By Pam Martens and Russ Martens: April 1, 2020 ~

Do you have an opinion on the Sprott Physical Products (PHYS; PSLV: CEF; SPPP)?

Do you have an opinion on the Sprott Physical Products (PHYS; PSLV: CEF; SPPP)?

Haven’t seen this anywhere else …

Published Sunday, April 5, at 5:30 p.m. EDTFollowed by Hyperinflation

Granted, two trillion dollars worth of consumer stimulus is bound to produce short-term benefits and a fleeting bounce on Wall Street. Were you aware that much of that money is in the form of loans that will allow employers to avoid laying off even a single worker? The loans are structured as gifts, and if you borrow a few million dollars now and don’t furlough any employees, there’s reportedly a good chance the debt will be forgiven. This effectively creates a months-long paid vacation for the idle at the expense of those who are working. Or perhaps not; for if those still on the job are not taxed at some point to pay for this epic giveaway, the money will have come, so to speak, from trees. To use another metaphor, it would be the torrent of helicopter money that Ben Bernanke famously asserted could prevent the U.S. economy from getting crushed by deflation.

An Ethereal $88 Trillion

Could halting the reversal of American’s long run of prosperity be as simple as printing tons of money? I somehow doubt it. But I am still not quite ready to cede the endgame to the inflationists. For even if a series of bailouts injects as much as $2o trillion into the system, that would still be far less than the sum remaining to be deflated from the asset side of America’s ethereal balance sheet. At early February’s peak, we owned in the aggregate about $32 trillion dollars worth of residential real estate, $16 trillion of commercial property and $40 trillion in stocks, for a total of $88 trillion. This sum was effectively reduced by $15 trillion when the stock market bottomed on March 23. Does anyone actually believe the low is in? In any event, real estate has not yet begun to collapse because transactions have temporarily dried up. But when price discovery returns to this crucial store of the nation’s wealth, it stands to be an even more powerful deflator than falling share prices. Indeed, were property values to fall as hard as they did during the 2007-08 crash, it would reduce the private sector’s balance sheet by a further $16 trillion.

So where does that leave us? Better sit down for this, because those assets, all $88 trillion worth, are just a drop in the bucket compared to the financial derivatives edifice for which they, along with the world’s supply of oil and natural gas, are the chief source of collateral. Financial derivatives constitute a $1.5 quadrillion-dollar market — that’s $1,500,000,000,000,000 — and even a thousand helicopters filled with Benjamins could not keep this black hole from imploding. Nor is it certain whether Nancy Pelosi and her ilk, presented with an unparalleled opportunity to give away vastly more OPM than all of their predecessors combined, will be able to muster the crazed gumption to undertake fiscal countermeasures commensurate with the problem.All Eyes on Illinois

But here’s the wild card: the great state of Illinois, birthplace of Abraham Lincoln and Ronald Reagan. Its pension plan is headed toward certain bankruptcy, undoubtedly sooner rather than later, and it remains to be seen whether Uncle Sam will go “all-in” attempting to save it. If so, you can be sure that two dozen other tottering states, including California, New York, New Jersey, Connecticut and Massachusetts, will scream “Help!!” I rate the political outcome a toss-up, because even the dumbest lawmaker on Capitol Hill — AOC, to name names — can probably see that only a hyperinflation could result. This would not be your grandmother’s QE, where the mountebanks who run the central bank are tasked merely with pumping up stocks and real estate via easy credit. No sirree, this is the kind of monetization that would require sending out checks every month to more than a million recipients. Provide the same free lunch, in perpetuity, to every public-job retiree in every tottering state, and Fed helicopter money would soon lurch toward infinity. The predictable result after just a few months is that the $1687 check the Illinois DOT retiree receives every four weeks would buy a small bagful of groceries. This outcome is so obvious that even Pelosi and AOL would see it coming.

