transgenders from servicing in the military. Story at Zerohedge.

transgenders from servicing in the military. Story at Zerohedge.

President to Block

NFTRH=thoughts on FOMC day

It is FOMC day, a periodic ritual where a group of economists get together and pretend to have decisions to make about interest rate policy. Well, according to CME and the Fed Funds Futures there is a 97% chance that the Fed sits on its hands today. That won’t be a surprise.

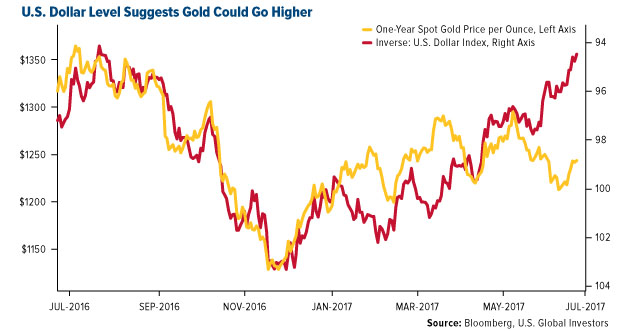

But Janet Yellen has a little problem and his name is Uncle Buck. The US dollar index and its pairing vs. several global currencies are on the verge of collapsing below important support levels. This update on currencies from this week’s NFTRH 457 explains why I am short the euro and prepared for the USD to find support and bounce. Now, at this point that is just a contrarian’s fantasy because the market says USD is in trouble. But have a look at the post and see if you might agree with some of its premises, especially where sentiment and Commitments of Traders are concerned.

So here we have the Fed, overseeing a massive bull market in stocks and ostensibly in accommodation removal mode. My premise since the election of Donald Trump has been that the Fed could now slowly and routinely remove the monetary policy stimulants it had injected into markets nearly non-stop during the Obama years because that admin’s goals depended on monetary policy (i.e. monetary stimulation, because there sure was precious little real economic stimulation going on) whereas the new Republican policies would depend upon fiscal stimulation. I would argue, however, that “fiscal stimulation” may be code for ‘dollar devaluation’ to spur exports and boost manufacturing.

So a big question now is whether the Fed, despite its slow tightening regime and stated intention to implement future rate hikes and reduce the size of its balance sheet (USD-supportive actions) actually means business, leaving the Trump admin to its fiscal policies; or whether the Fed will ‘play ball’ with this admin in a different way.

Core to the Trump fiscal agenda would be a weak US dollar. We just may get a look at Yellen’s cards today. If FOMC rolls over and keeps things well and dovish despite the weak USD, we’d have a clue that they are on board the weak dollar express. But what if the Fed chooses to support the dollar through some subtle jawboning about future hikes and balance sheet reductions? I have no real dog in this fight. I’m just trying to make sure NFTRH is on the right side of it.

Looking at it from a different angle and taking out the political while only considering market-oriented inputs, here is a big picture look at previous Fed tightening cycles. The stock market topped on the last two occasions that the Fed Funds Rate (FFR) caught up to and slightly exceeded the 2 year Treasury yield. But a more acute signal was when the 2yr began to decline and negatively diverge the FFR (note the red lines on the chart below).

Looking at the chart one might say that the 2yr and FFR have a long way to go before they reach a topping area equivalent to the 2007 example; but one might also look at the S&P 500’s mega hump and ask… ‘Really? That was 7 years of Zero Interest Rate Policy!’ The above is a picture of a distortion built on years of out-of-whack monetary policy (note how the 2yr began to rise in 2013 and the FFR did not start following it upward until late 2015). Maybe 1-2% is all that the Mega Hump and all that hot air can take on this cycle. It is the relationship between the 2yr and the FFR that will be important. At a current 1% to 1.25% the Fed is approaching the 2yr’s 1.4% but the market appears fine for now (and a bull trend is a bull trend until it no longer is).

A central question going forward is whether or not the Fed will choose to support the dollar and head off inflation, or wait to see the white’s of its eyes? Since the election the stock market has been very much tied to a dollar depreciation theme (and has, since 2011 been a primary beneficiary of the Fed’s inflationary operations). The last big rise in USD preceded a significant corrective phase in the markets (2015 into 2016). So which cards will Yellen show with respect to Uncle Buck and his current precarious state?

NFTRH=Thoughtd

NFTRH=Thoughtd

Maddog @ 0:34

Roger that, thank you, I started reading it. I see the banks as a one world socialist gov’t, and we all know socialism doesn’t work out after they run out of other peoples (or countries) money to spend. They control currency exchange rates. So they can move money (or hours of labor) from a rich country to a poor country via production of products. (wealth) Bottom line they moved too much US wealth off shore, and after 2008, they can’t really do that anymore, but they still are. Americans can’t spend money like they used to.

