (0)

Released from Isolation: 69 (11)

“Stay at home” orders. All but essential businesses closed. Mandatory 14 day quarantine for all incoming persons. Interisland travel quarantine also now… with exceptions for critical workers and medical personnel & patients.

Dept. of Transportation says incoming air passengers down 98.5% from last year this time. Remaining 1.5% incoming are mostly military personnel.

eff cruise ships and all the idiots that are on them

It’s a group of cowards running them anyways. They don’t pay taxes, they hire a bunch of dumb ass slaves, people are kidnapped all the time on them, they pollute like crazy, they throw trash overboard every night, they’re cesspools, the help trash every place they land. I can’t think of any redeeming qualities they have

Good news End of the Coronavirus

But now get these hospitals on board instead if some useless protocol.

Dr Stephen Smith was on Fox.

He said that ALL the patients given the Hydroxychloroquine combination for

4-5 days or more didn’t not get intubated.

This regiment works and said it’s a game changer. That this is will be the end of the Coronavirus.

Old Timer

Thanks, wasn’t familiar with his past much don’t care much scanned though it just observed what he’s morphed into. The current events with his anti constitutional alter ego as being some ruler over the world with chips and mandatory vaccines now wanting vaccine certificate for travel I’m aware of. Like the video that showed how he got out of paying taxes on his stocks that made him rich maybe just a addiction for money and power by profiting off it in a sociopathic sort of way at other people expense by forcing it on them. In summary our wise framers who wrote our constitution does not allow a MONARCHY in this country, where all men are equal WHERE THE BLANK DOES HE GET OFF???!

You have but to view the link I provided–it was on Fox Biz news too-I never

look at Kitco or the spot price–I was looking at June comex gold–as I write June is still up 7 bucks–if u look at the high u will see it was up $17 or so earlier

https://futures.tradingcharts.com/marketquotes/GC_.html

Also the June $ is down .148

Looks like no rally by morning

@ Goldilocks…

I saw that you mentioned the Gates sponsored 201 event.

I found this today, interesting background on the wicked mr. gates:

Gold had a $10 gap open at 6pm in evening trade-it was up $16…now up 14.00

and seems well bid….but there’s a LONNNNNNNNNNNNNNNNNG nite ahead until tomorrow morning…but this is better than a poke in the eye with a stick

April is going to be a disaster. We are not in a recession, we are in a depression, and it is global in nature.”

The Real Crash – Inflationary Implosion of Bond Market – Michael Pento

By Greg HunterOn April 1, 2020

Money manager Michael Pento has long warned the global financial system was “not sustainable or viable” because of record debt creation. Pento has also long said, “This was the biggest debt bubble in history, and it is going to pop someday.” That day has arrived. Now, Pento says, “This is a global depression just like we had in the 1930’s combined with a 2008 style credit crisis. That’s what it is. I was on your program about three months ago, and I predicted a global recession. That was wrong. It is a global depression. . . . We have learned that the S&P 500 earnings will decrease by 10% in the second quarter. We also know that GDP (Gross Domestic Product) for the second quarter is projected to decline by 35%. . . . We also know, according to the St. Louis Federal Reserve President James Bullard, that the unemployment rate in the United States could surge to 4

Pento also cautions, “So, what do you have left for the month of April? The lockdown is going to continue, and then you are facing a plethora of earnings warnings and economic data that is going to be absolutely horrific. . . . I think the stock market has to go lower for the month of April, and then I think we start to find our legs probably in the summer. . . .We have to get through this lock down, and the news is going to be the likes of which none of us have ever seen before–bad, horrific, rancid . . . It will be the worst economic data ever reported. . . . You are going to see GDP plunge at a 35% annualized rate. That has never happened before.”

As bad as this sounds, Pento says it’s going to get worse, “We are not headed into it–it’s here. This is it, a global depression the likes of which we have never seen before, but this is not the real crash. We are going to come out of this, but we are going to come out of this the wrong way, by borrowing and printing money. . . . But that is not the real crash. The real crash is when you have an inflationary implosion of the bond market, and there is not a darn thing central banks can do about it because you can’t bail out inflation by increasing the rate of inflation. . . . After the inflationary implosion of the bond market . . . . and they realize they are destroying the economy because of inflation, they will throw in the towel, and then there will be bail-ins and resets. We are going to default on the debt two ways. First, through inflation, and that’s going to fail. Then, we are going to deflate and rest.”

Pento also predicts, that in the end, the bond market will collapse, “Yields will rise, bond prices will crash.”