That doesn’t mean we can rule out an open-ended bailout, since it is politicians and their lackeys on the Open Market Committee who would decide. Assuming they agree, as is their wont, that “Voters will LOVE this!” we are no longer talking about a mere $20 trillion bailout, but one with no practical limit. This would come on top of national debt that is already at $23 trillion and growing by an unprecedented $500 billion a month. The Guvmint will eventually have to cap interest rates, since allowing them to rise to market levels would raise the burden of debt for all of us to a fatal threshold. Under such circumstances, the Fed would become the only buyer of Treasury paper — not because the banksters are economic dunces, which they manifestly are, but because their role as lender of last resort remains legally unconstrained and politically unimagined.Boxcars of Digital Money

Before hyperinflation erupts with the force of ten H-bombs, I expect deflation to play out ruinously in the private sector, impelled by a crash in real estate, commodities, household and business income. When the Guvmint comes riding to the rescue in a way that dwarfs the paltry trillions advanced us so far, that’s when hyperinflation will take off. It will probably play out more quickly than the Weimar hyperinflation of 1921-24, since the means to effect it are digital rather than via train and truckloads of U.S. currency. This scenario will be extremely tricky for those who would secure their financial fate with gold and silver. That’s because bullion will be trying urgently to separate out the mere suspicion that fiat currency’s days are numbered from the actual moment of its inevitable demise. Although I have long doubted gold could soar to the sensational heights predicted by some seers, I am now open to the possibility. I have remained firmly in the deflationist camp for more 30 years because I believed cumulative debt would eventually act like a black hole, sucking us into its maw so slowly at first that we would not feel the pull until it became irresistible. The pandemic has altered this dynamic by giving politicians and banksters a popular excuse for making mind-blowingly reckless decisions that are happening too quickly to challenge or resist. If the courage and sanity to oppose them exists, it will surface in token op-ed essays by the few who understand why money needs to be backed by something scarce that has real and enduring value.

|

||

|

||

|

I believe its a scam, but not that there is no real gold. I think the scam is that millions of little people that buy GLD to have and to hold, unwittingly put up all the money to have gold on hand for banks and gov’ts and maybe even to help make deliveries for COMEX in emergency situations.

Kind of like the old days and bank deposits. The banker knew not everybody would withdraw their funds, so they could lend out some of the inventory. Before those days there were gold smiths where people would deposit their gold and get a warehouse receipt.

The “goldsmith” or what ever they were called, knew for certain the same thing, there would ALWAYS be inventory, so they loaned out Gold “receipts” to people that did not have any gold stored there, to be paid back with interest. Which was the start of I guess gold backed paper money.

In the next emergency, TPTB may NOT have to confiscate Gold from people. (but they already did get gold from SOME people with GLD) to re-start the game. Its a strange coincidence, that the entire global economy was slowing after the 2008 crisis even though TPTB kept dropping rates globally, and blowing bubbles.

We had the everything bubble, Stocks bonds and real estate. The USA prosperity in my opinion was artificial. A lot of lower taxes and less regulations and more gov’t spending and tax incentives, and tons of hype and jaw boning. There is no prosperity in the USA until a 19 year old can buy a new car with a three years loan. We had none of that so hence, no real recovery. Simple. imo of course.

I have been telling relatives around me for two years now that the US economy was not really in recovery, and system was going to crash, its all “too good to be true”. Back in the middle of the ’08 crash, I was telling them, we hit bottom, we can’t lose anymore, and TPTB have to give the USA economic priority to lead the rest of the worlds economies, like 1945 all over again and everything was going to get better, and it did. “It was too bad to be true”.

Things did get artificially better during Obama, but too little late and too slow until Trump got elected. They went into speed up panic mode. They actually reversed the first reversal. No more time now. But the virus, versus a big bankruptcy to spark the crash, is a very strange coincidence, and some people say…”Nothing is a coincidence”. 🙂

I remember seeing this on TV around when Gold was around $1800, March 18 2012, it was all over the news. CNBC had a video, Bob Pisani being driven the secret location of GLD storage warehouse near London.

GLD does not have the gold they claim. They have a bunch of paper like Comex and would make it very difficult for anybody to withdraw physical because they are also drawing off the same hypothetical supplies in London and New York Comex claims to be representing.

They do have some physical inventory, but again, i can assure trying to get any of it would be next to impossible no matter who you are. It’s likely spoken for many times over as well. It’s a scam, like SLV, Comex, certificates, etc.

