Gold 8000 silver to 200. 2 days ago.

Maddog. I prefer your vision rather than mine…but….If you can’t hold it in your hand, you don’t own it!

Whatever you buy through your online broker belongs to your broker, unless you hold stock certificates which are almost never issued anymore since everyone has become a day/swing trader. Skipping many unforeseen events, I see many defaults coming when TSHTF! and the bottom line….if it’s not in your hand, you lose! IMO!

Michael Oliver

He’s a goat. Knows the metals in detail like the back of his hand.

Ipso

They’re finding more and more uses for silver so they’re growing demand. There’s also growing demand for tangible gold. Not just from inflation in the currency but the want to change to cashless non tangible digital. Either one, currency or digital it can lose value. With currency it’s inflation increasing the money supply or economic instability, With digital it’s dependent on buyers and sellers, can be stolen out of thin air in someone’s basement, it’s value can be manipulated by being controlled by governments.

silverngold

Re shares/ vs Metal

I beg to differ…..that idea may work if the metal prices are fairly static and way lower than this…up here the miners are going to be earning like bandits , thus the dividends will be massive, as will be the yield….as soon as those yields go north of Treasury rates , the demand for the shares will be enormous, plus shorts have to pay that dividend and face a rising price from dividend hunters and the longs ….who are mainly hard core bugs still, who will not sell at such cheap prices…..thus keeping the mkt thin.

Meanwhile we may well have continued rising metal prices, driving profits even higher……as of now the shares are dirt cheap vs the metal…and we are in a super bull, no way do shares stay lagging this badly in a super bull.

In a stock market that is very, highly valued the one sector that is dirt cheap is PM shares, but potentially paying a better yield than anything else with a super bull mkt in the metals.

BREAKING EXCLUSIVE: Alex Jones Responds To Supreme Court Ruling That Judges – Not Juries – Can Find Americans Civilly Liable For Billions, So The Power Structure Can Then Silence & Openly Destroy Them!

IMO good exposing 18 minute video of Alex Jones telling how the justice system is screwed.

Buygold and Deer79

Our shares may not turn around immediately but earnings season is coming soon and they should be stellar! The good producing cos will have lots of cash for dividends or for acquisitions. Juniors who have lots of ounces in the ground should get a re-rating. The skies are blue for us!

Cheers

Good morning, and if your cheerios taste salty it is because I am about to piss in them…FWIW!

This time you better get the real thing while you can. The shares will NEVER attain what they did in either 2008 or 2011, and this is why IMO. Recall that your Broker notified you that they were going to loan out your shares unless you specifically told them you would not allow it? Otherwise they consider your silence to be permission to do so. IMO this is the reason the shares are underperforming.

IMO, BlackRock and ALADDIN, their Super Computer….have made an agreement with your Broker to borrow your shares (for a fee paid to your Broker) so they can use your shares as proof that they “possess” the shares they are shorting and they are not NAKED short and do not have to report it as such. So you buy, say, 1000 shares of XYZ , then your Broker loans (for a fee) your shares to BlackRock/ ALADDIN who shorts your XYZ 1000 shares. The volume doubles, and XYZ goes almost nowhere! Meanwhile Physical gold and silver skyrocket while you miss the boat and sit there scratching your head. ???????

Better get physical silver and gold while you can. Once you see it you can’t un-see it. SNG

Ipso

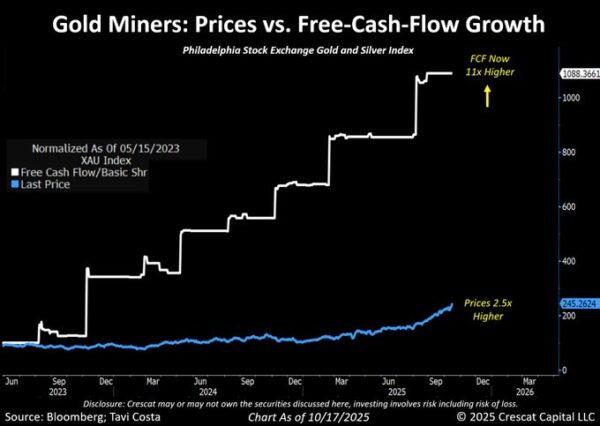

That chart should be flashing in bright lights!!!!

Perhaps we’ll start to get more rotation into the miners, in earnest, after the upcoming earnings cycle.

For the junior explorers ( which I have quite a few shares in), I feel that the overall success that these companies have achieved raising $ in PP’s, has been phenomenal…….I guess that, in itself, is a measure of success for these little guys…..

