I’ve watched some of his videos. He has well intention theories but I don’t think they would work out of put in place.

Only real system is a barter system. It eliminates the free rides and middle man.

The fact that he endorses claimed socialist a bartender/ waitress Cortez who would give everything away for free paid by gov that would then tax us at 70/80 percent on every dollar or more to pay for it would be slave labor and a red flag.

As far as jobs many have been getting raises. Trump tax plan gave most Americans raises with less tax deductions without forcing business some of which can’t afford it that could close them down or cut hours.

A place I used to work a newer employee told me they got a 7 dollar hr raise in order to keep their employees.

So his stories are only partially true like business like GM buying back their own stocks. As far as I know GM pays their employees good anyways.

When on a cruise before the 08 collapse there were a bunch of GM employees there who got the trip paid for by the company. I don’t know too many business that do that for employees.

I don’t think he ever ran a business but runs on theories.

He never gives examples of failed socialist states.

As far as China they have stole our products made them for cheaper to out compete with better paid American employees. They’re not better made either they fall apart made of cheap quality and many products due to cheating on cheaper ingredients have been toxic including using lead paint on children’s toys.

Apparently he thinks it’s a good idea to pay employees less to help the country’s politicians and government elite. It’s okay to force them out of their rural homes into big cities now polluted and air quality toxic like a sort of agenda 21 in the name of socialism and their GDP numbers. Kinda a oxymoron.

As far as Chinese or India citizens they’re coming in legally with education or money. Their trying to get away from their economy he praises.

They aren’t burning down calif like that nut caught starting some of the fires in Calif. Actually there was two of them. They don’t want that getting out though.

He talks about Trucks which come in handy as a man thing but dies he know in China a man thing is burning with a blow torch or boiling dogs alive is a aphrodisiac because making these poor trusting dogs suffer makes them matcho.

He picks and chooses what he critizes.

France apparently won’t go along with free trade either as Trump is trying to work on but has to go two ways.

Gold titan

Ororeef–thanks for the article–another sign that gold should be near a bottom-of course all depends on the rig holding together or not

Jeesh! JNUG down 4% in pre-mkt. at $9.27 on heavy volume—silver down .26…the bonfire of the PMs…Hey! Capt. Hook…I hope u got some ready cash…it’ll soon be the “MOTHER OF ALL BUYING OPPS”…..[guffaw!] I got my crash play on=I’m short the big banks via put options…bring it on!

Mr.Copper

He’s tried that and been warned off, as the Rig says a strong Dollar, weak PM’s and rates = Strong SM.

But I know what u mean…how much longer can they play the same game..nothing has dented their game so far…however Erdogan is a certified nutter and Vlad is as hard as hell.

Buygold

Come on…don’t be such a party pooper.

Time to buy the ETF calls for the moonshot….no?

The gold bugs have fundamentals, not to mention the moral high-ground, on their side.

The dollar is crap…right?

So back up the truck…load the boat…to da moon.

Those computers (and creditors) really care about stuff like that with a liquidity event approaching.

Chuckle

The Global Dow index is down big-are stocks starting a few days correction–the Fall correction-or the path to a crash? Remember yesterday Turkey was “stabilised”?

OPEN—LAST DATED AUG 15 2018 AT 8:33 A.M.M EDT

3,013.82- 19.91

Trump, Sooner Or Later, Will Have To Jawbone The Dollar Lower

I don’t know what he and his team are waiting for. Unless they work with the Fed like all the other administrations. The high dollar is a HUGE HUGE tariff on exported US goods.

I’ve noticed over the decades, the Fed tends to “squeeze the neck until the eyes start bulging, and then lets go”

If it can get worse, it will always get worse in pm’s

RSI’s on a lot of this stuff will be in the teens today. Unbelievable carnage

There’s nothing like

….the smell of napalm in the morning.

Global Capitalism: Immigration & Trade War

Excellent video by well known economist – Richard D. Wolff – worth watching, regardless whether you agree with him or not.

Gold already down $9.40 @ 6.45 am

Are “They” punishing Putin for selling Treasuries and buying gold + the fact that Turkey has significant amount of gold ?

USD up 0.16 0.17%, gold down 0.8% , so WTF is going on ??

Just a thought !

GT

Oh Oh !!!! Erdogan is upping the stakes….the scum are gonna have to put the Hamptons on hold, to save the Rig.

