So the plot thickens

I key in a few words and voila!

Fauci is in bed with Gates who we already know stands to make millions on a vaccine.

I posted this:

So the plot thickens. Dr Fauci is in bed with Bill Gates who stands to make millions on a corona vaccine? No matter if people die instead of being treated with the Hydroxychloroquine Zpac medicine saving them now?

The truth is that President Donald Trump is locked in an intense power struggle with Bill Gates, who is pushing his vaccines, which may not be available to the public until after November’s election. Gates has a lot of pull in the medical world, he has a multi-million dollar relationship with Dr. Fauci, and Fauci originally took the Gates line supporting vaccines and casting doubt on Chloroquine. Coronavirus response team member Dr. Deborah Birx, appointed by former president Obama to serve as United States Global AIDS Coordinator, also sits on the board of a group that has received billions from Gates’ foundation, and Birx reportedly used a disputed Bill Gates-funded model for the White Houses’ Coronavirus effort. Gates is a big proponent for a population lockdown scenario for the Coronavirus outbreak.

https://nationalfile.com/president-trump-vs-bill-gates-on-treatment-fauci-has-a-100-million-conflict-of-interest/

MG ( Midnight Gardener )

My family moved out in 1944 but I had an uncle and aunt on Carter Ave. who were like second parents to me . My uncle was known as ‘Big John’, and continued to work underground and then in the surface machine shop at Lakeshore until the mid-1950’s .

Why would they do this; most likely because if they didn’t the global banking system would have imploded.

Hi Bill,

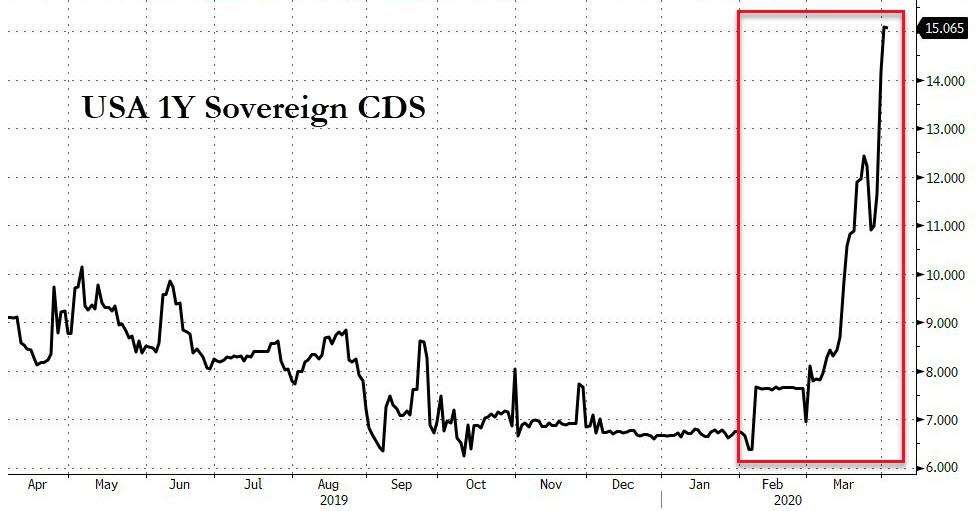

Only one word can describe what the Federal Reserve has done these past two weeks: PANIC!

The big spike seen in the chart below (from a 10Wk M/A of 18.23 billion to 82.66 billion) is only from the LAST TWO WEEKS! The FOMC has to using an enema bottle up the market’s back-door to “inject” this much “liquidity” into the banking system. Why would they do this; most likely because if they didn’t the global banking system would have imploded.

Wk Cng Fed Hold 10Wk MA

The clock is ticking for the day when the price of gold and silver are going to explode.

The clock is ticking for the day when the price of gold and silver are going to explode.

Mark

Good stats but are they irrelevant?

The Commitment of Traders Report

Silver

*The large specs reduced their long positions by 6,027 contracts and reduced their short positions by 3,218 contracts.

*The commercials decreased their longs by 104 contracts and reduced their shorts by 3,484 contracts.