Morning Ipso

I think Tavi is right.

The only thing that gives me pause is that volume in GLD and GDX were monstrous. OTOH, volume has been heavier on the big down days pretty much all the way up. I guess that will continue as we move higher. RSI on GDX now manageable at 58. SLV is 69, GLD still up at 75.

Monday is going to tell us a lot. It’s hard for me to see us selling off into the year end. If we head south Monday am, I think it will be bought.

Dalio has an article on ZH, he is recommending 15% portfolio allocation in gold. I can’t even imagine what the gold price would look like if people followed that advice.

I’m hopeful that we’re going much, much higher.

Otavio (Tavi) Costa

Otavio (Tavi) Costa

@TaviCosta

·

16h

Mining stocks are likely overreacting today, in my view.

Put loosely, these companies are effectively printing money at current gold prices.

Yes, mining stocks have performed incredibly well recently, but the aggregate free cash flow of the Philadelphia Gold and Silver index has surged 11x.

In short, fundamentals have far outpaced the rally, leaving these stocks even more undervalued than before.

Gold Train

Land of the midnight sun. This line was built

To take miners up to the Yukon.

https://www.railpictures.net/photo/888699/

This is not 1980.

1980, US debt was $908bn. Gold hit $800 on inflation concerns, which were squashed with high interest rates.

2026, US debt $37,000bn. If it’s shooting up because of inflation, interest rates cannot be used as a tool. Mr Market may push them up anyway, but 18% would kill everything. But all that debt means the USD is worthless anyway.

If the POG has anything to do with US debt, equivalent is $32,600/oz.

If it’s anything to do with M2, 1980=$1.5tn, 2025=$22tn, the equivalent is 11,733/oz

This time, it is different.

This is crazy.

I’ve seen this headline more than once but picked him cuz he doesn’t lollygag along but talks fast. Tokenizing debt and devalue the token value to you. You should listen to this esp if you own treasuries money in banks! Side tracks haven’t listen to it all yet. To be financially ready and options. Involving gold and crypto.

Buygold

7% is quite a bashing! I saw enough! 🙂

Maddog @ 5:48

Got it. That makes sense.

Buygold

Excusez moi ?

Ipso – Ha!

Barely a scratch. 🙂

I think I’m the only one who’s posted the last few hours. All you guys are hiding.

I just called a local buyer

I told them that I heard buyers weren’t taking junk silver.T hey said its just on hold. They are taking it because they’re not in a hurry to sell it but won’t bring the prices people would expect. 60 percent. So with the refinery issues they are getting a discount by holding it for now.

For all the weeping and gnashing of teeth

Gold still closed above $4200 and silver near $52.

The shares always do the most damage, and they were trashed as usual.

Hoping for a spike down Sunday night/Monday am followed by a reversal.

Could have been a lot worse and has been before, but if you were holding palladium today, you’d not be happy. Down $142, – 9% or platinum even, down $100, -6%. I thought the exchanges would stop trading once they were down a certain percentage. Maybe that’s only if they go up a certain percentage.

I’m pretty sure the supply problems in silver or delivery demands in gold haven’t been fixed since yesterday. They are rallying quite nicely in the AH’s, silver has just about retaken $52, gold up $20.

HUI close above 640

Would probably be a solid development.

Deer79, Captain

Deer79 – I think that’s a great move here. The shares are over done in this one session. Some down over 10% on a 2% move in gold? Craziness. They will come roaring back.

Captain – I’d think if they wanted delivery yesterday, they’d want it even more today.

This is a gift.

Platinum and palladium are getting crushed.

Biden or Obama would have loved this

“Outraged” Trump Refuses To Adhere To Global Carbon Tax On Shipping

The United States will vote “no” to a global carbon tax proposed by the International Maritime Organization (IMO) on Oct. 17, President Donald Trump said on Truth Social.

“I am outraged that the International Maritime Organization is voting in London this week to pass a global Carbon Tax,” he said in the post on Oct. 16, urging others to reject the proposal.

“The United States will NOT stand for this Global Green New Scam Tax on Shipping, and will not adhere to it in any way, shape, or form.

“We will not tolerate increased prices on American Consumers OR the creation of a Green New Scam Bureaucracy to spend YOUR money on their Green dreams.”

The net-zero framework proposal that was put before the U.N. agency specializing in regulating marine transport would require ships to comply with a global fuel standard for large oceangoing vessels, 5,000 tons or larger, to force the shipping industry’s greenhouse gas emissions down to net zero by 2050.

https://www.zerohedge.com/geopolitical/outraged-trump-refuses-adhere-global-carbon-tax-shipping