margaret 15:16 absolutely dear lady

show all aspects of it in your post and no need to ask permissions….remember this is a ‘free speech’ site….of course within reason! 🙂 best of cheers and with your book also. wj

Thanks Equis!

A surprise to me not to see Chile on that list. A dearth of South American countries.

Cheers

Louise YAMADA Turned Bullish!

ALERT: Legendary Analyst Louise Yamada Just Turned Bullish On Gold! March 02, 2016 ALERT: Legendary Analyst Louise Yamada Just Turned Bullish On Gold! Today legendary technical analyst Louise Yamada just sent King World News an interim update announcing a historic breakout in the gold market. Yamada has been correctly calling the moves in the gold market for years and this is a major change in her directional call for gold. KWN Yamada IV 3:6:2016Today legendary technical analyst Louise Yamada, who has correctly called the major moves in the gold market for years, told King World News that she has now turned bullish. By Louise Yamada, Founder of Louise Yamada Technical Research Advisors March 3 (King World News) – INTERIM UPDATE Gold Breaks Out GOLD BREAKS OUT The growing concerns over negative interest rates may be pushing investors toward Gold Spot price (GOLDS- 1,247.10), even though there was only a small accumulation in place as noted in our February write up. Gold price has now exceeded the 200-day Moving Average (MA) and additionally has penetrated both 1,200 first resistance and the 2013 downtrend, and lifted to the first higher high above the October and May 2015 peaks (see upper arrows below on Figure 1)). KWN Yamada I 3:3:2016 The daily (above) and weekly (see Figure 2) momentum models have moved to new one-year highs (lower arrows), offering both short and intermediate-term Buy signals. The next step would be for a pullback to hold at a higher low, above the December low, and perhaps complete a year-long reverse “head-and-shoulders” bottom (see Figure 2, saucers) which would extend the basing process. Thereafter a higher high would establish a new uptrend, the first in years.

Huge Vol going thru shares into close

as kamikaze Scum selling met massive buying, sure they knocked prices a bit, but it took monster Vol.

Needless to say SM was bid into close, just to get a near top tick close…..so once again Bubblevision can go home happy, their darling bull lives on.

I’d love to see the Scums open possy…the B o J admits to owning 52 % of all Nikkei ETF’s, I bet the Scum own over 500 % of US ETF’s.

ASK NOT WHAT THE USA CAN DO FOR YOUR COUNTRY, BUT WHAT YOUR COUNTRY CAN DO FOR THE USA. WE ARE NO LONGER FAT AND SPOILED

Hopefully, that’s what President Trump tell the world.

“WE ARE NO LONGER FAT AND SPOILED” “YOU FOREIGN COUNTRIES ARE SPOILED”

“If we have to defend you, we MIGHT, its no longer free, you will have to pay”.

And he’ll tell the big global corporations…..

“If you people want to sell you consumer product to the US consumer? You have to have it made by the US consumer work/force”

“And if you think you are too big to fail? “And you want a tax payer bailout? Forget about it” “Those days are over”.

Wanka

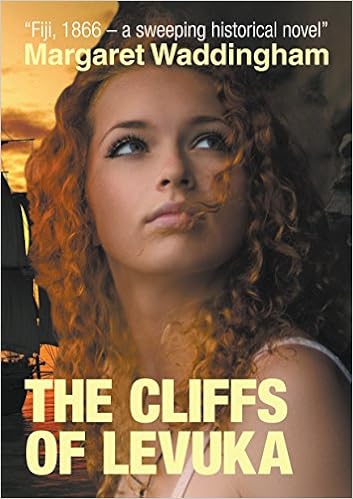

Two or three posters have shown an interest in the book I have just got published. (It hasn’t come in in paperback yet but is in Kindle) Would I be allowed to show the Kindle details on Goldtent?

The book will be out in about two weeks, I think.

Re Hillary “America needs more love and kindness.”