This will all be exposed one day at the fraud trials (chuckle – that will never happen).

Cheers

Gold to Oil ratio divides golds price (financial stress measure) by oil (industrial activity measure). uncharted waters… except for 1933 with gold at $36 & Oil $0.50.. Same ratio as today. Markets saying Depression looms.

Here are today’s videos and charts. The videos are viewable on mobile phones as well as computers. Double-click to enlarge the charts.

https://www.gold-eagle.com/article/gold-and-stock-market-key-candlestick-action

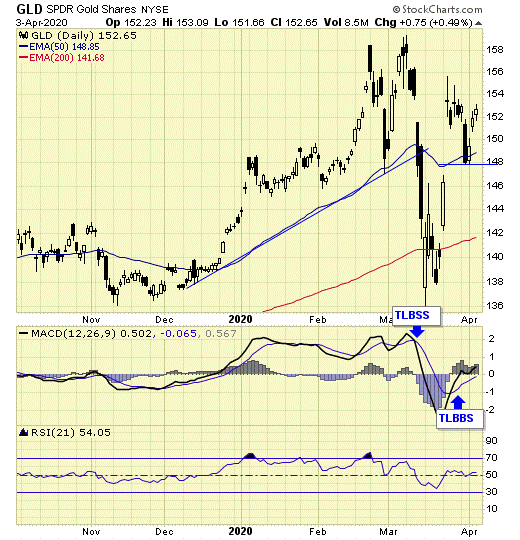

To public readers of our updates, our cycle indicator is one of the most effective timing tool for traders and investors. It is not perfect, because periodically the market can be more volatile and can result in short term whipsaws. But overall, the cycle indicator provides us with a clear direction how we should be speculating.

Investors

During a major buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema.

During a major sell signal, investors should be hedged or in cash.

Traders

Simply cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema

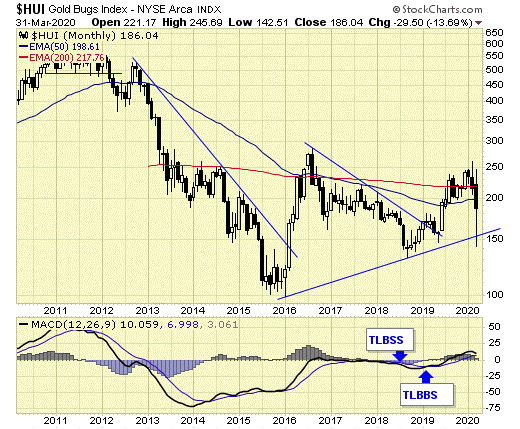

Gold sector remains on long-term buy at the end of March

GLD is on short-term buy signalGDX is on short-term buy signal.

XGD.to is on short-term buy signal.

GDXJ is on short-term buy signal.

Major support and resistance, with a median price are now established for trading the GDX.

Summary

Long-term – on major buy signal.

Short-term – on buy signals.

Gold sector cycle is up.

We are holding a core position, and also trading the short-term with GDX.

https://www.gold-eagle.com/article/gold-price-exclusive-update-shows-sector-cycle-sky-rocketing

32 NEW CASES, ONE NEW DEATH. Stats from HDOH:

Total cases: 351 (32 new)

Hawai’i County: 22 (2)

Honolulu County: 266 (29)

Kaua’i County: 15 (2)

Maui County: 38 (2)

Pending: 8 (-3)

Residents diagnosed outside of Hawai‘i: 2 (0)

Required Hospitalization: 19 (1)

Hawaii deaths: 3 (0)‡

Released from Isolation: 82 (4)

Cumulative totals as of 12:00pm, April 4, 2020

‡A fourth death was reported on 4/4/2020 in a hospitalized individual on Oahu and will be included in tomorrow’s counts.

“Stay at Home” orders. Mandatory 14 day quarantine for air travelers, including interisland travel. Travelers arriving without a place to stay are immediately turned away at airport and sent back. Most business closed.

By far, the Chevrolet Express‘ strongest selling point is its cargo space. Base cargo vans have a total capacity of 239.7 cubic feet, while opting for the extended-wheelbase cargo van nets a whopping 284.4 cubic feet.

