@ ipso facto Agreed I understood the point, it just got me thinking. I gotta stop that. LOL

My thoughts of the 1970s to 1982 rates 5% to 21%? I looked back at it like a person (or economy) is getting strangled, the eyes are bulging, and the victim near death, and the strangler releases the grip (drops rates) at the last minute and poor slob comes back to life and happy.

In other words, with the economy, its to create a “relief rally”

Mr.Copper

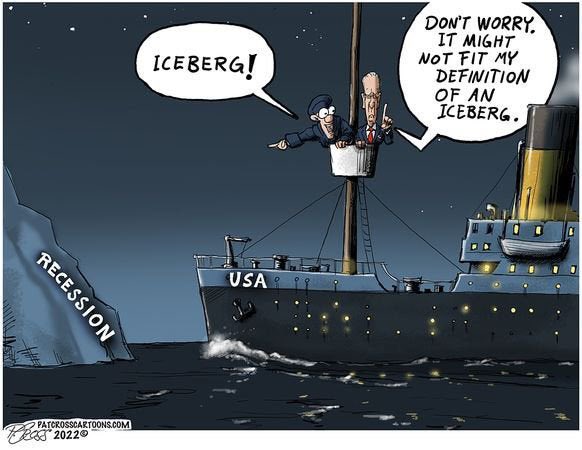

The point of it is that Biden and his pals are changing the generally accepted definition of “Recession” so that we won’t be in a “recession” and they won’t look bad in the midterms.

PS The check engine light …. got to be a bunch of BS half the time!

ipso facto @ 10:38 Re We Already Had About Eight Recessions Or One Long Term Depression Since 1970

The over all US Economy and living standards. And fake Gross Domestic Product numbers.

Just like a stock chart, there are many up-legs in a down trend, like a ball going down the stairs. The Economy goes up and up and up on the way DOWN with little fake booms and busts but overall, the country has been in a downtrend since 1975.

The photo you posted with the Iceberg named recession, should be named, “The Reset” or “The Last Big One” Elizabeth, or the “Last Blow Off Bottom” or “The End” of the past nonsense. And the beginning of a new USA.

So we COULD say, the USA had 8 great recoveries during a long great depression of 1970 or 1975. Nobody thinks what I think, and nobody says what I say on Financial Media. My info is original, not copied from anywhere or anybody. I’m brutally practical. And realistic.

The entire USA has been robbed, embezzled, that why Trump started to make America great again. Its not been great. Unless you are a tax absorber, on the receiving end of taxpayers. Gov’t subsidies, support grants etc. Or part of the Climate Change economy. Solar panels wind mills etc. And the auto mechanics??

Mine told me “It was a genius that created the Check Engine Light”. I heard they kept it in the north east because new car dealer service departments needed work. Sales and Service absorb wealth. Manufacturing CREATES wealth. Merry Christmas China et al. But its time to be happy. Because its all going to change for the better after we hit bottom, not 50 more years away.

Fed day today

so they could throw open Fort Knox and admit all the Gold is gone and that the Fed is short 300,000 tonnes…….the Gold price wud still not be allowed an uptick……

Rates down, USD down

no help…

Now that’s what I like to hear!

Why chocolate could be just as good for the heart as high blood pressure medication

https://www.studyfinds.org/chocolate-cocoa-high-blood-pressure/

Galantas Gold Enters Into Loan Agreement

https://finance.yahoo.com/news/galantas-gold-enters-loan-agreement-213000577.html

Probe Metals intersects 4.4 g/t Au over 15.4 metres in Expansion Drilling at Monique, Val-d’Or East Project

https://finance.yahoo.com/news/probe-metals-intersects-4-4-103000245.html

Karora Resources Closes Acquisition of the Lakewood Gold Mill

https://finance.yahoo.com/news/karora-resources-closes-acquisition-lakewood-113600947.html

Mayfair Gold Drills 1.40 g/t Gold over 65.0m from Fenn-Gib Expansion Drill Program

https://finance.yahoo.com/news/mayfair-gold-drills-1-40-120000048.html

Eskay Mining Discovers More VMS Targets and Commences Drilling at Scarlet Ridge

https://finance.yahoo.com/news/eskay-mining-discovers-more-vms-120000848.html

Musk Metals Announces Drilling To Commence on Its 100% Owned “Elon” Lithium Project in Quebec, Canada

https://ceo.ca/@accesswire/musk-metals-announces-drilling-to-commence-on-its-100

Benchmark Delineates Multiple New Drill Targets Adjacent to the AGB Gold-Silver Deposit

https://ceo.ca/@newsfile/benchmark-delineates-multiple-new-drill-targets-adjacent

Arras Minerals Acquires Five New Mineral Exploration Licences Increasing Its Total Land Package in Northeastern Kazakhstan by 70%

https://ceo.ca/@globenewswire/arras-minerals-acquires-five-new-mineral-exploration

Austral Gold Reports Encouraging Results at Casposo

https://ceo.ca/@newsfile/austral-gold-reports-encouraging-results-at-casposo

Leocor Gold Identifies 12 Gold Targets on the Hodges Hill Property; Follow Up Work Underway

https://ceo.ca/@thenewswire/leocor-gold-identifies-12-gold-targets-on-the-hodges

Metallic Minerals Announces Start of Drilling at La Plata Silver-Gold-Copper Project in Southwest Colorado, USA, and Extends Warrant Expiry

https://ceo.ca/@accesswire/metallic-minerals-announces-start-of-drilling-at-la

Monarch Produces First Gold Bar From Its Beaufor Mine

https://ceo.ca/@globenewswire/monarch-produces-first-gold-bar-from-its-beaufor-mine

Alistair write elegantly making the case for gold–I’ve read his work for the past 34 yrs.–but it just doesn’t matter

Yeah, no surprise

Silver has had a lot of ground to cover if the ratio ever gets back to reality.

…historically, silver is extremely underpriced compared to gold.

Fed day

SM gonna have a strong open, even dragging pm’s with it a little, although the scum is already chipping away at the meager gains.

It’s all about what Powell says in the presser…

Ororeef 23:16

If the cost rise to get the gold, sliver or other metals out of the ground as well as supply issues, environmental issues and who knows what else issues to slow the process down, wouldn’t it drive the price up? Since you can’t just put it on a machine and print it like fiat or computerized dreamt up digital wouldn’t that make the physical more expensive to own? Also wouldn’t it make industrials that use it in their products want to compete to keep it down or at least get priority over other buyers? If inflation is moving faster than you get get it out of the ground it would seem to make sense the price should go up and why aren’t they setting that price?