getting back to its roots …The Coca as in Cocaine is no longer mentioned in Polite company ..So Coca Cola has decided to keep upwith the TIMES and incorporate Marijuana into their drinks assortment .Out with the Cocaine affiliation and in with the acceptable Marijuana drinks ..its the new image thats ok with the Millennials .

Next thing they will say is “we do it for the children”.

Coke could make a move into cannabis-infused drinks

by Chris Isidore @CNNMoney September 17, 2018: 2:22 PM ET

Coca-Cola is considering a move into the growing market for cannabis-infused drinks.

Coke said in a statement Monday that it is “closely watching” the growth of CBD, a non-psychoactive component in marijuana, as an ingredient in what it called functional wellness beverages.

“The space is evolving quickly,” Coke (KO) said. “No decisions have been made at this time.”

CBD, which does not produce a high for the user, has been used for medical purposes, including easing inflammation, pain and nausea.

Coke’s interest was first reported by Bloomberg, which said the company was in talks with Aurora Cannabis, a Canadian cannabis company. Aurora has also expressed interest in cannabis drinks. Neither would comment on a possible deal.

“There is so much happening in this area right now and we think it has incredible potential,” said Aurora spokesperson Heather MacGregor. “Stories like this are further validation of the massive global potential of the cannabis industry.”

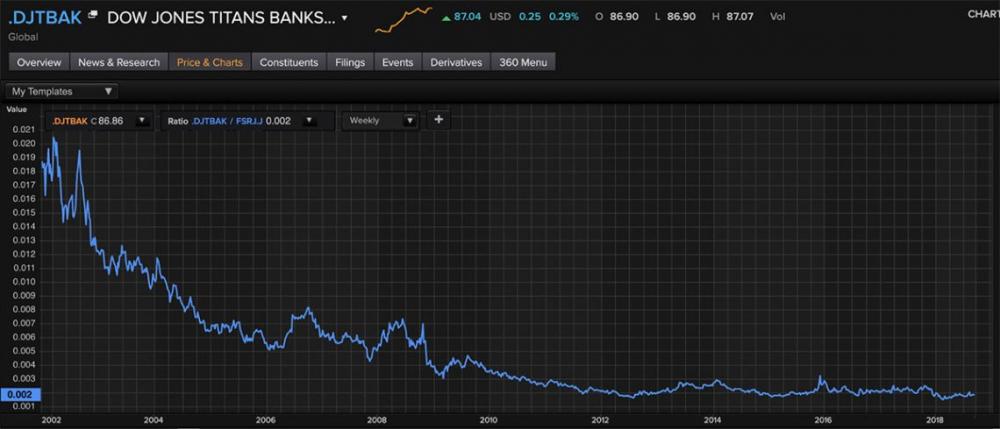

Constellation Brands(STZ), the maker of Corona beer, Svedka vodka and Casa Noble tequila, announced last month that it is investing an additional $4 billion in the Canadian cannabis company Canopy Growth (CGC).

A number of Canadian cannabis companies, including Cronos (CRON) and MedMen Enterprises (MMNFF), now trade on US stock exchanges, and some American companies have taken stakes.

And Lagunitas, a craft beer label of brewing giant Heineken (HEINY), already has a drink infused with THC, marijuana’s active ingredient, which does produce a high. It can be purchased at marijuana dispensaries in California.

Both cannabis and CBD are still illegal in the United States under federal law, even though a number of states have legalized marijuana. But the prohibition against CBD is not strictly enforced. There are third-party sellers offering CBD-based products on Amazon (AMZN), for example.