*The small specs reduced their longs by 1,925 contracts and decreased their shorts by 1,354 contracts.

The commercials reduced their net short position to 41,300 contracts.

Gold

*The large specs reduced their long positions by 30,399 contracts and reduced their longs by 882 contracts.

*The commercials reduced their long positions by 7,628 contracts and decreased their shorts by 35,492 contracts.

*The small specs reduced their longs by 2,120 contracts and reduced their shorts by 3,773 contracts.

The commercials reduced their net short position to 283,959 contracts.

All the various players are exiting the scene. However, the silver commercials net short position is near our magic 135,000 number, while the gold commercials are frantically doing what they can to exit their short gold positions.

Another joke becomes prophecy as near-end times for the global economy seemingly has gold stymied and confused, “looking for direction” sayeth the MOPE brigade

James Mc checked in early…

Fake gold “shrugs off” TEOTWAWKI-like NFP numbers

Bill,

If a minus 700k NFP print, which was 7 times worse than expected, and prior to the catastrophic May NFP which everyone knows is coming can’t move the fake gold price then you know it is a RIGGED casino. Hey, shrugs all the way around, the dollar, Dow, S&P also seem very nonplussed. After all, TEOTWAWKI is no big deal, right? Another joke becomes prophecy as near-end times for the global economy seemingly has gold stymied and confused, “looking for direction” sayeth the MOPE brigade. This is hilarious- even a million standard deviation from norm event doesn’t stop the NFP riggers from making their appointed rounds. People are wising up to this charade however.

The EFP’s have disappeared for the second straight day. Yesterday’s 2,529 tally is a far cry from the halcyon days of the past year, or, even as recently as last Tuesday. Gold and silver volume have also disappeared due to the margin hikes and the recognition the Crimex is a rigged casino. In the real world the premiums for real stuff will only keep growing.

Here’s a quick checklist for a path to $100k gold:

*Derivatives crash

*Economic crash

*Hyper-monetary expansion

*Equity crash

*TBTF Banking crisis

*Social unrest

*ZIRP/NIRP bond yields

*The acute need for ultimate safety

*Decades-long gold suppression scheme unraveling

ALL criteria for a gold and silver explosion are currently being met. If gold were allowed to anticipate ANYTHING it would already be well on the way to $100k. The approaching monetary debasement will destroy global currency values. We’re currently in the first inning of monetary destruction.

One of my long held beliefs has been the reason gold, and particularly silver prices have been unreasonablysuppressed is because THEY have to. Kryptonite kills, and a silver blow-up is a nuclear event. I have maintained since the run up in 2011 they could have suppressed gold around $2,000, and silver $50 and nobody would have even noticed or cared. The fact that $1600 and $14 silver exists in the fictional world of the Crimex is proof THEY have short obligations out there that will blow to Kingdom Come if ever those prices become reality. We are witnessing the pre-Kingdom Come phase of the cartel fright show. The Wizard of OZ, aka LBMA, is shouting in his megaphone trying to terrorize people into believing there’s too much gold out there. HAHaHa. (Real) money talks, bullsh*t walks.

who knew?

https://www.canberratimes.com.au/story/6711213/anti-parasitic-drug-kills-covid-19-in-lab/?cs=14231

ivomec kills coronavirus! i have ivomec on the shelf. they sell it at the feedstore as a wormer for cattle and sheep. i’ve been using it as a wormer for dogs for years. for cattle and sheep it’s injectable. i’ve been giving it to the dogs orally. a) draw the dose from the vial with a hypodermic syringe (handy for measuring the dosage – 1 ml/100 lb of dog). b) pull the needle off and squirt the syringe down the dogs throat. easy-peasy.

i checked on the web, and it’s used on humans (for worms or other parasites) about the same dosage. now if the fda can figure out the dosage for CV-19……

Gold Is Not A Consumer Product. Lower Oil Is Deflationary For Most Other Products

We heard the opposite in the late 70s, that oil ($3 to $40) was involved in practically everything and higher Oil was making everything cost more. Naturally the Media blamed the United Auto worker too because their wages were going up lock step with cost of living.

