Since food is going to be a issue and gold or silver might not even help if there is none to sell.

I decided to get a noodle press because we’re of some of us are going to go back to making things yourself. I decided to look for a ravioli cut out too @ like cookie cutters.” I found some simple low cost ones. Okay then moved to searching crab meat for crab ravioli I can store.

OMG 200 a pound???!!! I had to settle for cheaper brands of shredded kind you wouldn’t put in crab cakes but hopefully okay for ravioli mixture.

I wouldn’t wait too long less you have some crab traps. I’m just not into that anymore. Last time years ago I’d kill them and the lobsters fast with a hammer. Not let them boil alive. I can still hear the crunch of their shells. I’m eating more vegetarian too.

Speaking of battles

Ipso and all here

One thing about being stubborn is not giving up so easy, I think we all have that in common.

Yes we’ll have to pick or battles too and there’s plenty to choose from.

But in the meantime like the quote in the terminator “ get up solider.”

arm yourself with knowledge that can give us a better chance.

Here’s what to watch for when gold will rise. “ Not meaning to infinity” or someone’s magical number but what’s going on cuz like the Fed is doing now can change things. I’m sharing homework. You hear people talking about timing but they don’t know fundamentally when the timing is.

Look for this happening.

I learned this from Michael Pento and still doing my homework on it but I’ll share what I have and or am learning at this time.

He hands you the fishing pole not the fish.

When the real yields start to fall. “ In anticipation of a crash.”

Ref: homework

Outside of equities, the inverse relationship between gold and real yields also stands out, with the yellow metal rising when real yields fall and declining when real yields rise.

When the credit market freezes. The Fed is going to lower interest rates significantly.

Then look for them to “re-liquify” the credit markets.

The falling dollar.

So if we have nominal rates flat, inflation rising, real interest rates to fall and that’s rocket fuel for gold.

He also mentioned utility’s falling is good miners too. I’m not sure about that one happening lol

amals

I can’t agree more! What’s the value of being “rich” when there’s chaos outside and the grocery stores are burning. I didn’t know this was going to be a fight to the death!

As far as the POG goes, over the last 20-25 years and how we’ve been smashed, if it wasn’t for the rig I think gold would be couple of thousand higher. It’s not a fair market and none of us knew how unfair until it was demonstrated without letup.

ipso, Buygold, diamondhead

I think most of us on this board are in the same boat, more or less. I’ve been aboard since the late 90’s, and my faith is still not shattered. I truly believe we are on the right side of the situation. The problem is, it will probably have to all come apart in ways we wish it wouldn’t in order to be vindicated.

Buygold

Although Idaho isn’t bad too you sold your house during the high before it was too late then moved to Florida so you can’t be that crazy. You could of listened to a carpet salesman and spent the money on gold. Can’t do much about a rigged market just the carpet salesman.

De Santis and the Surgeon General of Fl just drew a line in the sand and gave the middle finger to the CDC that if they add that bioweapon by these incompetent quacks to the children’s already lengthy vaccine list there not going to have it in their state. The Surgeon General already put out a warning that males under the age of 40 should not take that the jab “ that’s neither safe or effective and a plain lie” because of serious health risks. I don’t know why he just said males though.

There was already a infiltration and recording of a CDC telling the infiltrator for truth that big money was coming to the CDC to approve it and put it on the school mandates. I can guess where some of that money came from.

They need to be investigated.

Diamondhead

Really good to see you posting along with some others. We all wait to see what happens, something has to give. I believe gold is in our DNA from its years of being money. We still hear about it in movies, books, commercials; it’s a symbol of wealth – always.

I have little doubt that if it were not such a threat to the USD we’d see fair value. Whatever that is in relation to real goods.

Thanks again for posting.

Aloha people,

Buygold, I feel the same, although over the years I have diversified into stock funds, and bond funds in closed end funds that trade like stocks but have characteristics of mutual funds. The strange thing is stocks and bonds have been selling off too! Very difficult times for conservative investors. In fact, although physical gold is down, I think its doing better than the s&p 500 and the 10 year bond. CD’s and money market funds are currently the best. I’m holding my fizz, but haven’t added to the pile in a long time. The few times my mining stocks were above cost I would get excited and think this is finally it- and then down they go. I made a personal vow never to buy another mining stock ever! And if the ones I hold go back to even- get out and I only buy something with a decent dividend. Also, I sell a mining stock for capital loss too- this year was MUX. Last year was GPL and AUY. Maybe AUY was the year before. I look forward to having zero mining stocks in my account. Sometimes I will look at 321 GOLD and yes, there is almost always an article proclaiming the mining stocks are about to take off.

How about the great silver squeeze? Silver would shoot up like gamestop! Never happened. I agree about the ego, too. Definitely! I’m glad you survived the hurricane! Aloha fellow tenters, Diamondhead

Maddog, Deer79

Funny how that works though with the rates. Palladium was up $71 and platinum up $31, rates didn’t bother them at all.

Deer79 – yes. This has been wearing me down for years. I’m afraid to miss if it finally does take off. It always works that way if I sell something.

I’m to the point I’m pulling for the BRICS + Saudi Arabia and others, to establish a parallel economy/currency that is backed by gold and other commodities. Unless the west is able to counter with its own backed currency, we will be destroyed. We are modern day Babylon and I’d like to see the rats scurrying around and jumping ship.

I’m afraid though that we’re going to now get this digital currency that treats gold just like the dollar does.

Maddog

The Dutch should decouple from the EU put that traitor on the run and keep their food for themselves. Is Schwab untouchable to something? Another German Nazi hiding in Switzerland. The UK should do the same.

rates are allowing the scum to lean on PM’s…….as the SM is reacting to rates as well

Rates are beginning to get out of control here folks….the scum can’t stop them rising……this could be when the wheels fall off.

