Let me sum it up. You got how the corporates started and to this day constant change because many of these foreign doctors are coming for the experience then want to move on and called them groups. The insurance companies went a long with this then assigned people to these groups who then cant go out out of that group to see a doctor leaving their doctors out of the insurance companies, and people can no longer choose, including specialists. They will take anybody from anywhere who will fill the slot

Ipso

COVID why are they still giving it. It started in my guestimation with corporates to profit over health care making it the most expensive healthcare in the world. Apparently by people who aren’t competent doctors or doctors at all just looking at the dollar signs. There working with insurance companies to push everyone into HMOs to force people out from American independent doctors.

I wrote this to a friend earlier more casually then even here.

A must watch …

… from two champions of freedom … Catherine Austin Fitts and Jimmy Dore …

Very good information … they don’t talk about it directly … but this is why you go local and stop supporting the commies in DC, NY, & the Bank for International Settlements (BIS) et al.

They are your enemies and will kill you if you are not careful (and do whatever they say).

They will send drones (to kill you like in Gaza) to wherever you are in the future if they get the power they are engineering with digital IDs and CBDCs.

Go local folks … use cash as much as possible … get out there and support those trying to save your freedom (and lives – this is not drama).

Time is getting short now.

Act

Hey Buygold

History made me for one kinda weary of the rally monkey. When the rally monkey went up, gold tanked.

Mr. Copper, Ipso

Mr. Copper – thanks. Agree with you about the computers. Interesting you overlay with GLD, I’ve found that the indexes correlate more closely with silver than gold over the years. Do you find that the shares lead the metals? I’ve always gone with that thesis, but I’m not so sure anymore. After the drubbing yesterday, I’m really hoping they aren’t leading the metals

The shares and metals got screwed by every metric today. The dollar was down significantly, the metals didn’t do that well and the shares were downright pathetic. The buyers just disappeared overnight? They should have bounced nicely today.

Ipso – I’m pretty sure that Trump is seeking regime change in Israel. He’s done with BiBi. Been screwed one to many times by him and had it with being spied on by his ally.

Here is something else to piss off the Israeli’s

Trump announces plan to lift punishing sanctions on Syria.

@Buygold re Mining Share Performance

Its hard to say how they are priced, maybe partially by computers, because sometimes they are suddenly flying upwards, and some kind of news, suddenly sends them down. I doubt very much people are listening to news and suddenly selling or buying.

But anyway I use a GLD overlay on all my charts, showing percentage gains, 6 mo, 2 months and one going back to 2016 and an intra day chart. to see which ones outperform the Gold price and which ones under perform.

Everything I look at has a $300 million mkt cap and above. The bigger caps like NEM AEM FNV etc tend to stay pretty much even with GLD. Above and below the GLD line. The smaller caps like $800 million to 10 billion like AGI HMY ORLA DRD ARMN etc tend to out perform GLD by a lot.

The best Silver miner is ASM way outperforming GLD by a mile, MAG CDE IPOAF just about keep up with GLD.

Oil is running up 3%

Rates are knocking on the door of 4.5% which is the line in the sand for the SM, supposedly.

Mr. Copper – hope you’re right about that

Any thoughts then on why the shares are so weak?

The way they are acting today and even yesterday, it looks like gold is going a lot lower. This is non-sensical action.

Here’s My Bold Prediction:

We will never see Gold below $3,200/oz , and we will never see Silver below $32/oz. To me they are now support levels.

… and how is this poison still encouraged? I guess the money is gigantic. So should be the repercussions!

illuminatibot reposted

healthbot

@thehealthb0t

Medical officer reveals Covid Vaccine related HEART ISSUES skyrocketing in active duty Naval officers.

Myocarditis rises 151%

Pulmonary heart disease up 62%

Ischemic heart disease up 69%

Heart Failure increased a whopping 973%

Buygold

“Rally Monkey” Not gonna do it Nope not me Nope! ![]()

Positive development? Some kind of game?