She represents the global welfare recipients that are afraid they will be losing wealth coming from the USA taxpayers and consumers, the gravy train sugar daddy USA is in revolt stage and they know it.

Global community, COMMUNE:

Modified:

A group of COUNTRIES, living together and sharing possessions and responsibilities.

Synonyms: collective, cooperative, communal settlement, kibbutz

“The USA lives in a commune”

@ Maddog RE: 10:58

after 5 years of beatings, goldbugs (me) are conditioned to expect the worst.

One day it will change. Hope I’m around to see it.

I just heard Hillary say that she believes that America needs “more love and kindness.”

Her track record makes me wonder if she has any idea of what the words mean.

Struggling with tax issue…Sterling Mining, and others…

On my 2012 tax reporting statement from Fidelity, there was a small Cash Liquidation Distribution (Line 8, 1099-DIV), but no mention of long-term realized loss on 1099-B. The shares– quantity and cost basis showing, but “unavailable” price or market value– are still showing up on monthly statements. I didn’t take the loss in 2012, 2013, or 2014 taxes. I need to do amended returns for all those years if I am going to claim the loss/deduction. Does anyone know what’s up with Sterling, and other stocks that get de-listed, or show up on your statements with (–) Price Per Unit, and unknown valuations? When do you know that the stock is genuinely finished and need to declare loss?

For information sake, I might add that Oil Sands Quest is a stock that went back and forth from being listed with valuations, and being listed in the Unpriced Securities section, for some months before it showed permanent failure. Some miners seem to go to zero, or near-zero valuations, but are not, apparently, permanently “out-of-business”, and ready for a write-off. If one would rather hold onto the shares in the hope that they will come back (especially because they are so nearly worthless as to make it pointless to sell), what are the signs, or declarations, that the company is truly finished and the stock no longer valid?

I have to leave for awhile; I’ll check back with this later. TIA.

drb2

We had a pretty big attack in the hour before and after the Crimex opening…..but it was seen off, as were other attacks during yr night ….which I have to say is very good to see.

fitteen dollah silvuh!

again, boss!

Natural News: Hillary Clinton opposes women’s rights on vaccine choice

She claims to support women’s rights and women’s CHOICE. But when it comes to vaccine choice, Hillary Clinton is strongly opposed to women’s rights.

Even while she uses words to talk about “compassion” and “children,” she’s advocating totalitarian medical interventions that damage children for life!

Larry Edelson: Kiss the Euro Goodbye

Dear Silverngold

Way back in 1998, before the euro even got off the ground, I told everyone I could that the currency wouldn’t last. At best, I said, it would last until the year 2020. Few believed me. Many said I was nuts. After all, how could I make such a definite longer-term forecast, especially involving a region of the world that then, and now, still represents the second-largest economic region in the world? Click here to read why I think the euro’s plunge is about to get a whole lot worse. The investment strategy and opinions expressed in this article are those of the author’s and do not necessarily reflect those of any other editor at Weiss Research or the company as a whole. |

Moody’s Downgrades China’s Credit Outlook From Stable To Negative – Full Text

It is likely just a coincidence that just a month after we reported that China’s real consolidated debt/GDP was far greater than the 280% or so accepted conventionally, and was really up to 350% if not higher after the recent record loan issuance surge, moments ago Moody’s officially downgraded its outlook of China’s credit rating from stable to negative, citing three key risks:

The ongoing and prospective weakening of fiscal metrics, as reflected in rising government debt and in large and rising contingent liabilities on the government balance sheet;

A continuing fall in reserve buffers due to capital outflows, which highlight policy, currency and growth risks;

Uncertainty about the authorities’ capacity to implement reforms – given the scale of reform challenges – to address imbalances in the economy.

While these were topical about a year ago for the financial media, and about 6 months ago for everyone else, we can’t help but notice that as expected Moody’s has said nothing at all about China’s biggest current risk factor – its collapsing labor market and surging unemployment. That’s ok, we are confident even the rating agencies will be up to speed with what we have been reporting since last November before the year is done.

wj

wj