Published: March 25, 2021 at 10:20 a.m. ET

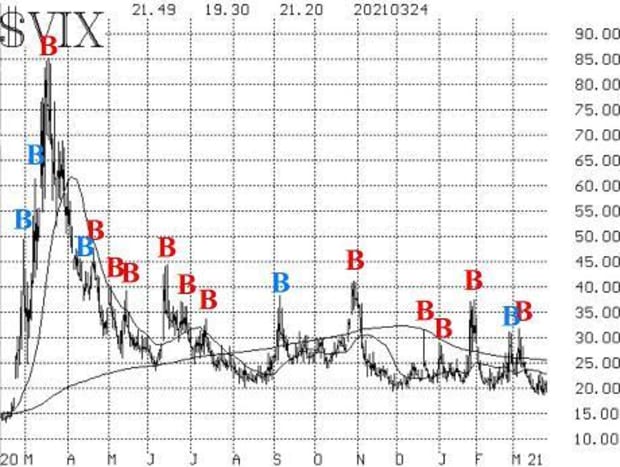

Countering the negativity of put-call ratios, breadth, and new highs vs. new lows, is the fact that the volatility indicators still remain generally bullish. VIX has not risen substantially (yet), so the “spike peak” buy signal of March 4 remains in place.

Moreover, the trend of VIX VIX, -1.26% continues to be lower, as both VIX and its 20-day moving average are below the declining 200-day moving average. In fact, on March 22, VIX closed at its lowest price (18.88) since February 2020.

If VIX should continue to fall below there, it would be a bullish sign for stocks.

As we’ve noted previously, the fact that VIX has remained so high all during the huge rally over the past year has been a worrisome sign for many traders. But the traders that were keeping VIX higher were actually correct, because realized volatility of SPX (i.e., its 20-day historical volatility) has been just below 20 since early March. Thus, realized volatility rose to meet implied volatility, rather than the other way around (which is more often the case).

Now, if one wants to make the case that it is worrisome to see both forms of volatility this high, then so be it. But there is no longer any significant difference between the S&P’s realized and implied volatility.

The construct of volatility derivatives has remained bullish throughout. VIX futures are all trading at premiums to VIX, and the term structure slopes upward through the coming summer. Similarly, the term structure of the CBOE Volatility Indices slopes upward through the next six months as well.

The first sign of a negative reversal here would be if the April VIX futures traded above the price of May VIX futures.

Near-term deterioration in some internal indicators is certainly a cause for worry, and small countertrend bearish positions can be taken because of that. However, the S&P’s trend is still higher, and the trend of VIX is still lower – both bullish factors. So we still maintaining a “core” bullish position until those two trends are broken.

New recommendation: SPY sell signals

We want to take a small bearish position because of the negative indicators discussed above. We will increase the size of this bearish position if the trend of SPX and VIX begin to reverse.

- Buy 1 SPY Apr (16th) at-the-money put and sell 1 SPY Apr (16th) put with a striking price 30 points lower.

- IF SPX closes below 3870, THEN add one more put bear spread using the same instructions as above (note that this may result in different strikes for the two spreads)

- IF VIX goes back in “spiking” mode – that is, if it rises at least 3.00 points over any one, two or three-day period (using closing prices), THEN buy a third SPY bear put spread with the same instructions.

Stop yourself out of 1) if new highs outnumber new lows for two consecutive days. Stop yourself out of 2) [if it was established] on an SPX close above 3,985. Finally, stop yourself out of 3) [if it was established] on a VIX close below 18.88.