Buygold

Totally agree with everything you’ve

said about the PM’s. I always felt that

Gold & Silver would be able to separate

themselves and appreciate in their own.

They may still do that ( as I love ipso’s positivity), but with each passing day,

my personal positivity continues to drop.

GLTA, as it will be very interesting how everything unfolds in the next year or so.

Maddog @ 14:26

The WEF and their plans have to go out the window. There’s already people in the streets. Not too hard to notice these bastards cutting off the food supplies … hungry people are going to get real nasty and want retribution!

I feel sorry for the people of the EU this winter!

out for a bit

ipso facto

Re Holland

Rutte has also introduced laws to cut nitrogen that will cause 100’s of Farms to shut down…the farmers are going ape…he just carries on as if the protests are not happening, even though his popularity has collapsed…..they just don’t care as they are zombiefied by Schwab.

Here in the UK we have silent coup going, run by Schwab….Truss has been kicked out and no doubt Sunkak is next, for PM, as he was anointed by Schwab.

drb2 and Mr. Copper

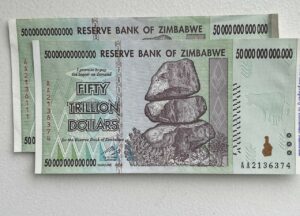

If you look at the Zimbabwe bill it shows you can buy some rocks! Cool!

Buygold

All you say is true but I’ve still got hope. I guess I am a raving lunatic!

Ipso

poof and it’s gone with the SM, and the USD now flat.

I can only speak for myself, but I am clearly mentally ill. We’ve been patient but we’ve fought the money powers. For me it’s also ego, somehow, I want to be right as others are wrong and be crowned for some illusive investment. Gold, silver and especially the shares are all an illusion. I thought we’d find riches and we’ve found poverty. I’ve also bought into the idea that gold would outperform in times of chaos and SM downturns. Not only have we not found protection, we underperform on the downside in these times.

The other illusion is being afraid of missing out on the really big gains when “it” finally becomes the “go to” asset. IT’S NOT COMING. Sticking around for 20 years holding this stuff is insane and creates depression for me. Easily #2 on the list of things I’ve done wrong in my life.

I remember back before 2008-09′ crisis Peter Schiff on “Fast Money” saying the gold stocks would trade like the next tech stocks because of the USD collapse. The people on the show laughed at him, back then I should have listened to the crowd.

I will never recover financially from investing in pm’s, but I could have if I listened to my son who told me to buy APPL 12 years ago, or Rambus, even Fully.

Sorry for posting a novel, this haunts me every single day of my life.

@drb2 re your Our country figured this out a long time ago…. and then forgot.

Right on that. And those $1 Silver coins are now about $40. Times 40. I’m being nice using times 20 all the time. Even spot Silver is always around times 20, but you can’t buy any Silver at that price either. I believe they need a REAL currency FIRST, before it can be debased and turned into a fiat currency. Its impossible without good one first. They will need to create a new GOOD one again FIRST. Its easy to ruin a good thing, but impossible to make a badly damaged thing good. They will have to start over after the distorted system, bondo bucket fix or repair daily economy fails. They probably have a new “car” ready after this old one goes dies and to the junk yard.

New high on the 10 year bond 4.2%. The $64 question is how high will they go? And the FED may have lost control if there was too much selling, (after they allegedly stopped buying) and sellers around the world overriding their buying. They may be lying and acting like its THEM in control raising the rates on purpose. I assume very few were holding Bonds to maturity, because the Bond prices themselves were rising. Who wants to hold bonds to maturity if the principal value is falling? With rates rising.

https://finance.yahoo.com/quote/%5ETNX?p=^TNX&.tsrc=fin-srch

BTW I can’t find a Heating Oil/Diesel ETF anymore. There used to be a UHN. This is very strange. Unless they want less speculation on that. Speculation betting, opinions, emotion, seems to be the price setter these days until price gets too distorted and rebounds the other way.

@ Mr. Copper RE: “There is no way to stop inflation until something is written on the money”

Our country figured this out a long time ago…. and then forgot.

then >>  and now >>>

and now >>>

Buygold @ 12:31

I just wanna know … are we very patient or insane? ![]()

Have I been living under a rock all these years or did someone finally die so this could now be published?????

I started watching this Full Documentary last night as a total skeptic and am now a 100% true believer. I hope a few will watch it and pass it on.

ELVIS FOUND ALIVE!

Yeah Ipso

but looks like we’re trading with the SM, so no idea if we’ll hold any gains. USD is down a little.

At least the HUI seems to want to hold this 180 area.

Sometimes it’s easy to see who is the enemy

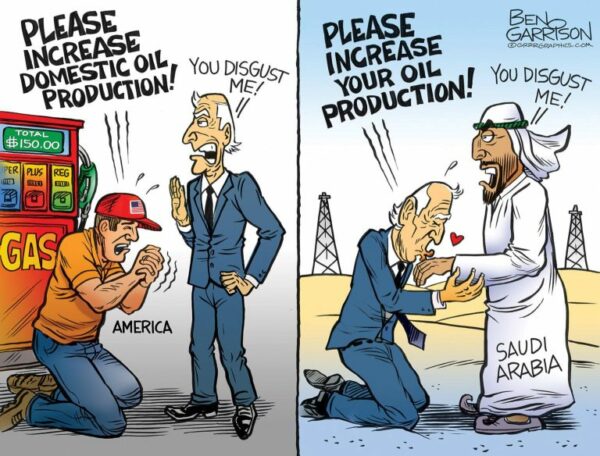

IMF Chief says Central Bank Digital Currency should be used alongside Social Credit System to control what people can and cannot buy