European Banks

The concept of negative-yielding debt is totally irrational and incoherent. It contradicts every fundamental rule we learn and attempt to apply in business, finance, and economics. It implies that the future is more certain than the present – that the unknown is more certain than the known!

When the investment/lending hurdle rate is not only removed but broadly disfigured in how we think about allocating resources, precious resources will be misallocated. The magnitude of that misallocation depends on the time and extent to which the policy persists.

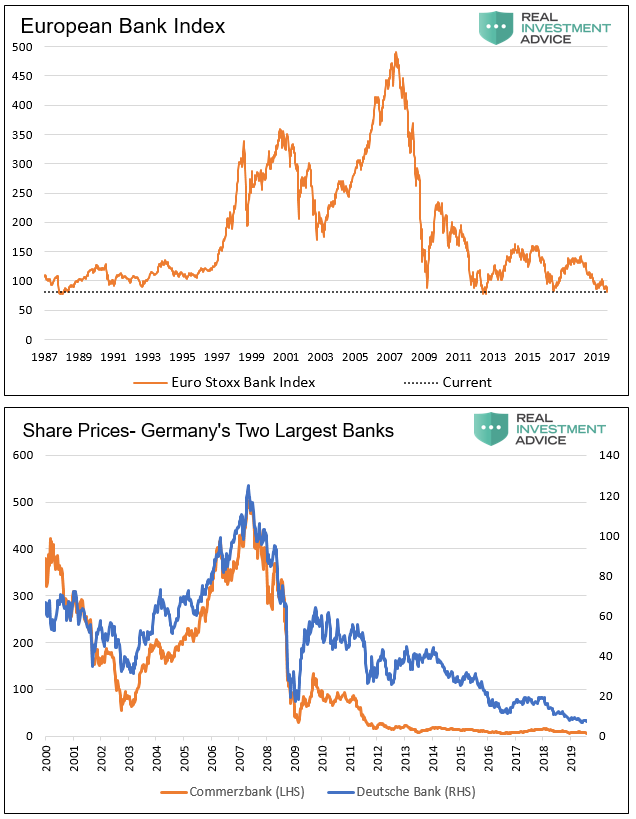

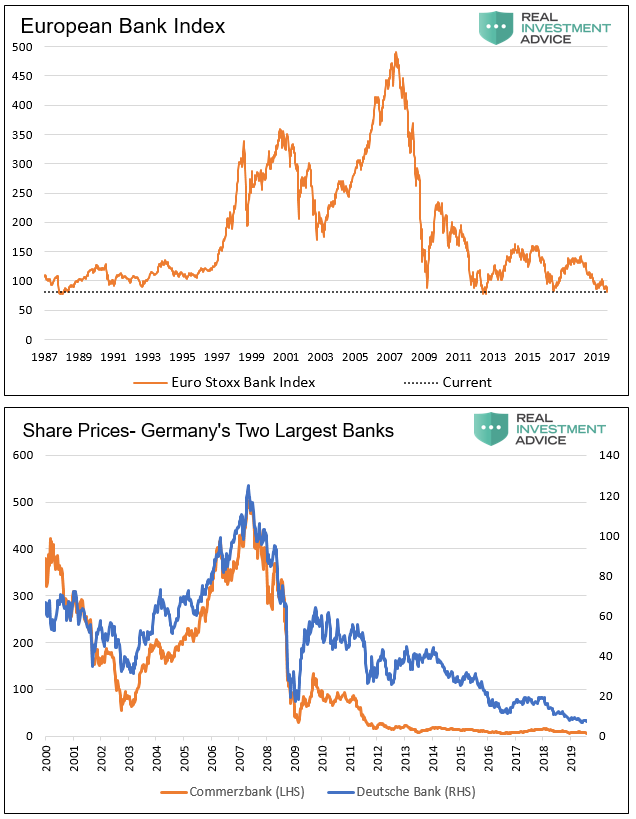

As brought to our attention by Raoul Pal of Global Macro Investor and Real Vision, the first evidence of problems is emerging where the negative interest rate phenomenon has been most acute – Europe. European financial institutions are growing increasingly unhealthy due to the damage of negative rate policies. Currently, the Euro STOXX Bank index, as shown below, trades at levels below those of the trough of 2009 and its lowest levels since 1987. More importantly, the index is on the verge of breaking through a vital technical level to the downside. The shares of Germany’s two largest banks, Deutsche Bank and Commerzbank, are at historical lows. Just as subprime was not isolated to the U.S., this problem is not isolated to Europe. These banks have contagion risk that, if unleashed, will spread throughout the global financial system.

Data Courtesy Bloomberg

Summary

The market is reflecting a growing lack of confidence in the European banking and financial system as telegraphed through stock market pricing shown above.

The risk facing the global financial system is that, as problems emerge, the second and third-order effects of those issues will be both impossible to anticipate and increasingly difficult to control. Trust and confidence in the world’s central bankers can fade quickly as we saw only ten years ago. The inevitability of gold

https://www.zerohedge.com/news/2019-08-14/negative-new-subprime