the scum are desperately trying to prevent Silver from busting loose, by jettisoning lots of paper Gold contracts here…..

Buygold

Exactly right! I mentioned this last week, but NEM earnings are out tomorrow….

Stock is holding up so far today…

Algo’s hit the sell button on the shares

too bad we don’t get the benefit of a rising SM like we do when it’s falling.

Pretty big reversal in gold from the overnight markets. Probably time for a pause.

How big is yet to be determined. Too bad it comes at a time when earnings start to come out for the big players.

adogsbody @ 18:33

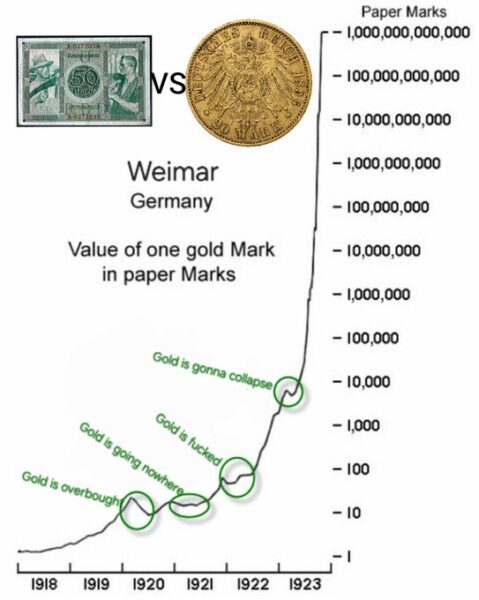

Yes this move in gold is catching a lot of people flat footed because an event like what is unfolding right now has not been seen for 70 years.

This is a monetary event. That’s why silver is being excluded.

Silver will move higher once attention on the monetary event moves onto what they expect to be a period of stability and growth.

I expect this view to be naive and what will happen in the future is a period of commodity strength that sucks up most of new currency in the future (and bond sales) due to increased global demand and supply mismanagement.

We are at the same point in the larger cycle as the turn in 1929 to 1930 right now.

Stocks should be weaker than most expect near-term – then a grinding correction higher for six months or so (where commodities outperform) – followed by a 50 to 80% crash in stocks as rising prices and falling bonds ravage the ignorant.

Bond and bank failures are going to dominate the news next year – along with some possible geopolitical realignments that result.

I wrote about this in the previous decade as a result of being convinced of such an outcome that started by reading Schumacher – Small is Beautiful – Small is Beautiful Revisited 50 Years On – Schumacher Center for a New Economics – amonsgt other cycle/market related studies.

In Elloitt (EWT) terms – this is the culmination of the Grand Supercycle Degree event.

Cheers

Midland Announces the Acquisition of the Kan Gold Project in the Labrador Trough

https://ceo.ca/@GlobeNewswire/midland-announces-the-acquisition-of-the-kan-gold-project

Triple Flag Proposes to Acquire Orogen Royalties Inc.

https://ceo.ca/@businesswire/triple-flag-proposes-to-acquire-orogen-royalties-inc

NOVAGOLD and Paulson Advisers Announce $1 Billion Transaction to Acquire 50% of the Donlin Gold Project From Barrick

https://ceo.ca/@GlobeNewswire/novagold-and-paulson-advisers-announce-1-billion-transaction

Goldshore Intersects 124.35m of 1.65 g/t Au, Including 47.0m of 3.08 g/t Au, at the Moss Deposit

https://ceo.ca/@newsfile/goldshore-intersects-12435m-of-165-gt-au-including

American Pacific Commences Drill Program at the Madison Copper-Gold Project in Montana

https://ceo.ca/@newsfile/american-pacific-commences-drill-program-at-the-madison

Borealis Annouces Timing to Gold Production and Appoints Robert Buchan as Non-Executive Chairman

https://ceo.ca/@newsfile/borealis-annouces-timing-to-gold-production-and-appoints