979 Cubic Feet of Gold, divide By the smaller 240 cu ft van is about 4 van loads.

979 Cubic Feet Of Gold divide by the bigger van 284 cu ft van is 3.5 Van Loads.

Each of 4 Vans would have about 244 tons inside. One ton is max load. The floor, suspension tires and rims would squash down.

So A 1 ton cap cargo van would only be able to haul one, 14″ cubic square block, and you’d need a fork lift for the block. And it would probably cave in the floor a little with 2,000 lbs on a 14 inch surface.

The Entire GLD Hoard, stored in a four car garage with the vans parked inside.

A 747 cargo 300,000 lbs max or about 150 tones, or only 150, 14″ Square Blocks Of Gold. And you can NEVER stack it in one spot. It would cave in the floor. They would have to spread it out on the entire floor.

Can an investor take physical possession of the gold backing his/her shares of SPDR® Gold Trust (the “Trust” or “GLD”)?

The Trustee of the Trust, The Bank of New York Mellon, does not deal directly with the public. The Trustee handles creation and redemption of the Trust orders for the Trust’s shares with Authorized Participants, who deal in blocks of 100,000 SPDR® Gold Shares. An individual investor wishing to exchange the Trust’s shares for physical gold would have to come to the appropriate arrangements with his or her broker and an Authorized Participant.

Comment:

Now, who or what “participants” would be needing or wanting to take possession? JP Morgan? Chase? GLD had stored In 6/30/06, 372 Tons, 979 today. Allegedly. Sounds like its in London 400 oz bars.

A 14″ X 14″ X 14″ Square Block Of Gold Is One Ton or 2000 lbs. So todays 979 Tons sounds like a lot but its a little over 979 Cubic Feet. A typical 14 cu ft in a refrigerator? So its the size of 70 refrigerators. ? Double check the numbers I did this fast.

You said, “I’ve never seen the Crimex raise margin requirements when the price of the metals is falling – never.”

Actually that’s how they killed the rally in 2011. The difference this time is OI is at the lows now.

Go ahead, raise the margins more — they are sold out with the risk to the upside because of this.

Thing is, if they raise margins more from here buyers would be stupid to speculate in futures with little leverage.

Might as well buy physical silver and go for the ten bagger with little risk.

Cheers

Ipso – Pretty damn funny and so true. People can buy gold all day long for the paper price and never receive an ounce, worse, more than likely lose their asses because of their manipulation! When the rules don’t work in their advantage, i.e. margin requirements, they just raise them to scare the regular folks, almost always long, out.

I’ve never seen the Crimex raise margin requirements when the price of the metals is falling – never.

Captain – I hope I’m right too, but I think your statement here pretty much says it all:

“This is until these idiots are parted from enough of their money they stop…PMs will continue to be held back.”

Unfortunately, I have no clue where we go from here…

That brings to mind the old Soviet joke.

A guy walks into a bakery and says to the baker: “Hey how come your bread is 70 kopecks, the baker down the street is selling his bread for 50 kopecks?”

The baker says to him: “Well why don’t buy your bread there?”

The guys says: “He doesn’t have any bread to sell.”

The baker says: “Well when I don’t have any bread to sell I sell it for 50 kopecks too.”

By Pam Martens and Russ Martens: April 1, 2020 ~

Goldman Sachs Bank USA is the poster child for the insanity inherent in the U.S. banking system (with JPMorgan Chase and Citigroup’s Citibank not far behind). It has $228.8 billion in assets, $34.5 billion in risk-based capital, and $42.2 trillion in notional derivatives (face amount). Federal regulators are relying on Goldman Sachs Bank USA to have hedged $42.2 trillion in derivatives so that its netted out total credit exposure from all of its derivative contracts is just $118.4 billion rather than $42.2 trillion — which is still 344 percent of its risk-based capital.