Though needless to say this is all PM bearish…according to the Rig.

Ororeef .37

The word dog is too good for her but probably a nice way to call her a bitch which is more accurate. Watch them get their pants riled but it’s okay to throw out a bunch of BS words toward him and us like deplorables. They can give it out but can’t take it.

Trumps

criticism of Amorosa and characterization of her as a DOG is probably incorrect …DOGS are more Loyal to those that befriend them .She dosent meet that standard….

USDX

Looks like 98.00 may be next stop. Those long gold, short USDX guys are getting their heads handed to them.

rno

Ororeef

The government is a part of these costs. They’ve got layers of fees like blood suckers attached to them. Users fees taxes all seperated, and more fees I can even remember depending on what state your from.

Verizon

fios tried to scam me ..they delivered internet speed far below what I was led to believe I was getting ..Router not functioning properly then charged me rentals on devices I never got or were supposed to be free .Then when I told them how unhappy I was with them they agreed to give me credits and fix things ..that was two months ago ..The new system was installed at current speeds and works fine ,but the credits are nowhere to be seen ..despite getting my son in Law to call them in addition to my self calling them …He suggested he might could help ,( he’s been an executive at Major corporations like IBM,HP CompAssc..etc they give a lot of lip service ,but credits never got here )..Im looking to get rid of them too at this point…Cable companies only know how to raise prices ..Fios tricks initial service customers by giving discounts at the inception and then they disappear and any changes you make start out the same ..everything starts out at a “discounted price” and after a year disappears giving them increases not just by increasing FEES ,raising Rates and the disappearing discounts….NOT getting the credits promised is the last straw !

All I need is internet service ,I about to get rid of TV ..I already long ago got rid of telephone ridiculous fees and taxes by going to Ooma phone ..best thing ,I saved thousands already !

So That’s How It’s Going To Be, Vanguard? NO FRIEND of GOLD !