Vizsla Royalties Announces U.S. Listing on the OTCQB

https://ceo.ca/@newsfile/vizsla-royalties-announces-us-listing-on-the-otcqb

McFarlane Lake Intersects 6.2 Grams per Tonne (g/t) Gold Over 6.45 Metres (M) Within 14.9 m of 3.0 g/t Gold and Discovers New Mineralized Zones at Depth Containing Visible Gold – Assays Pending

https://ceo.ca/@accesswire/mcfarlane-lake-intersects-62-grams-per-tonne-gt

Aztec Minerals Announces Private Placement

https://ceo.ca/@thenewswire/aztec-minerals-announces-private-placement

Barrick Announces Sale of Stake in Donlin Gold Project for Up To $1.1 Billion

https://ceo.ca/@GlobeNewswire/barrick-announces-sale-of-stake-in-donlin-gold-project

StoneX Precious Metals Vault in New York is granted CME Registered Depository status for Gold, Silver, Platinum, and Palladium

https://ceo.ca/@GlobeNewswire/stonex-precious-metals-vault-in-new-york-is-granted

Emerita Intersects 10.8 Meters Grading 4.8% Copper, 1.4 g/t Gold and 8.9 Meters Grading 1.1% Copper, 1.2 g/t Gold at El Cura Deposit

https://ceo.ca/@GlobeNewswire/emerita-intersects-108-meters-grading-48-copper

Triple Flag to Acquire Orogen Royalties and Its 1.0% NSR Royalty on the Expanded Silicon Gold Project

https://ceo.ca/@businesswire/triple-flag-to-acquire-orogen-royalties-and-its-10

Newcore Gold Drilling Intersects 2.50 g/t Gold over 15.0 Metres and 3.00 g/t Gold over 10.0 metres at the Enchi Gold Project, Ghana

https://ceo.ca/@GlobeNewswire/newcore-gold-drilling-intersects-250-gt-gold-over

Astra Exploration Receives $1,025,000 from Early Exercise of Warrants, and Commences Drilling at La Manchuria, Argentina

https://ceo.ca/@newsfile/astra-exploration-receives-1025000-from-early-exercise

Radisson Announces Fully Subscribed C$7 Million Private Placement

https://ceo.ca/@newsfile/radisson-announces-fully-subscribed-c7-million-private

INTEGRA ANNOUNCES STRONG FIRST QUARTER 2025 GOLD PRODUCTION RESULTS FROM FLORIDA CANYON MINE AND INCREASED CASH BALANCE TO US$61 MILLION

https://ceo.ca/@newswire/integra-announces-strong-first-quarter-2025-gold-production

Sitka Gold Intersects 108.9 Metres of 3.27 g/t Gold Including 45.0 Metres of 4.52 g/t Gold Within 352.8 Metres of 1.55 g/t Gold at Its RC Gold Project, Yukon

https://ceo.ca/@newsfile/sitka-gold-intersects-1089-metres-of-327-gt-gold

Skeena Announces Positive Judgment by the Supreme Court of Canada Regarding the Albino Lake Storage Facility

https://ceo.ca/@accesswire/skeena-announces-positive-judgment-by-the-supreme-court

Tudor Gold Increases Overall Gold Recoveries to Over 80%, Produces a High-Grade Copper, Gold and Silver Concentrate for the Goldstorm Deposit at Treaty Creek, Northwestern B.C.

https://ceo.ca/@newsfile/tudor-gold-increases-overall-gold-recoveries-to-over

Golden Cariboo Terminates Drill Hole within Visible Gold Mineralized Zone

https://ceo.ca/@thenewswire/golden-cariboo-terminates-drill-hole-within-visible

Formation Metals Commences Permitting for Fully Funded 5,000 Metre Drill Program at the N2 Gold Property to Build on 877,000 oz Historical Gold Resource

https://ceo.ca/@accesswire/formation-metals-commences-permitting-for-fully-funded