Gold went up 75% with that 1930s deflation. $19 to $34? 75% again? $2800? Looks too cheap.

This cheap oil, is going to kill electric vehicle sales, and other gas saver cars. And the shortage of pilots? That’s going to reverse. And the artificially cheap airline tickets? That will probably also reverse too because a lot less travelers to divide the costs, less volume equals higher unit prices. Henry Ford figured that out. Higher volume lower cost.

I remember when the our US Oil producers were using our oil. Our rig guys were getting $35/hr a lot of money back then, but overseas $3/hr or a day, I forget. Same thing happened after 1971 with US manufacturers, that had their/our products made overseas and re-imported.

I think TPTB are doing a rain dance.

@Maya re Copper Pennies, $50 worth of Wheat Cent Pennies Costs $240

Almost a nickel each in bulk. I remember going to a coin show years ago, and a dealer had loose wheat pennies he was selling for .25 and .50 each depending on condition, in small quantities of course.

https://www.providentmetals.com/copper/other-copper-bullion/copper-pennies.html

Goldie, Captain, R640

Goldie – yeah, you’re right. I’d have done a lot better in this sector had I bought RGLD and FNV, and maybe some other major producers. It’s as you say, the lottery ticket juniors that have absolutely killed me. Not had a single one that has done the infamous “ten bagger”.

Captain – thanks. The gamblers are what they are, they won’t stop playing with fire. Just gotta hope someone large enough at the Crimex stands for delivery and breaks their dumb asses.

R640 – So, you’re Sunday night gold explosion was just a joke? What about your post of a couple days ago where you thought gold and the shares would jump and I told you your call was “prophetic”?

So, is there anything you actually post that you believe or post with conviction? There are a lot of folks here that might rely on information posted on this small forum. I’m sure there are some posters here that take your opinions very seriously. Please take that into consideration when you are just “yolking”

KL

Thats cool Alex Valdor. I just worked out of there for a while. The mines were pretty much not doing much at the time. But it did put enough of a bug in my ear that when KL the Company started up, I bought bunch for sentimental reasons, (hows that for DYODD! LOL)… been sitting on it the whole time, still haven’t sold a share. One of my better ones.

We would sit around in the bar there, and listen to the miners say all the mines went in one direction, and if they ever went the other way, they would find just as much gold there too. Thats always kind of sat in the back of my mind. I think KL is now exploring “in the other direction”.

Cheers

Midnight Gardener

I was born in KL…at home !

Captain Hook @ 14:04

First Majestic has been selling silver to the public for years. I think it’s a smart strategy and like you say at least that silver isn’t going to crimex.

“Not needing money” I don’t know about that!

Cheers

Detour Lake

Here is a bit of my history, years ago, in the mid 90s, usually on a Friday, we would fly into Detour Lake mine and pick up the latest load of bars. It was pretty cool to fly, usually about 10 of them, down to Timmins and unload. Some times they were accompanied by security, and sometimes just us two pilots.

Now KL has bought Detour. Bit of a small world story. For some of that time I lived in Kirkland Lake.

FYI, Spot Gold Kitco $1616 and $1644 Spot Finviz Retail Add $185

This reminds me of real estate when its going up. The sellers want next years price. It looks like the U.S. Mint and or Gold Eagle retailers are asking anticipated higher prices.

Gold One 20 oz Roll $36,550 $1,828/oz $185 over the higher spot price.

2020-1-oz-gold-american-eagle-20-coin-mintdirect-tube

https://www.apmex.com/product/196142/2020-1-oz-gold-american-eagle-20-coin-mintdirect-tube

ipso facto @ 13:44

I thought he said he didn’t need the money right now.

Oh well, maybe it’s because he doesn’t want to help out the horses arses at Comex.

Chuckle

Midnight Gardener

I had early success with the juniors as well … but in the last few years, with exceptions, the bigger issues have done better.

That’s not saying I won’t be buying more of them … 🙂

Usually a few of them work and I press them. That has kept me in the game.