Trump’s Rift With Bibi Might Be Irreconcilable

A report circulated last week alleging that Trump cut off all direct contact with Bibi after feeling manipulated by him. For as sensational as it sounds, the larger context suggests that it might be true. For starters, there was bad blood between them since late 2020 after Trump reportedly felt betrayed by Bibi recognizing Biden’s electoral victory while Trump was still challenging it in the courts.

https://www.zerohedge.com/geopolitical/trumps-rift-bibi-might-be-irreconcilable

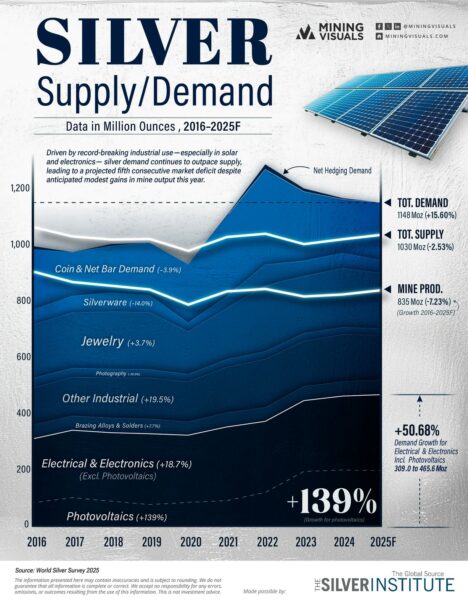

Ipso – nice chart there of silver uses

I guess it really is an industrial metal for the most part. Problem is that it somehow ignores the supply/demand imbalance and makes it even more important to keep the price on lockdown.

We are the 3.9% of users that actually want it to go higher, everyone else wants to get it cheaper.

Will one of you guys throw the rally monkey out there? I can feel it coming…. 🙂

First hour in the books. Time for these shares to sh*t or get of the pot.

Treefrog

Indeed. ??

CPI comes in soft

2.3% vs 2.4% estimates y/y

0.2% vs 0.3% estimates m/m

The dollar is slipping a little. SM up a little, QQQ’s outperforming. Oil still up over 1%. Bitcoin up about 1%. Rates about the same 4.44%

Then there’s pm’s, trying to hold the flatline after being higher all night. Smells like a correction, even though a lot of damage was done yesterday to the shares. How long is beyond my capacity to know. Not sure what has changed. Pressure should be on the Fed, but we’ll see.

buygold, 19:25

fauxcahontas, not pocahontas…

Buygold

“How much easier would it have been if we’d never allowed these countries to rape us in the first place?”

I’m with you brother. No one’s been minding the store for a very long time!

Silver47 and Summa Silver Announce Merger to Create a Premier U.S. High Grade Silver Explorer & Developer and C$5 Million Brokered Financing

https://ceo.ca/@newsfile/silver47-and-summa-silver-announce-merger-to-create-f05db

RUA GOLD Completes the Second Phase of Surface Exploration and Drill Targeting at the Glamorgan Project, New Zealand

https://ceo.ca/@newsfile/rua-gold-completes-the-second-phase-of-surface-exploration

Golden Cross Resources to Utilize VRIFY’s AI-Assisted Mineral Discovery Platform at Its Reedy Creek High-Grade Gold Project in Victoria, Australia

https://ceo.ca/@newsfile/golden-cross-resources-to-utilize-vrifys-ai-assisted

Kuya Silver Announces Joint Venture Agreement on Umm Hadid Silver-Gold Project, Saudi Arabia

https://ceo.ca/@newsfile/kuya-silver-announces-joint-venture-agreement-on-umm

Northern Superior Reports New Discovery With 18.0 Metres of 2.48 g/t Au Including 4.9 Metres of 7.02 g/t Au and Strong Step-Out Results With 50.3 Metres at 0.70 g/t Au Including 13.3 Metres of 1.47 g/t Au at Philibert(1)

https://ceo.ca/@accesswire/northern-superior-reports-new-discovery-with-180-metres

Aztec Minerals Closes Oversubscribed $3.6 million Private Placement

https://ceo.ca/@thenewswire/aztec-minerals-closes-oversubscribed-36-million-private

Aya Gold & Silver Reports Record Q1-2025 Results, Strengthens Liquidity and Reaffirms Guidance

https://ceo.ca/@GlobeNewswire/aya-gold-silver-reports-record-q1-2025-results-strengthens

G2 Drills 76m @ 1.5 g/t Au and 3m @ 12.5 g/t Au in Scout Drilling at Peters Mine, Guyana

https://ceo.ca/@GlobeNewswire/g2-drills-76m-15-gt-au-and-3m-125-gt-auin

Cabral Gold Drills 2m @ 52.3 g/t Gold at the Machichie Main Gold Deposit, Cuiú Cuiú Gold District, Brazil

https://ceo.ca/@newsfile/cabral-gold-drills-2m-523-gt-gold-at-the-machichie

Mawson Finland Limited Announces Significant Progress in Permitting Process for the Rajapalot Gold-Cobalt Project, Finland

https://ceo.ca/@accesswire/mawson-finland-limited-announces-significant-progress

Exploits Enters into Option Agreement for District-Scale Gold Project in Ontario

https://ceo.ca/@newsfile/exploits-enters-into-option-agreement-for-district-scale