Mako Mining Provides Corporate Update

https://ceo.ca/@accesswire/mako-mining-provides-corporate-update

Providence Update on Tuolumne Property Lease

https://ceo.ca/@thenewswire/providence-update-on-tuolumne-property-lease

Canary Gold Corp. Reports Visible Gold in Panned Samples from Initial Air Core Drilling at Madeira River Project, Brazil

https://ceo.ca/@thenewswire/canary-gold-corp-reports-visible-gold-in-panned-samples

Spanish Mountain Gold Reports Initial Drill Results, Multiple Near Surface and High-grade Intercepts

https://ceo.ca/@businesswire/spanish-mountain-gold-reports-initial-drill-results

PTX Metals Updates: Ontario’s Premier Announces Support to Unleash the Economic Potential for Critical Minerals and Energy in Ontario and Ring of Fire

https://ceo.ca/@newsfile/ptx-metals-updates-ontarios-premier-announces-support

Sokoman Minerals Spins-out Shares of Vinland Lithium Inc.

https://ceo.ca/@newsfile/sokoman-minerals-spins-out-shares-of-vinland-lithium

Michael Gentile Announces Filing of Early Warning Report Related to Acquisition of Common Shares of Astra Exploration Inc.

https://ceo.ca/@newsfile/michael-gentile-announces-filing-of-early-warning-report-16c90

Lumina Gold Announces Acquisition by CMOC for C$581 Million

https://ceo.ca/@newswire/lumina-gold-announces-acquisition-by-cmoc-for-c581

ORION MINE FINANCE PROVIDES UPDATE ON ITS BENEFICIAL OWNERSHIP OF COMMON SHARES OF ALLIED GOLD CORPORATION

https://ceo.ca/@newswire/orion-mine-finance-provides-update-on-its-beneficial-60c54

Sherritt Announces Successful Closing of Transaction to Extend Debt Maturities and Strengthen its Capital Structure

https://ceo.ca/@businesswire/sherritt-announces-successful-closing-of-transaction

Decade Receives Approval for Purchase of the North Mitchell Property in Golden Triangle Surrounded by Reported Resources of 200 Million Gold Equivalent Ounces

https://ceo.ca/@newsfile/decade-receives-approval-for-purchase-of-the-north

Don’t normally watch crypto other than Bitcoin

but checked out Etherium and it’s been cut more than in half. I think it got up around $3600 at one point.

Litecoin from I think $120, now $77

Interesting that of those sort of “big 4” names, that Bitcoin and to a lesser extent XRP have held most of their recent gains.

G & S slowly gaining ground again.

Rates inching back up as well.

Apparently $3500 & $33 will be defended

We’ve given up about half the gains from a couple hours ago in gold, and silver has fallen into negative territory.

Dollar rebounding a bit, oil strengthening, as are SM futures. Rates still flat.

PM shares up some in sympathy with the SM early on here but hard to see that lasting, even though gold is still up 1%.

Looks a bit like yesterday at this time

Gold up $68 and silver up $.17. Same script, let gold run, keep silver pinched.

Dollar is weaker, but not too bad. SM futures trying to bounce. Oil and Bitcoin up near 1%. Rates flat.

Gold just a few bucks from $3500. Amazing run in the last couple weeks.

Silver OTOH having trouble trying to break $33, only $.05 away right now, but having more trouble than it probably should be having.

The HUI chart is giving me pause. It’s flatlined the last 3-4 days at the 400 area and looks like it could break down soon if this continues another day or two. I guess that would either coincide with a break in gold, which would take silver down as well. HUI is near 30% above its 50 dma and doesn’t usually get more overbought than that. At least it hasn’t in the last 5 years.

I suppose a sharp move higher in silver along with a SM bounce could give the HUI a lift, I don’t know. Hard to bet on that happening though.