Pento thinks physical gold and silver are some of the “must have” assets. He has also recently doubled his investment in precious metals.

Join Greg Hunter of USAWatchdog.comas he goes One-on-One with money manager Michael Pento of Pento Portfolio Strategies.

American Isolationism in the 1930s? Learn, Un-Learn, and Re-Learn, Cycle

We Should all be happy for the future, everything is being re-learned.

parts:

“During the 1930s, the combination of the Great Depression and the memory of tragic losses in World War I contributed to pushing American public opinion and policy toward isolationism. Isolationists advocated non-involvement in European and Asian conflicts and non-entanglement in international politics. ”

“The leaders of the isolationist movement drew upon history to bolster their position. In his Farewell Address, President George Washington had advocated non-involvement in European wars and politics. For much of the nineteenth century, the expanse of the Atlantic and Pacific Oceans had made it possible for the United States to enjoy a kind of “free security” and remain largely detached from Old World conflicts.”

Nevertheless, the American experience in WW I served to bolster the arguments of isolationists; they argued that marginal U.S. interests in that conflict did not justify the number of U.S. casualties.

In the wake of the World War I, a report by Senator Gerald P. Nye, a Republican from North Dakota, fed this belief by claiming that American bankers and arms manufacturers had pushed for U.S. involvement for their own profit. The 1934 publication of the book…

The isolationists were a diverse group, including progressives and conservatives, business owners and peace activists, but because they faced no consistent, organized opposition from internationalists, their ideology triumphed time and again. Roosevelt appeared to accept the strength of the isolationist elements in Congress until 1937.

https://history.state.gov/milestones/1937-1945/american-isolationism

Florida lockdown

Well, the gonernor has issued an unnecessary, unconstitutiomal lockdown starting tomorrow night.

BS

It’s A Shame With Society, The Learn, Un-Learn, and Re-Learn, Cycle

Did Boeing forget how to make planes? That dumb 737 Max that took them down? ? What were they thinking?? Less energy use? Just raise ticket prices. We want more miles per gallon? Less smoke out the exhaust? Trying to save money? And you lose.

Look at the 747 was a perfected plane that came for the late 1960s? No computers? And what about the SR 71 Black bird, same era, and they can’t duplicate these days even with computers.

And what about that Shuttle that blew up on re-entry because they used new environmentally friendly insulation that broke off on lift off and knocked tiles off the wing. And the cars? They were perfected by 1970. Keep it simple stupid. The cars today are too complicated. If you get stuck on a country road forget about it. No nearby farmer and his shade trade mechanic son can help you.

Buygold @ 15:08

Good post. That’s the crux of our problem.

Buygold

Who….how about someone who scares the crap out of the banksters……Vlad.

He just sent over a AN 124 full of medical supplies…it can carry 150 tonnes….maybe he told Crimex to fill it up….. or else ?????

I’m getting the same feeling about gold that I had about VXX

I was stalking VXX for about 6 weeks–I knew there was a big trade with VXX…and I was in an out of it 5 or 6 times until I finally caught it

Right now…today…I got the feeling that gold is READY to surprise the majority including the chartists…and their beautiful charts that indicate gold is about to go to SHEOL TACHTIT**…and all these cheap prices and option premiums will look like the greatest missed opportunity…could be tomorrow…or a few days…but no longer..

**And we learned that whoever descends to Avadon, that is called bottom, never rises. That is referring to a man who was cut off and lost to all worlds. [Therefore, ‘tachtit/bottom’ is also called ‘Avadon‘ for one is lost there forever.] And we learned that those men who despised saying ‘Amen’ are lowered to that place. [Not one who neglected answering once but such a man] that many ‘Amen‘s were lost to him, that he did not ascribe importance to them, [therefore] he is punished in Purgatory and lowered to that lowest compartment which has no opening, and he is lost and never rises from there. Hence it is written, “As the cloud is consumed and vanishes away, so he who goes down to ‘Sheol’ [Hell] shall rise up no more”.]

Maddog re: Comex Expiry

To me the question really becomes: who is strong enough to stand up to the banks and demand physical delivery at the risk of being destroyed either financially or being killed?

We’re not talking small stakes here, we’re talking about a chink in the armor of the financial system that will be defended at all costs by men without honor, hell-bound to keep the fiat currency system.

Bloomberg News, “Plenty Of Liquidity” What’s That All About? Did They Have Pan Cakes At The Nautilus Diner? Or Maybe It Was The Fish?

A couple of car dealers I know told me if you want a good physic go to that diner and have the pan cakes.