Besides those two cute little dogs that little kitten is adorable too. It looks like it him or her would rather be sitting on momma lap. So cute. With increasing homeless good to have moucers around.

California has seen them come in with winter approaching from other states. Most here anyway don’t bother anyone, sleep in cars or pitch tents but the ones who leave trash everywhere and don’t just bag it but create a potential for rodents which my street had a problem with when a convoy pitched up tents and cars at a nearby field. One cat if their a good mouser can do better than a professional exterminator.

Winedoc

Beautiful Bichons

Winedoc..What great little dogs! We were lucky enough to have a bichon share her life with us for twelve years. Once she taught us what she wanted it was the start of a great time. You can measure wealth with ounces and stacks of cash or by the smiles and joy that those little creatures can bring us. Thanks for posting that family portrait.

Silver premium

APMEX premium is still $6.00/oz. I wish I had funds to take delivery on the Comex.

Happy Hour with Aquilla : 16:47

Cheers and well stated …….

Im 50/50 …….. Phyzz and Paper games

I don’t trade anymore, though.

Phyzz and a broker to manage my RRSP (Canuck version of 401K)

The brokers always want you to stay in “the Game”

Caveat Emptor …… on both. 🙂

Likely we are screwed either way

Onward Pilgrims

Winedoc

PS

new family photo of the “children”. ………. for pet lovers ………..

The Whole Agenda To Use Less Oil and Gasoline Was Not To Save The Planet, Remember the 1970s and Peak Oil

They went off the gold standard, Dopey/Dollar dropped, Gasoline went .25 cents to $1.30, Oil $3/bbl to $42/bbl and the lying PTB blamed the Arabs and shortages. Suddenly Oil crashed back to $7. They were predicting consumption would out strip production, and it would be the end of the global economy. But later on after Oil crashed, they kept up energy saving to save the planet.

TPTB Media also didn’t mention higher oil reason, long term agreements with the Arabs was 1 oz Silver for $1/bbl of Oil, and 1 oz Gold for 15/bbls oil. Silver was .92 cents and Gold $35/oz. They dropped the dollar, causing those AU AG prices to soar, so it was only natural for the Arabs to want more money to cover higher silver and gold.

parts:

Oil was both the lifeline of the economy and a vital resource for the country’s national defense. American oil had played a decisive role in the Allies’ World War II victory, and with the Cold War raging on, U.S. oil remained a top national security concern.

The news was also stunning because the public was generally not aware that the country imported any oil at all. The United States was still the greatest single producer of oil in the world, as it had been since 1901, when Spindletop, near Beaumont, Texas, became synonymous with a sometimes uncontrollable 150- foot- high gusher of black gold. But with the spread of cars, suburbs, and factories in post– World War II

front-page story “As Prices Soar, Doomsayers Provoke Debate on Oil’s Future,” quoting the founder of the Association for the Study of Peak oil as saying “Holy Mother! The good ol’ moment’s arrived!” Oddly, the article didn’t mention the alternative explanation for high prices,

published an article by two retired geologists called “The End of Cheap Oil,” which presented the idea that world oil production would soon peak while demand kept rising, creating economic shock waves and even ‘the end of civilization’ as one co-author said subsequently.

How an oil shortage in the 1970s shaped today’s economic policy

Confronting Trudeau’s COVID quarantine agents in the Calgary airport (but getting the silent treatment and no answers)

Looks like “welcome to Stalag 17!” First Canada, then USA????? Better watch this and be prepared!!

Buygold your 0941

“Time for me to make some serious decisions.”

I’ve been playing this since 2000. Yes it gets tiring trying to convince yourself that someday logic and true value and decent moral behavior will win over seemingly irrational market movers driven by greed and corruption and fear of being exposed and downright evilness.

I don’t know what to say. Even phys could be problematic with the surveillance state recording our every move and AI financial analysis watching every penny come and go looking for patterns.

The beautiful people launder billions and we are suspect for every twenty dollar bill.

To me the bottom line is don’t rely on paper profits as a significant source of future financial security. My Plan C is the hvac company I have going on the side. Also I hope to never have to rely on a fixed income until no other options exist.