High tonight in gold is $3499.70.

Hunter 11 days ago

He has raised his gold target but can’t say yet because of his subscribers at that time and silver still 75 plus other targets.

Buygold

9-10k plus it could, Dave Hunter one month ago. Target currently 3400 or more .. up again end of year. A bust coming in the market then commodities will run. So far so good.

$9-10K Gold

That would take some moves like we’ve never seen before. OTOH, we’re starting to see 3% up days.

Why couldn’t it do Bitcoin type moves?

What if the buyer is the US Treasury pushing the price where they ultimately want to revalue? Might explain why there’s been very little resistance.

Here’s the COT Report

CFTC Commitments of Traders Report – CMX (Futures Only)

Sure seems like there should be a lot more activity than what’s shown here.

Surreal.

Hook

That video you posted with Mike Maloney. I saw a very recent video he did saying that he has switched most of his pms into silver? Felt silver had a higher beta and loved the GSR over 100.

Dog

Re ORLA Why is Orla Mining Up Today

Orla Mining Ltd. (NYSEAMERICAN: ORLA) has experienced a notable increase in its stock price recently, reaching an all-time high of $11.74. Several key factors have contributed to this upward momentum:Investing.com UK+2Investing.com India+2MarketBeat+2

1. Record Gold Production and Financial Performance

In the first quarter of 2025, Orla achieved record gold production, bolstered by strong performance at its Camino Rojo mine in Mexico and the newly acquired Musselwhite mine in Ontario. The integration of Musselwhite has been smooth, contributing 17,786 ounces of gold to the quarter’s output. Financially, the company reported adjusted earnings of $0.07 per share for Q4 2024, with an operating profit margin of 64% and a net profit margin of 43%, reflecting efficient operations and strong profitability. orlamining.com+5Seeking Alpha+5Investing.com India+5Investing.com India+1Investing.com UK+1orlamining.com

2. Strategic Acquisition of Musselwhite Mine

Orla’s acquisition of the Musselwhite mine from Newmont Corporation has significantly expanded its asset base and production capacity. This strategic move has been well-received by investors, as it diversifies the company’s operations and enhances its long-term growth prospects. Reuters+5orlamining.com+5Seeking Alpha+5

3. Positive Analyst Ratings and Institutional Investment

Analysts have responded favorably to Orla’s recent developments. BMO Capital Markets maintained an “Outperform” rating and raised its price target to C$14.50, citing strong quarterly performance and successful integration of the Musselwhite mine. Additionally, institutional investors like FMR LLC have increased their holdings, indicating confidence in the company’s future. Investing.com India+6orlamining.com+6Nasdaq+6Investing.com India+1Investing.com UK+1MarketBeat

4. Favorable Market Conditions

The rising price of gold has positively impacted gold mining companies, including Orla. As gold prices climb, the profitability of mining operations improves, attracting investor interest and contributing to stock price appreciation.Yahoo Finance+1MarketBeat+1

These factors collectively have driven investor optimism, leading to the recent surge in Orla Mining’s stock price.

Re GAU or why is Galiano Gold up today?

Galiano Gold Inc. (NYSE American: GAU) has seen a recent uptick in its stock price, influenced by several key developments:galianogold.com+3Stock Titan+3PR Newswire+3

1. Termination of Gold Offtake Agreement

In December 2024, Galiano Gold terminated its gold purchase and sale agreement with Red Kite Opportunities Master Fund for $13 million. This agreement had previously required the Asanko Gold Mine to sell 100% of its gold production, up to 2.2 million ounces, at prices selected by Red Kite during a nine-day quotational period post-shipment. The termination allows Galiano to now sell gold at prevailing market prices, potentially enhancing revenue in a bullish gold market. Stock Titan+1Seeking Alpha+1