Dr. Steve Garwin Provides Independent Review of American Eagle’s NAK Project

https://ceo.ca/@newsfile/dr-steve-garwin-provides-independent-review-of-american

Liberty Gold Commences 40,000 Meter Feasibility Drill Program and Bulk Metallurgical Sampling at the Black Pine Oxide Gold Project, Idaho

https://ceo.ca/@GlobeNewswire/liberty-gold-commences-40000-meter-feasibility-drill

Fortuna Completes Divestiture of Yaramoko Mine and Provides Updated 2025 Production and Cost Guidance

https://ceo.ca/@GlobeNewswire/fortuna-completes-divestiture-of-yaramoko-mine-and

GOLDEN AGE EXPLORATION LTD. Explora on Update

https://ceo.ca/content/sedar/GDN-2025-05-13-news-release-english-b8cd.pdf

West Red Lake Gold Intersects 48.97 g/t Au over 18.7m, 52.86 g/t Au over 4.5m and 25.49 g/t Au over 7.5m at South Austin – Madsen Mine

https://ceo.ca/@GlobeNewswire/west-red-lake-gold-intersects-4897-gt-au-over-187m

Golden Cariboo Intersects Additional Strong Veining with Visible Gold in Halo Zone Extension

https://ceo.ca/@thenewswire/golden-cariboo-intersects-additional-strong-veining

Hi-View Resources Acquires Additional Claims Contagious to Lawyers East Block in the Toodoggone District

https://ceo.ca/@GlobeNewswire/hi-view-resources-acquires-additional-claims-contagious

Starcore Announces Fourth Quarter Production Results

https://ceo.ca/@newsfile/starcore-announces-fourth-quarter-production-results-448db

2024 Exploration Update for Strategic Minerals JV

https://ceo.ca/@GlobeNewswire/2024-exploration-update-for-strategic-minerals-jv

Gold Mountain Provides Update On Elk Mine Project

https://ceo.ca/content/sedar/GMTN-2025-05-12-news-release-english-ed73.pdf

Ascot Reports First Quarter 2025 Results

https://ceo.ca/@GlobeNewswire/ascot-reports-first-quarter-2025-results

Dynasty Gold Announces Non-Brokered Private Placement Up to $1 Million

https://ceo.ca/@newsfile/dynasty-gold-announces-non-brokered-private-placement-4df87

Prime Mining Reports Q1 2025 Financial and Operating Results

https://ceo.ca/@GlobeNewswire/prime-mining-reports-q1-2025-financial-and-operating

Carlton Precious Announces Non-Brokered $1 Million Private Placement

https://ceo.ca/@GlobeNewswire/carlton-precious-announces-non-brokered-1-million

Gold Resource Corporation Reports Financial Results for the First Quarter of 2025

https://ceo.ca/@businesswire/gold-resource-corporation-reports-financial-results-23a4e

G Mining Ventures Announces Restatement of its 2024 Financial Statements Following Non-Cash Foreign Exchange Accounting Adjustments

https://ceo.ca/@newswire/g-mining-ventures-announces-restatement-of-its-2024

Kalo Gold Closes First Tranche $4.07 Million in Oversubscribed Private Placement to Fund Drilling at Vatu Aurum Project, Fiji

https://ceo.ca/@accesswire/kalo-gold-closes-first-tranche-407-million-in-oversubscribed

GALIANO GOLD RELEASES 2024 SUSTAINABILITY REPORT

https://ceo.ca/@newswire/galiano-gold-releases-2024-sustainability-report

EMX Royalty Announces Q1 2025 Results; Significant Increases in Royalty Revenue, Adjusted Royalty Revenue and Adjusted EBITDA

https://ceo.ca/@newsfile/emx-royalty-announces-q1-2025-results-significant

Gold Terra Closes Final Tranche of Financing Package Raising a Total of C$2.4 Million with Additional C$2 Million funding from Osisko Gold Royalties

https://ceo.ca/@accesswire/gold-terra-closes-final-tranche-of-financing-package

Melkior Announces $1.5M Non-Brokered Private Placement

https://ceo.ca/@thenewswire/melkior-announces-15m-non-brokered-private-placement

BULLION GOLD ACQUIRES THE CADILLAC EXTENSION (LANGLADE) PROJECT

https://ceo.ca/content/sedar/BGD-2025-05-12-news-release-english-b7e9.pdf

BULGOLD Extends the Occurrence of Epithermal Quartz Veins to 1.2KM of Strike Length Within the Sinter Field on the Lutila Gold Project

https://ceo.ca/@GlobeNewswire/bulgold-extends-the-occurrence-of-epithermal-quartz