That’s a big leap of faith given that JPMorgan Chase in 2012 had no idea its derivative traders in London were hiding massive losses on their derivative trades until a media leak brought on an investigation. JPMorgan CEO Jamie Dimon told the media at the time that it was all just “a tempest in a teapot.” But once the Senate’s Permanent Subcommittee on Investigations looked into the matter, it turned out to be a $6.2 billion loss on derivatives. The London traders had used the insured deposits of the bank as if they were chips in a gambling casino.

Even a calamity like that, which launched an FBI probe, did not move the Federal Reserve to tame these banking behemoths on Wall Street.

Buygold…you said, “Almost appears that the most of the other players left have finally figured out that the Crimex is a sucker’s game.”

I hope you are right, however knowing how stupid these idiots can be (attempting to not over-generalize), it could simply be the margin increases set against increasingly challenged liquidity conditions. Notice PM’s are still trading in the same direction as the larger equity complex.

Of course your next point could account for this, that being, “if we could just get rid of all the ETF’s – GLD, SLV, GDX, etc. maybe pm’s and shares could have a chance to trade freely”.

A truer statement concerning PM’s you will not find. That’s why the ETFs were put into the formula by the bankers. Because they knew it wouldn’t take much to turn many former PM investors into rabid gambling speculators that would be easy to push around using the machines.

This is until these idiots are parted from enough of their money they stop…PMs will continue to be held back.

Cheers

https://www.golddealer.com/product-category/products-2/bullion/silver-bullion-coins-bars/

https://www.golddealer.com/product-category/products-2/bullion/gold-bullion-coins-bars/

Can get some Gold Eagles for $1788, only a 10% premium, which given the bullshit the Crimex is subjecting the gold market to, seems rather cheap to me if someone doesn’t own physical yet.

Just sayin’

From the looks of the COT Report it almost appears it won’t be long before the Commercial Banksters will be betting against themselves on the Crimex.

Almost appears that the most of the other players left have finally figured out that the Crimex is a sucker’s game.

Now, if we could just get rid of all the ETF’s – GLD, SLV, GDX, etc. maybe pm’s and shares could have a chance to trade freely?

That the coronavirus crisis is a catalyst for piercing history’s greatest Bubble greatly broadens the scope of institutional failure. “The Coronavirus Pandemic Will Forever Alter the World Order,” is the title of Mr. Kissinger’s insightful piece. “While the assault on human health will—hopefully—be temporary, the political and economic upheaval it has unleashed could last for generations.”

Confidence in government will be shattered for years to come. Here in the U.S., we run up national debt past $21 TN – and fail to accumulate a reasonable stockpile of ventilators, masks and PPG. No preparation for a pandemic? After the downfall, it will take generations to restore faith in central banks. If trust in Wall Street has been thin, just wait. And right now Washington is hell-bent on destroying trust in government finances. We continue to witness behavior ensuring a systemic crisis of confidence in the financial markets and policymaking.

It’s a different world now. The chasm that developed between inflated expectations and deflating economic prospects gapped wider than ever. Prospects for a ravaging EM meltdown keep me awake at night. The existing financial structure, dominated by unsound debt, leveraged speculation, derivatives and free-flowing finance – I don’t see how it works going forward.

When EM citizens come to appreciate their boom experience has left them with unmanageable debt loads – and see their nation’s reserve holdings depleted in fruitless currency support operations – there’s going to be hell to pay. The house of cards is being exposed – and a crisis of confidence is at this point unavoidable. A domino collapse of currencies, Credit and banking systems, and economies has become a frighteningly high probability outcome.

In such a scenario, how would a crisis of confidence in Chinese finance be held at bay? Will Beijing turn more insular as it confronts calamitous domestic issues? Or would a more aggressive global stance be considered advantageous in the face of mounting domestic insecurity and dissent? The upside of Bubbles, buoyed by an optimistic view of an expanding “pie,” is conducive to cooperation, assimilation and integration. The downside unleashes a demoralizing slide into antipathy, disintegration and confrontation.

Kissinger: “We went on from the Battle of the Bulge into a world of growing prosperity and enhanced human dignity. Now, we live an epochal period. The historic challenge for leaders is to manage the crisis while building the future. Failure could set the world on fire.”

=http://creditbubblebulletin.blogspot.com/2020/04/weekly-commentary-king-of-sovereign.html