…still holding, maybe that’s the new base. we can hope.

New Poll New Poll

Exercise your rights!

A few items from Murph tonight–this jobs revision# is a very big deal but will have no effect cause it won’t be mentioned on Tee Vee

Aug 21, 2019 10:42 a.m. ET

WASHINGTON (MarketWatch) — The U.S. economy had 501,000 fewer jobs in March 2019 than previously reported, government revisions show, suggesting that hiring was not as strong in the past year as it seemed. Hiring was weaker in retail, restaurants and hotels. The annual revision is much larger than is typically the case. The preliminary revision in 2018, for example, was just 43,000. Every year the Bureau of Labor Statistics updates its figures based on unemployment data that nearly all employers are required to file with the states. The current revision is one of the largest ever.

*********************************************************************************

Gold has made quite the advance over the past three months. Basically that advance has been made without any help from a weakening dollar or a lasting Fear Trade, which kicks in every now and then. This makes the move in gold that much more impressive. Should both of those factors go into high gear, the momentum shift into gold and silver by even more new buyers ought to be awesome. As is, continuing lower interest rates and the need for further monetary stimulus around the world is propelling the gold price.

It is so preposterous that gold depends on a few words from the FED–so if they don’t raise in september

all u.s. and world debt and deficit problems are magically solved?? If the 10 yr t-note. yield rises from 1.5% to 1.75% or 2%…people should panic out of gold and into stocks, bonds or other paper…? The municipal-state-and federal debt. and deficit spending will still be a problem…

It’s 5:515 and e-trading in gold is closed for 45 minutes until the night session…with yields up a wee bit and ditto the dollar at days. end…gold is only dowm 3.10…not bad at all…considering that the FED statement. was hawkish…next if Friday and Jackson Hole…Powell. may not. be. super dovish on friday buy I doubt. he’d. be as. hawkish as. today. sounded

Hopefully the Cartel won’t be able to bring gold in by morning down 15 or. 20…

Well course now that I’ve opened my yap

things have deteriorated. Some things never change.

Rates and USD moving up, SM moving up as usual, pm’s also moving down as usual.

Bummer, thought we were seeing something different today.

Not too bad for post Fed B.S.

We’ve seen worse, but hey I’m used to extreme meltdowns.

Fed aka the scum speaks

Dollar catches bid, Bonds ease and PM’s lent on …shock horror no SM bid ?????

This is VIP article=Trader: Getting Rich Off The Greater Fools Has Worked Wonderfully…Until Today

Mr. Copper–the 9:26 pension post was brother Ipso…But I love. this India & gold insight

[But the report is delightful for its presumption that gold is for the great unwashed while modern financial assets are for more sophisticated people, people gaining “financial literacy.}

FT imagines ‘financial literacy’ is defeating gold in India

by cpowell on 03:08PM ET Wednesday, August 21, 2019. Section: Daily Dispatches

Maddog @ 11:33

“The forced buying” That’s gotta be one of the only things holding them up. It’s absolutely insane.

Instead of “their” money being a store of value it’s a value sink.

SILVER…

trying to go green for the day,

dollar index trying to go red

I think Trump

should offer to buy HongKong ! wouldent that be a HOOT ! and make it a self Governing entity ! No threat to China ! He could also guarantee China’s right to be self Governing for the next 40years ,that way theres NO political threat to China Politics .

Ipso, treefrog

Ipso – no, I don’t hold Gatling, my most recent buy has been Fortuna – FSM

treefrog – seems that way, hope you’re right. I guess we have Fed minutes in a little while, we’ll see how that goes.

ipsofacto

Re German bond rates

Remember that the EU has been very deceitful, by insisting that Pension Funds have to hold a large percentage of their assets in so called Highly Liquid Assets…ie top quality bonds…so no matter what the rate, they have to buy.

