Posted by silverngold

@ 23:42 on May 15, 2021

Posted by Ororeef

@ 19:52 on May 15, 2021

is a death sentence for bit coin ..Its going to lose public support and the banks ARE GOING TO EXPLOIT IT. POLITICIANS love the publicity as it gives them a reason to regulate it into oblivion . GOOD for GOLD,it removes the last obstacle for a GOLD RUN !

Posted by Ororeef

@ 19:44 on May 15, 2021

87 % just wasent enough ,it was close..Statistical evidence suggest it takes 90 % sentiment level to to flip it all…better luck next time….!

Posted by Ororeef

@ 19:40 on May 15, 2021

Biden created a opportunity in the Mid East ,dont let a crisis go to waste.. make the most out of it .Biden killed more Palestinians in 100 DAYS then trump did in 4 years ..His policy is create a crisis of any sort,,then blame the other party ,that keeps the supporters from defecting ….aha now we know the game plan..Make the most out of it,blow it up as much as possible ,then blame TRUMP, that’ll work !

Posted by Richard640

@ 13:15 on May 15, 2021

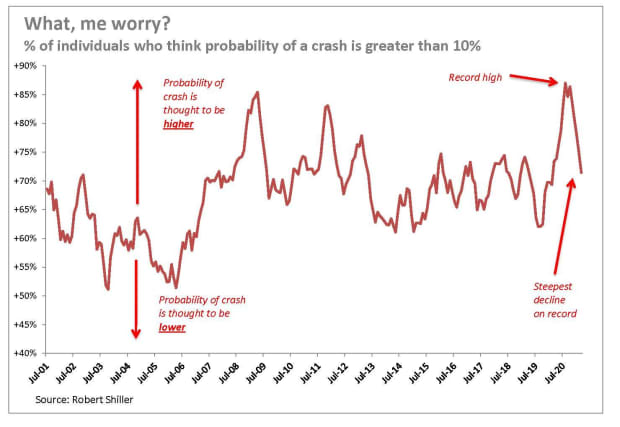

Fewer investors fear a catastrophic loss today than they did last summer. Complacency has typically led to lower investment gains.

It’s a bad sign that investors over the past six months have become much less worried about a U.S. stock market crash.

Last summer, 87% of individual investors thought there was a greater-than-10% probability that the stock market would suffer a catastrophic loss within six months — an all-time high.

https://www.marketwatch.com/story/investors-are-less-worried-about-a-stock-market-crash-and-thats-not-good-11620386405

Posted by Kentucky

@ 12:57 on May 15, 2021

I just do not get a 25% spread. Would really like someone to explain.

Posted by ipso facto

@ 12:08 on May 15, 2021

I wish HE WAS my man. I’d give him a cesspool cleaning job!

Posted by silverngold

@ 11:55 on May 15, 2021

Amazing Polly is…………… AMAZING!!

Posted by goldielocks

@ 11:37 on May 15, 2021

He should be in Gitmo. Not only did they fund China but they were giving grants to at least one I did DD on that did A trial on hydroxy chloroquine and said it didn’t work. I wonder if they were overdosing them like the other one while they were at it.

Posted by Alex Valdor

@ 11:18 on May 15, 2021

– he’s a little man , a sociopath , with a Napoleon complex .

I think his Waterloo is looming on the horizon .

Posted by Buygold

@ 10:25 on May 15, 2021

Posted by Buygold

@ 9:40 on May 15, 2021

$15,200 for a monster box

https://www.golddealer.com/product-category/products-2/bullion/silver-bullion-coins-bars/

Still about $3 over spot. There does seem to be a bit of a shortage until the scum throws billions of paper at it.

Posted by Pict

@ 9:16 on May 15, 2021

The time is getting close for Basel 3 to kick into effect. Ticking time bomb should help us greatly.

Posted by ipso facto

@ 9:12 on May 15, 2021

Posted by ipso facto

@ 8:45 on May 15, 2021

Posted by Ororeef

@ 8:36 on May 15, 2021

“STOCKS HAVE REACHED A PERMANENT PLATEAU” IN 1929 ARE NOW TELLING US GET YOUR VAX,BUY us BONDS ,and from the FED …”The economy is in a good place”! (and I got a bridge in Brooklyn i’ll sell you very cheap). trust me..

Posted by Kentucky

@ 8:30 on May 15, 2021

If you want to buy a monster box random year it is 20,770 and they will pay you 14,900. No wonder they are sending out emails.

Posted by Buygold

@ 8:24 on May 15, 2021

has been leading lately and is now only a buck or so away from the 52 week high. Will NEM and the pm shares lead gold and silver on the way higher?

It hasn’t been that way in a very long time.

Posted by Buygold

@ 8:12 on May 15, 2021

It seems to me rates need to drop quite a bit further for the bond market to be “sniffing out” anything. 10 yr. is still up near recent highs and I’d think for some sort of train wreck they’d need to go back toward 1% or below like the rest of the western world.

Would nice if that happened because it should be bullish for gold and bearish for the USD.

Posted by Richard640

@ 6:18 on May 15, 2021

Friday afternoon from Bloomberg: “Dip-Buyers Report to Duty to Save Stocks From Worst Week of 2021.” While the late-week rally had traders feeling pretty good about things, the bottom line is Monday through Wednesday market action was ugly. It looked about as one would expect from faltering Bubbles – from tech stocks to crypto to ARK.

Unsettled by mounting inflationary pressures, the Treasury market finds peace in global Bubble fragilities. And I actually believe the Fed is on the same page. Officials will resolutely dismiss inflation risk – because they’re scared to death of collapsing Bubbles. At this point, they must believe it’s best to just let the Bubbles and manias run their course.

The Fed and market pundits stick blindly to the assertion “inflation expectations will remain well anchored” – assuring the bond market, dovish Fed policies and the great bull market are all equally well anchored. Yet this is not an environment where anything is securely anchored.

We live in a period of acute disorder – monetary and otherwise. Society has been rocked off its foundation. The insecurity that comes with a once-in-a-century pandemic – our health, our economy, our institutions and our social cohesion. Hurricanes, floods, drought, devastating fires – the frightening uncertainties associated with global climate change. Power outages. Water shortages. Shootings. A ransomware hack that takes down a major U.S. pipeline and leaves millions fearing they won’t be able to fill their tanks. Who and what next? The Fed “printing” Trillions – seemingly blind to inflation and Bubble risks. Multi-Trillion dollar deficits. Wealth redistribution. Traditions and political institutions in disarray.

It was an unnerving week. Things seem particularly Un-Anchored.

Posted by Richard640

@ 5:47 on May 15, 2021

[yields on the 10 yr and 30 yr dropped yesterday]

Weekly Commentary: Un-Anchored

A BIG WEEK ON THE INFLATION FRONT

Posted by Maya

@ 2:58 on May 15, 2021

Posted by Maya

@ 2:56 on May 15, 2021

It is always good to get to know your local ‘coin dealer’ for cash transactions. Make a few small ones first so he gets to know your face. Even out here in the jungle… I know a guy. Pays me comex closing spot, cash, no ID. But I’m not selling right now, either. 🙂