A requested repost=Market Forces Are Aligning For A Powerful Trend In Gold Prices

Market Forces Are Aligning For A Powerful Trend In Gold PricesLior Gantz, founder of Wealth Research Group, believes that fundamentals for precious metals have been confirmed and expects a major rally.

I hate false breakouts. They disgust me, and the entire community despises them!

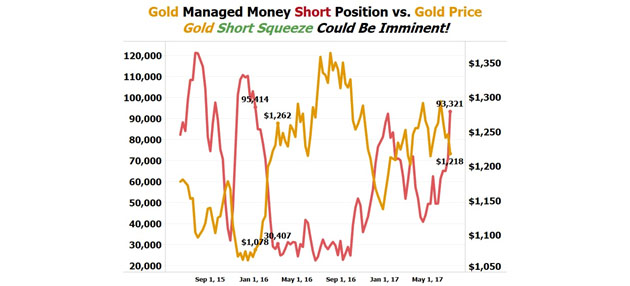

That’s why for the entire duration of the past week, we’ve been checking and confirming this rally from every angle, and I can tell you that the mother of all short squeezes is upon us.

My contacts in Asia (India and China), a fund manager in Russia’s gold inner circle, and the people I’ve been using for years in the European capitals of “old money” (Brussels, London, Vienna, and Monaco) have all vetted this short squeeze and indicated that the paradigm has shifted, pursuing the last Federal Reserve minutes and Yellen’s congressional testimony.

I even called in to some of the larger Swiss bullion dealers, as a would-be customer with a large order, and they informed me that if I want physical shipment, “I should experience severe delays.” One dealer said they had been emptying parts of the vaults they hadn’t used in 14 months!

It’s time to position using your best strategy.

For the majority of the past year since our September 2016 flash alert, “Overbought conditions in gold sector signal the top is probably here,” we’ve implored and suggested to take profits on 2016’s thick gains from your winners.

Since that time, we’ve been cautious, restrained, almost bearish at times, only pounding the table on the most obvious opportunities to scoop up the Rolls Royces of this sector for Mitsubishi prices, but now isn’t such a case.

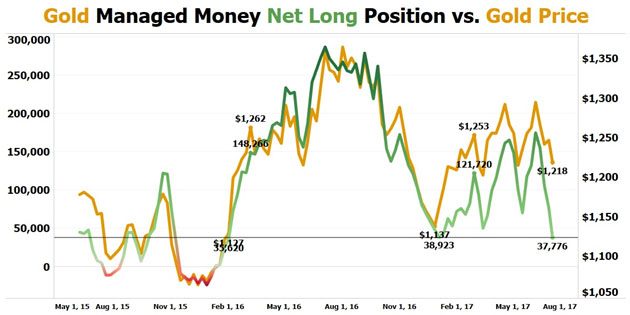

You see, for 11 months, the market has been consolidating, building up bearish sentiment, shaking out all the thousands of so-called gold investors with a “dabbling in the sector” approach, and even the institutional money has been duped into shorting gold in bulk option contracts right as the market turns.

They are all about to feel what it’s like to have a herd of elephants run over them!

Gold net long positions hitting an extreme low and the last two times this happened, we saw a 10% move, which would bring about $1,400 in a matter of months.

We’re not holding back anymore and we’re not delicately picking up surgical positions any longer. It isn’t a casual event this time around—it’s time to reap rewards!

Understand that what was missing up until now is a confirmation of fundamentals for precious metals. The threat of multiple rate hikes, coupled with low inflation data, was killing the catalysts for gold. That threat has disappeared from the landscape, so get strapped, as the coming months could be a defining moment for our portfolios.

Get busy researching ways to take advantage of this rare period.

Goldielocks

Naproxen Sodium OTC works for me. 🙂

Ipso

They’re hoopla about change is like a flea sitting on a horse and saying it’s to heavy for the horse to carry.

Now what the flea or tic can do is cause havoc so can man. Pollution of land and air and deforestation killing species and air as well as polluting oceans killing species and air. The dont talk about that and it’s the one thing that can kill us as well as other species. They might not care about other species just like people standing around taking pictures of someone in peril and doing nothing until it’s them but by then it will be to late because like the market were all interlinked.

Buygold

Some gold watchers some non bias.. Not selling it.. are looking at move above 1260 but still theres resistance at 1300. Silver above 17.

Mr Copper…ur gonna love this.

Central Bankers ‘Are’ The Crisis

http://www.zerohedge.com/news/2017-07-25/central-bankers-are-crisis

snip

Over the past few years the Automatic Earth has argued repeatedly, along several different avenues, that American society was at its richest between the late 1960s and early 1980s. Yet another illustration of this came only yesterday in a Lance Roberts graph: