Sitting at the dinner table, our eleven-year old son inquired: “If a big meteor was about to hit the earth, how much money would the Fed print?” I complimented his sense of humor. Yet it was a sad testament to the historic monetary fiasco that will haunt his generation.

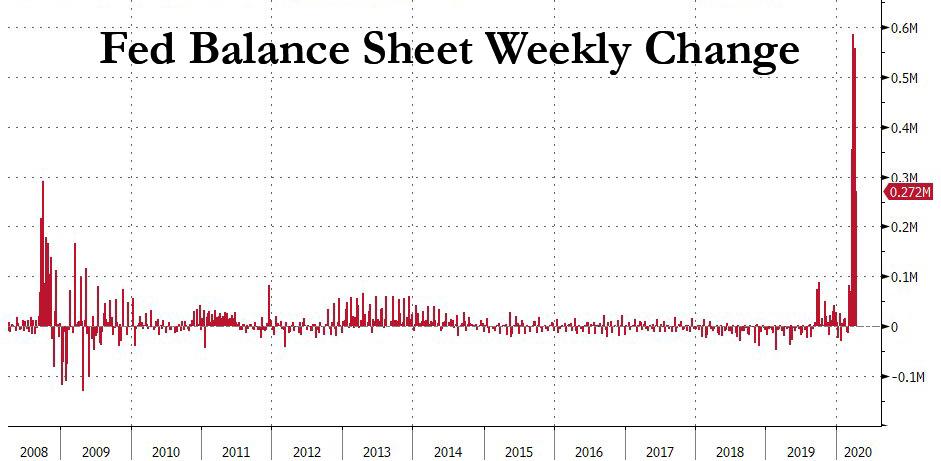

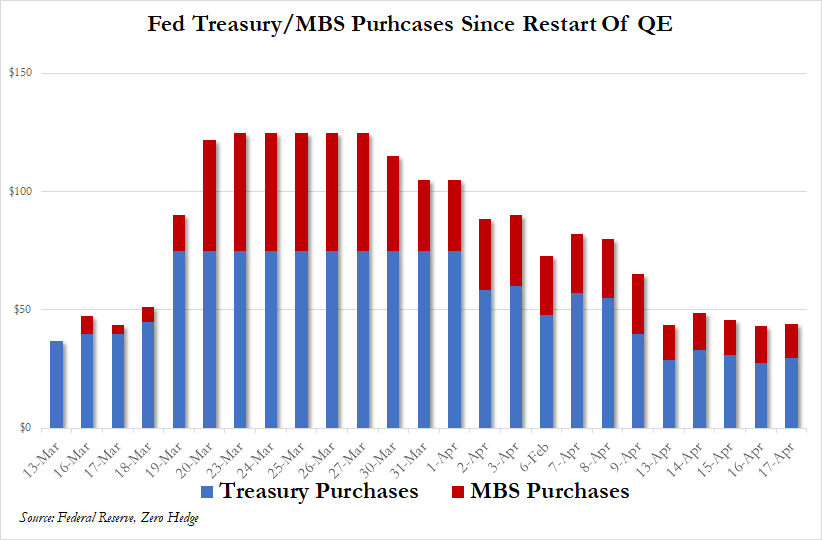

Federal Reserve Assets surpassed $6.0 TN for the first time, having inflated another $272 billion for the week (to $6.083 TN). Fed Assets inflated an astonishing $1.925 TN, or 46%, in only six weeks. Bank of American analysts this week suggested the Fed’s balance sheet could reach $9.0 TN by year-end.

M2 “money supply” surged another $371 billion for the week (ending 3/30) to a record $16.669 TN. M2 expanded an unprecedented $1.136 TN over five weeks (up $2.123 TN, or 14.6%, y-o-y). For some perspective, M2 has expanded more during the past six months than it did the entire nineties (no slouch of a decade in terms of monetary inflation). Not included in M2, Institutional Money Fund Assets expanded an unparalleled $676 billion in five weeks to a record $2.935 TN. Total Money Fund Assets were up $1.375 TN, or 44%, over the past year to a record $4.473 TN.

There was a sordid process – rather than a specific date – for When Money Died. But it’s dead and buried. There are a few things that should remain sacrosanct. Money is absolutely one of them. Money is special. Sound Money is precious – to be coveted and safeguarded. As a stable and liquid store of value, Money is the bedrock of Capitalism, social cohesion and stable democracy. Society trusts Money – and with that trust comes great responsibility and risk.