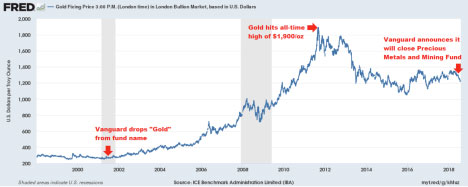

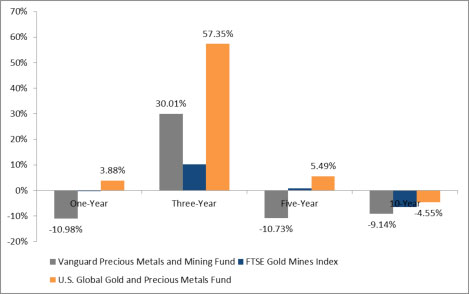

So That’s How It’s Going To Be, Vanguard?Bob Moriarty It looks like Vanguard, one of the world’s largest fund companies, is leaving gold investors up a certain creek without a paddle. Starting next month, the $2.3 billion Vanguard Precious Metals and Mining Fund (VGPMX) will change not only its name and advisor but also its investment strategy. Its position in precious metals and mining stocks will be slashed, from at least 80 percent today to only 25 percent. The firm’s July 27 press release doesn’t explain the reasoning behind the decision but I imagine it’s because VGPMX had a long history of inferior performance. The fund was unable to beat its benchmark for any period as of June 30. Vanguard liked to call attention to the fund’s low fee structure—it charges only 0.36 percent—but like everything else in life, you often get what you pay for. Walmart’s cheap, too, but I’m guessing you wouldn’t shop there to buy an outfit for an important job interview. You might not make the first impression you were hoping for. Or how about McDonald’s? In the short-term, you might save some money eating every meal off its dollar menu, but because of the risks of high blood pressure and diabetes, you could be looking at higher medical expenses later on. My point is that cheaper is not always better. In fact, cheaper often costs you more in the long run. So instead of fixing VGPMX, Vanguard’s board threw in the towel. This leaves shareholders in the Vanguard ecosystem without a way to participate in an industry that, in the U.S., produced more than $75 billion in raw materials last year. That’s bullshit, and investors deserve better, as I’ll show you in a moment. Does This Mean Gold Has Found A Bottom? There could be a silver lining here. Some analysts see Vanguard’s move as a further sign that the gold market has found a bottom—and that the metal could be teeing up for a reversal. You see, this isn’t the first time Vanguard changed the fund. In 2001, when gold was similarly near a bottom, the company removed the word “Gold” from what was then the Vanguard Gold and Precious Metals Fund. The change coincided with a decade-long precious metals bull run that saw gold rally from an average price of $271 an ounce in 2001 to an all-time high of more than $1,900 in September 2011. That’s more than a sevenfold increase. And now it’s dropping the fund altogether. (Click on images to enlarge) So could this mean another gold bull run is in the works? No one can say for sure, of course, but the timing of Vanguard’s announcement is certainly interesting. What I can say with certainty is that there are many investors—no doubt hundreds—who are in for a rude awakening when they find out their exposure to the metals and mining sector has inexplicably shrunk. Seeking a Better Gold Fund Now that Vanguard has decided to close VGPMX, it’s time for investors to look for not just “another,” but a better gold fund. A superior gold fund. After doing some digging myself, I think an excellent option is U.S. Global Investors’ Gold and Precious Metals Fund (USERX), the very first no-load gold fund in the U.S. USERX invests at least 80 percent of net assets in precious metals and mining companies. The top 10 holdings include growth-y, smaller-cap names like St. Barbara, Kirkland Lake and Wesdome Mines. You can also find precious metal royalty firms like Sandstorm Gold and Wheaton Precious Metals—both of which have among the highest revenues per employee of any company in the world. This tells me the fund’s co-managers, U.S. Global CEO Frank Holmes and Ralph Aldis, have done their homework. And the homework appears to have paid off in spades. For the one-year, three-year, five-year and 10-year periods as of July 31, USERX beat not only its benchmark, the FTSE Gold Mines Index, but also Vanguard’s $2.3 billion fund. For the three-year period, it outperformed VGPMX by more than 2,700 basis points, according to Bloomberg data. Source: Bloomberg, U.S. Bancorp The fund charges 1.66 percent, but I think it’s important to point out here that, with USERX, you’re paying for experience, expertise and—above all—performance. The returns in the chart above? Yeah, they’re computed after fees. USERX is still the leader in every time period. What’s more, USERX holds an amazing FIVE-STAR rating overall from Morningstar as of June 30 in the Equity Precious Metals category. It also holds five stars for the three-year and five-year periods, and four stars for the 10-year period. Sound too good to be true? Check out the Gold and Precious Metals Fund (USERX) for yourself by clicking here! ### Bob Moriarty |

Copyright ©2001-2018 321gold Ltd. All Rights Reserved

The US-Turkey Crisis: The NATO Alliance Forged In 1949 Is Today Largely Irrelevant

Just read this and considering the protagonists, there is no easy solution…so yet again it is the Rig that is at work, taking the SM etc up today, as if there wasn’t a care in the World.

Cash is King

and the borrowers shall die….The Us Banks make loans in Dollars to foreign country’s then interest rates rise making those loans carry a high er rate than those countrys can pay.So their loans get expensive to pay back.Then when they do pay back it takes MORE of local currency to pay the exchange rate difference making loans harder still to pay back .

Then trade negotiations are getting tougher causing more job losses for them….So the free ride from the US is OVER and the Uncle Sam wants his due….Turkey ,Greece most of Europe wont repay loans..certainly not Africa and now MAYBE China or anybody else that BORROWED from US Banks or US DOLLARS abroad.Thats what Bankers do..they put you in debt ..then they raise rates AND Raise the value of the DOLLAR making payback impossible.Then they foreclose…they confiscate your collateral ,your house,your business,your land…..Thats how Banking works ! Always have your debt in a weak currency,your assets in a strong currency .Most of the world financiers do the opposite.They should have hedged their loans by owning Gold with a PUT option for insurence…but they dont think like Bankers.Do not borrow for consumption ever !Borrow to make money in your business only if its profitable…..

When is CASH KING ? , in a Depression !You can buy assets for 10 % of peak price…or even less.The US creates growth by developing the third world with debt ..We built China with loans ,we gave them jobs for their cheap labor ,now they need to PAY BACK ,same with TURKEY and Europe,Canada ,Mexico ….time to pay up !Theres NO free LUNCH…

Dont send us your poor anymore ,send us your smartest ,your educated thats the price you pay for your loans…..

US needs to reduce its debt ! pay up…..say the Banksters….The only way out is for the US to DEVALUE …!

Just no stopping the USD

Killing pm’s and currencies around the world.