2. Increased Ownership of Asanko Gold Mine

Galiano completed the acquisition of Gold Fields’ 45% interest in the Asanko Gold Mine, increasing its ownership to 90%. This consolidation provides Galiano with greater control over operations and a larger share of the mine’s profits. Reuters+5Stock Titan+5Robinhood+5

3. Positive Analyst Ratings

Analysts have responded favorably to Galiano’s recent developments. For instance, BMO Capital Markets maintained an “Outperform” rating on the company’s shares, reflecting confidence in its future prospects. Investing.com

4. Strong Financial Position

Galiano reported a robust financial position at the end of 2024, with approximately $105.8 million in cash and no debt. This financial strength provides the company with flexibility to invest in growth opportunities and navigate market fluctuations. Stock Titan+1Investing.com+1

These factors collectively contribute to the positive sentiment surrounding Galiano Gold’s stock.

Re Hecla HL Why Is Hecla Up Today?

Hecla Mining Company’s (NYSE: HL) stock has experienced a notable increase recently, driven by several key factors:ir.hecla.com+3Stock Titan+3ir.hecla.com+3

1. Strong Financial Performance: In the fourth quarter of 2024, Hecla reported revenues of $249.7 million, surpassing expectations and marking a 29% year-over-year increase. This growth was primarily attributed to higher metal prices, particularly silver, which significantly boosted the company’s top line. Timothy Sykes+1StocksToTrade+1

2. Record Silver Reserves: Hecla announced that its silver reserves have reached 240 million ounces, the second-highest in the company’s history. This substantial reserve base enhances investor confidence in the company’s long-term production capabilities. Hecla Mining Company

3. Positive Analyst Ratings: The company has received favorable evaluations from analysts, including a Zacks Rank of #1 (Strong Buy) and a Momentum Style Score of B. These ratings reflect positive earnings estimate revisions and strong price momentum, indicating bullish investor sentiment. Nasdaq

4. Institutional Investment: Significant institutional investors have increased their holdings in Hecla Mining. For instance, Vanguard Group Inc. raised its position by 1.3% in the fourth quarter, and other firms like Landscape Capital Management L.L.C. and Bryce Point Capital LLC have also acquired substantial shares. This institutional interest often signals confidence in the company’s prospects. MarketBeat

These combined factors—robust financial results, substantial silver reserves, positive analyst coverage, and increased institutional investment—have contributed to the recent uptick in Hecla Mining’s stock price.

Buygold, Captain Hook, Maddog and Maya

I’m sure all of us will be glad to see the last of him! Too bad that he’s got his son now to carry on his anti-human ways. I don’t think he’ll be too happy when he meets up with his maker. Maybe he thinks he’ll be sitting up alongside lucifer as his pal …

Pretty disappointing day for the PM shares! At least we ended positive. For a while it looked like we’d have an HUI down day with gold up near $100!

Maya

After taking on a building project using sewing skills I made my own baby bed with rocker and even a heart shaped head board. Using a saw for the first time I realized you need eye protection. I can see why they wear face protectors along with the splash risk.

Very good assessment of why gold …

… can reach $9,000 this year – maybe $10,000.

So why has the Gold/Silver Ratio broken above 1oo?

Because if gold goes to $9,000 this year with stocks breaking down, history suggests silver will continue to lag.

How much?

Let’s say silver is allowed to rise to $50 (remember everybody but Russia, silver producing countries, and silver investors want silver to rise) – that would equate to a GSR of 180 (9,000/50)

Gold is the only place to be right now because not only is a world war possible – central banks will only buy gold until a new currency system is struck.

Sorry silver investors but this is a very real possibility.

Cheers all

Ipso & Maddog Re: Schwab

I think I need some eye-bleach… Stat!

goldielocks @ 10:59

Well I’m an adult engineer and it made perfect sense to me to have every possible tool that might be needed to accomplish a major mechanical retrofit on me. I was glad to see that workbench full of tools. But at the same time quite humorous as it resembled a well equipped automotive garage. 🙂