That said we still have a large percentage of our wealth in the stock market because of mental inertia and 401k-plan-is-good mentality. I think keeping some portion in the paper scam market is ok just to look good (PC) but… At what point do you give up and say I can’t take it any more I’m just going to hunker down and try to keep what I have, cast off the risk of burning paper, and accept my position in the working class where the only income can come from work not rent.

Maddog @ 15:22

Eventually I’m sure you are right. Hopefully we can extract some value from the miners and some decent dividends at some point. It’s awfully hard to beat our heads against a situation where someone else holds all the cards and can manufacture “money” to support their position from a private Magic Font.

Ipsofacto

That article about the Naked Shorts, is hopelessly optimistic about anyone stopping it, but it is excellent in showing how bad the situation is and just how utterly corrupt they all are, in mainstream finance……

We really are careering twds a time, when phys in hand is the only asset u can trust.

NAK

Holding up well in the downdraft.

Here’s a cool little site with charting options

Has all sorts of news on it too even PMs now the younger crowd learning more about it. That’s where I learned about it the younger crowd.

https://www.tradingview.com/

Re Conspiracy Theories, They Actually Don’t Happen, There Is No Such Thing, And Don’t Say Or Imply It. You Are Just a Suspicious Historian

If you get confronted by a gov’t Media trained subject, aka liberal democrat, that makes fun of you and embarrassed you, calls you a derogatory name like you are a “conspiracy theorist” this is how you answer. Don’t forget. What has unfolded over decades, was simply an ongoing history and results of special interests events. No conspiracy.

“Oh no, you are mistaken. I’m not that at all. I’m just a history buff with a memory, and have already witnesses so many scandals that I’m only “suspicious” because of past history” “I don’t believe in conspiracies” “There is no such thing, and you know that”.

Same thing if gov’t Media trained subject accuse you of being a biased person or racist, same thing. “Oh no, you are mistaken. I have seen and read so much bad violent Gov’t Media news with photos and names of the criminals, plus my own personal experiences and observations, have unfortunately led me to be suspicious”

Same as a Credit Score with the credit card company. If you have a bad history you won’t get the loan. They are NOT conspiring against you, NOT being biased or prejudiced because of your bad “score.” Its just your or his HISTORY that makes the loan officer’s decision.

Don’t let gov’t Media trained subjects intimidate or suppress you.

P.S. “Conspiracy Theorists believe the moon landings never happened, and the Trade Center was bombed from inside by the gov’t. “A conspiracy theory explains an event or set of circumstances as the result of a secret plot by usually powerful conspirators”

DO NOT LET THEM PUT YOU IN THAT GROUP.

Thanks to a messed up government

We currently appear to have a short term position trade and failure to communicate world situation right now I don’t have too much time for but that and stop loses and or pre buy limit orders incase sites go down no time for right now seems the only way to protect your profits and or limit loses.

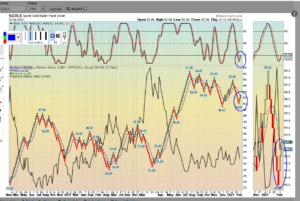

Comex silver

Silver hit the $30.00 upside target on very high volume and then sold off the next day. Today, silver hit the 20 day moving average and stopped, for now. The next support level is down another $1.00. The scum made a $4.00 trade in three days. I guess the only good news is maybe it is a typical straight down correction in a bull market.

rno

Low volume sell off

at least in the shares from what I can see.

Unfortunately, the damage is done to both the metals and the shares regardless of the volume.

It goes on and on, like it always has.

Mr.Copper @ 13:12

“naked long”

An interesting idea Mr. Copper, you’d be like buying a stock without ever delivering any money. Somehow I’m not sure the seller would cooperate. 🙂

@ipso facto re Naked Shorts Versus Naked Longs :)

How come the these banker bozos never came up with a Naked Long stock position idea. You get all the shares you want, even tho you don’t have any money or credit, and when the share price goes up, the broker gives the investor just the profit?

If the stock goes down, the investor can just hold forever until he finally sees a profit. Then sell the phantom shares. I hear there is no time limit on a short position. People can be long term short, so you can hang on.

I’ve heard of that with houses, 105% mortgages. That looks like naked long to me. The banks should come up with naked short thing on housing as a hedge to over ride their next housing price crash. Especially for retail stores and shopping malls.

But I guess they depend on taxpayer bailouts if they lose.