McLaren Resources Purchases NSR on Its McCool Gold Property

https://ceo.ca/@newsfile/mclaren-resources-purchases-nsr-on-its-mccool-gold

Opus One Gold Obtains 4.12 g/t Gold Over 7.3 m at 135 m; Including 6.1 g/t Gold Over 4 m From the First Hole of the Drilling Season on its Zone 1 Gold Discovery, on Noyell Project

https://ceo.ca/@GlobeNewswire/opus-one-gold-obtains-412-gt-gold-over-73-m-at-135

Dolly Varden Silver To Mobilise Four Rigs for 35,000 Meter Summer Drill Program

https://ceo.ca/@thenewswire/dolly-varden-silver-to-mobilise-four-rigs-for-35000

Lion One Drills 54.16 g/t Gold over 1.9 m, Including 156.55 g/t Gold over 0.6 m at Tuvatu Gold Mine in Fiji

https://ceo.ca/@newsfile/lion-one-drills-5416-gt-gold-over-19-m-including

Canadian Gold Corp. Tartan South Zone Continues to Hit: 140m Vertical Expansion Intersects 9.4 gpt Gold/ 3.3m

https://ceo.ca/@newsfile/canadian-gold-corp-tartan-south-zone-continues-to

Riverside Resources Sets Date to Receive Spinout Shares of Blue Jay Gold Corp

https://ceo.ca/@newsfile/riverside-resources-sets-date-to-receive-spinout-shares

Silvercorp Announces Updated Mineral Resource Estimate for its Condor Project, located in the Zamora Chinchipe Province of Ecuador

https://ceo.ca/@newswire/silvercorp-announces-updated-mineral-resource-estimate

Kenorland Completes Top-Up Right from Sumitomo and Centerra

https://ceo.ca/@newsfile/kenorland-completes-top-up-right-from-sumitomo-and-e8a40

Teuton Outlines Plans for 2025 Regarding the Ram, Clone, Harry, Fiji, Tonga and Konkin Silver Properties; Plans for Argentina; Update Re Spin-Out of Luxor Metals Ltd.

https://ceo.ca/@thenewswire/teuton-outlines-plans-for-2025-regarding-the-ram-clone

Silver slowly slipping away

Now back below $33 and giving up nearly half the overnight gains.

Would explain the lackluster share action pre market. Besides the fact that the shares suck. ?

The morning after

Silver bouncing back nicely, up near 2%, and above $33. Gold a little tentative, up .5%

The shares that are trading aren’t really moving much though, which begs the question, why did they get hit so hard yesterday?

SM futures down a little, oil flat, Bitcoin flat, rates down 2 bips.

Not sure I trust pm’s, especially gold, to hold these small overnight gains, simply because of the way the shares got tagged yesterday on heavy volume.

Might be up to silver to do the heavy lifting, and that’s not a good thing to rely on.

Eco data today includes the CPI. Probably will move things around. I’m not sure what pm’s want from that, soft or hot inflation.

Maya

Physical terrorists eh lol We were all friends but occasionally they were terrorists when they had someone do something that actually broke the seal of a wound vac and that isn’t easy to do and when they race to treat a patient before I got there to treat a wound while other times had to wait because something they have them do would compromise the bandage depending on where it was both on our own time thing but I had other things to time like their showers.

That is awesome. You have some good doctors around you Your in a good place. You know, where you live can have a big impact on the kind of doctors your gonna have around you. People thinking they wanna go off the grid somewhere in the boon docks might not think about that.

Goldi

Walking is wonderful! No more stabbing pains. Muscles still a little weak so I’m being careful with small steps. Wednesday I have appointment with the Physical Terrorists. They will evaluate my progress. But I walked the Costco warehouse for shopping without even hanging on to a cart. Actually feels good to get some circulation going in the legs. I’m at 90% easily.

Gluing a flat slipper sole onto my good sandals works wonders to balance out the leg lengths. It works. No lower back pain from the imbalance, and I can walk in comfort.