@Richard re 9:26 How do pension funds that need a return make any money? It’s a bad joke IMO

Food for thought. If the system goes into a deflation, the money gains value or purchasing power. So if you take a 10% hit on the bonds, and costs go down by 20%, you STILL have a 10% gain on a 10% mathematical loss. Eh? 🙂

In fact, what if you had $100,000 in the bank, and along came a fast 10% deflation in costs. TPTB would not want that, and confiscate 10% of your $100k bank account. TPTB’s biggest nightmare would be your money GAINING value. It goes totally against their agenda since 1913.

Buygold are you still holding this one?

Gatling Drills High-Grade, Near Surface Gold at Cheminis Deposit Including 12.3 g/t Au over 5.0 meters

fifteen/seventeen…

…starting to look like support – for now at least.

Oops I can’t understand why no one wants it

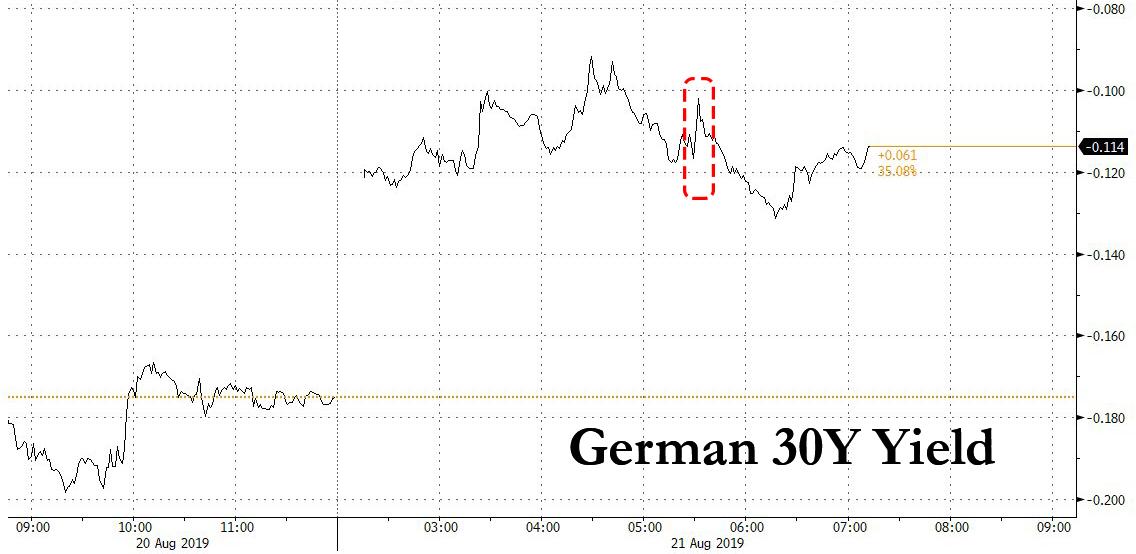

Germany Sells World’s First 30-Year Negative Yielding Bond… And It’s A Failure

We. gotta. remember that for at least the. 1st. half of the gold. rally stocks and gold rose together

Wollie said. they would…he also said yesterday gold and rates would rise together…maybe…maybe not…

Just for the record, although Wollie. has. been correctly bullish since the 1980s….he walked in front of 2 speeding Mack trucks in the form of the 2000 and 2008 crashes–I remember him. calling for “lunatic” DOW numbers right into the. the start of the crashes….he’s doing the same thing now…

Speaking of crashes, last year there was much talk of a crash bout this time of the yr but now I never hear a crash mentioned anywhere…and I certainly can’t see one coming,,,not with zero rates, a Trump administration going all out just to prevent even a measly little recession…Trump will do everything he can to keep the Casino open and viable…

So if you [not me] want to be a big, bad contrarian, then start calling for a crash..

How do pension funds and other entities which need a return make any money off of this? It’s a bad joke IMO

Germany Is About To Sells Its First Ever Zero-Coupon Ultra-Long Bond

Investors Intelligence just. out=II Bullz 49.1 Bearz 17.9–contrary analysis says this is slightly bearish

All during the 1990s I.I. showed high bullish. readings among advisors…contrary theory failed cause stocks just kept going up.

Buygold

Hopefully this is the correction…if so v strong overall.