I can’t verify anything but China said it’s only sending over humanitarian supplies like diapers. That it didn’t want war. What they said anyways.

It wasn’t China that guaranteed their sovereignty when they gave up their weapons it was Europe and the US.

Ipso 18:48

How stupid is the US State Department and the US leadership? Plenty!

US Unexpectedly Sanctions China Officials Hours After Demanding Beijing Condemn Russia

Apparently not content with diplomatic war on one front with Russia, the Biden administration appears ready to escalate with China following on the heels of last week’s persistent accusations that Beijing was mulling cooperation with Moscow on weapons resupplies for its Ukraine operation, as well as assistance on Western sanctions evasion.

Monday afternoon Secretary of State Antony Blinken announced more visa restrictions on Chinese officials related to prior charges that state authorities are overseeing the ethnic cleansing of Uighurs. It’s certainly interesting timing in terms of pulling out the the human rights card, given that throughout last week the admin’s China criticisms seemed exclusively focused on its “fence-sitting” over Ukraine.

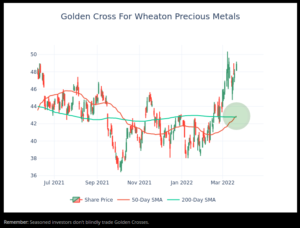

I just hope if the market crashes and looks like it wants too it doesn’t pull everything down with them this time. All equities have death crosses, are in a bear market with the bulls still fighting to bring it up and impending recession signals.

Did anyone see the huge selling volume on the Dow!

I dunno

Ukraine’s Gold Reserves Secretely Flown Out and Confiscated by the New York Federal Reserve?

Ukraine’s Gold Reserves Secretely Flown Out and Confiscated by the New York Federal Reserve?

Buygold @ 16:23

Re: Dolly Varden I saw that. A very good day and one I own a decent amount of shares of. I was underwater for a long time but not anymore. Maybe some other company is sniffing around?

Ipso – Dolly Varden had a big day today

Up 19%

Weird that it was on light volume. Almost all the shares had below average or light volume.

Maddog

What seems different to me is that this rate cycle is not crushing gold. Maybe I don’t remember correctly, but the last time the Fed talked about ending QE, gold got crushed – even before the rate hikes.

Bill Gross of PIMCO fame said the economy is toast with 2.5-3% rates. We’re almost there.

Buygold

Re Rates

If the world was anywhere near normal, rates would be screaming higher…..as lets face it, who would lend to any of these governments, at anything like current rates….Canada has already shown, they will cancel u as an individual, it is not much of a step, for them to renege on governments debts, as nothing seems sacred to these bums.

Then just look at the bums in charge etc….and the lies that trip off their tongues so freely…U can just imagine saying I want my money back and getting the answer….What money ???

Wow, rates are blowing up. USD up. PM’s should be down hard and yet…

Is there something breaking under the bond market surface?

Yield Curve Inverts, Stocks Sink After ‘Hawkish’ Powell Comments

“if we conclude that it is appropriate to move more aggressively…we will do so.””

Shoot looking at the Canadian First majestic it’s got to get over 18. Almost there but not quite. Hopefully they’ll be buying tomorrow.

Ipso – yeah

a little bit of a bid coming into the metals now. I love that the shares have been leading!

I would have thought we might get some new blood into Oasis. Probably means the general public isn’t participating just yet.

So for now it’s just the few of us hearty souls reaping the rewards. 🙂

Some people are having trouble signing up and are getting

an error message saying “bad cache” with a particular IP address.

Anyone here had-have this problem? Thoughts? The IP address does not belong to Dreamhost.

Dreamhost is looking into it but has no answers so far.

out for a bit

goldielocks

I’d settle for one of those … although their price is probably climbing like everything else.

Ipso

I know how bout a Lamborghini? I’m not making any bets though.

Ipso

I saw that this morning. They didn’t seem to be very fast as getting people up there if there was any survivors.

Boeing stocks started to sell off fast.

Wow! No glide path there …

China Eastern Airlines Mu5735 crash pic.twitter.com/ZZ3P7PnscO

— JET News (@JETVVV) March 21, 2022

Ipso

I’m learning.

goldielocks

Think bigger! ![]()

US Treasury sanctions one of Africa’s biggest gold refiners

The U.S. Treasury sanctioned Belgian gold trader Alain Goetz and his African Gold Refinery Ltd., one of the continent’s biggest processors of the metal, for allegedly contributing to conflict in the Democratic Republic of Congo.

Goetz and Uganda-based AGR are key players in Congo’s illicit gold trade, which is worth hundreds of millions of dollars each year and is the largest source of revenue for armed groups in the country, the Treasury said Thursday in an emailed statement. Goetz, AGR and eight other linked companies will have their U.S.-based assets blocked under the sanctions, it said.

SIGN UP FOR THE PRECIOUS METALS DIGEST

“Alain Goetz and his network have contributed to armed conflict by receiving DRC gold without questioning its origin,” Under Secretary of the Treasury for Terrorism and Financial Intelligence Brian Nelson said in the statement. “Treasury has been very clear: global gold markets, at every step of the supply chain, must engage in responsible sourcing and conduct supply-chain due diligence.”

Ipso

Lol I’m not thinking big enough. All I was thinking is hedging inflation.

Buygold @ 9:47

Gold getting a nice boost now!

I’ve thrown out my catfood recipes and now I’m checking out the Maserati ads. ![]()

Wow

That’s a relief, Ag just pushed past resistance and I got more back in time before if they do anyways start buying tomorrow.

I picked up a little bit on a oil stock too at the same time it’s in the positive. I was hoping they’d go down for a little bit before summer and not sure if this is a impulsive day trade move for oil.

Now they’re talking about a titanium shortage. I didn’t look into it close but China had plenty anyways.