This is VIP article=Trader: Getting Rich Off The Greater Fools Has Worked Wonderfully…Until Today

Mr. Copper–the 9:26 pension post was brother Ipso…But I love. this India & gold insight

[But the report is delightful for its presumption that gold is for the great unwashed while modern financial assets are for more sophisticated people, people gaining “financial literacy.}

FT imagines ‘financial literacy’ is defeating gold in India

by cpowell on 03:08PM ET Wednesday, August 21, 2019. Section: Daily Dispatches

Maddog @ 11:33

“The forced buying” That’s gotta be one of the only things holding them up. It’s absolutely insane.

Instead of “their” money being a store of value it’s a value sink.

SILVER…

trying to go green for the day,

dollar index trying to go red

I think Trump

should offer to buy HongKong ! wouldent that be a HOOT ! and make it a self Governing entity ! No threat to China ! He could also guarantee China’s right to be self Governing for the next 40years ,that way theres NO political threat to China Politics .

Ipso, treefrog

Ipso – no, I don’t hold Gatling, my most recent buy has been Fortuna – FSM

treefrog – seems that way, hope you’re right. I guess we have Fed minutes in a little while, we’ll see how that goes.

ipsofacto

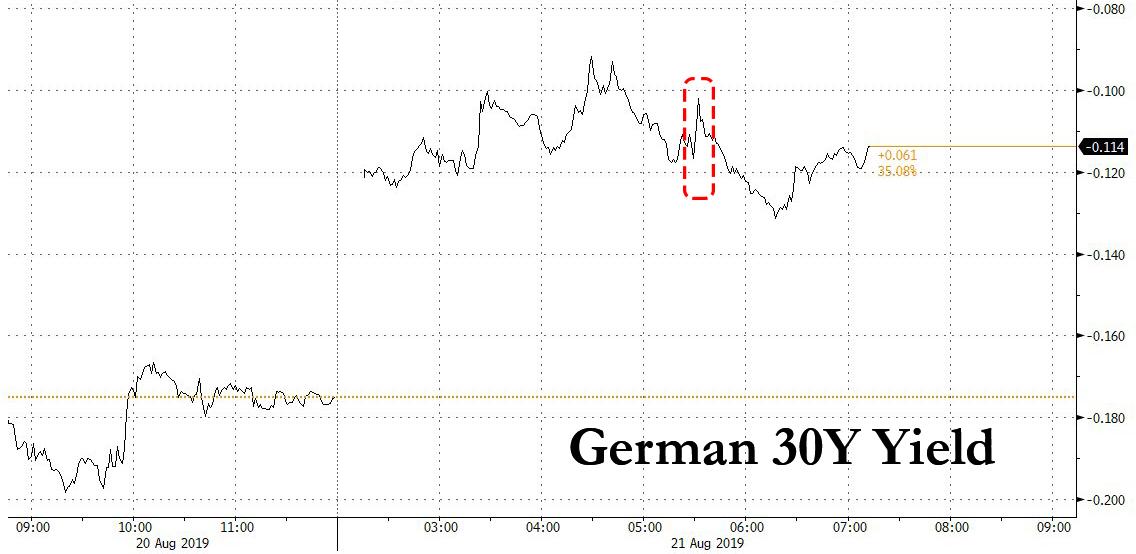

Re German bond rates

Remember that the EU has been very deceitful, by insisting that Pension Funds have to hold a large percentage of their assets in so called Highly Liquid Assets…ie top quality bonds…so no matter what the rate, they have to buy.

@Richard re 9:26 How do pension funds that need a return make any money? It’s a bad joke IMO

Food for thought. If the system goes into a deflation, the money gains value or purchasing power. So if you take a 10% hit on the bonds, and costs go down by 20%, you STILL have a 10% gain on a 10% mathematical loss. Eh? 🙂

In fact, what if you had $100,000 in the bank, and along came a fast 10% deflation in costs. TPTB would not want that, and confiscate 10% of your $100k bank account. TPTB’s biggest nightmare would be your money GAINING value. It goes totally against their agenda since 1913.

Buygold are you still holding this one?

Gatling Drills High-Grade, Near Surface Gold at Cheminis Deposit Including 12.3 g/t Au over 5.0 meters

fifteen/seventeen…

…starting to look like support – for now at least.

Oops I can’t understand why no one wants it

Germany Sells World’s First 30-Year Negative Yielding Bond… And It’s A Failure

We. gotta. remember that for at least the. 1st. half of the gold. rally stocks and gold rose together

Wollie said. they would…he also said yesterday gold and rates would rise together…maybe…maybe not…

Just for the record, although Wollie. has. been correctly bullish since the 1980s….he walked in front of 2 speeding Mack trucks in the form of the 2000 and 2008 crashes–I remember him. calling for “lunatic” DOW numbers right into the. the start of the crashes….he’s doing the same thing now…

Speaking of crashes, last year there was much talk of a crash bout this time of the yr but now I never hear a crash mentioned anywhere…and I certainly can’t see one coming,,,not with zero rates, a Trump administration going all out just to prevent even a measly little recession…Trump will do everything he can to keep the Casino open and viable…

So if you [not me] want to be a big, bad contrarian, then start calling for a crash..

How do pension funds and other entities which need a return make any money off of this? It’s a bad joke IMO

Germany Is About To Sells Its First Ever Zero-Coupon Ultra-Long Bond

Investors Intelligence just. out=II Bullz 49.1 Bearz 17.9–contrary analysis says this is slightly bearish

All during the 1990s I.I. showed high bullish. readings among advisors…contrary theory failed cause stocks just kept going up.

Buygold

Hopefully this is the correction…if so v strong overall.

Struggle for $1500 and $17 back on

not really a surprise with the way the shares closed yesterday- a little soft.

Plus we have the Fed heads opening their yaps this week in Jackson Hole.

Would be nice to see the shares hold their ground despite what the metals do and show some leadership….but I digress.

Richard640 Novo bust I agree

I think the Chinese passed on it years ago, its just no one remembers because its not known for tourists.

I watched a BBC doc on the aborigines and you $ee they would be a problem in that area.

Richard640 @ 18:33

With the cretins on the run it seems that reality is being manifested. Just hoping here that the smell of burning Walmarts and Quick Stops doesn’t soon permeate the landscape.

We may not see this but certainly our children will get a taste.

I highly. respect Cliff & am glad to see him bullish on gold-like so many he thinks gold needs to correct a wee bit–but he/they don’t realize that gold just finished

[a 3-4 week correction and will soon go to new highs. as the seasonally strongest period of the year for gold is. here]

Gold’s Strength Will Outlast The Dollar’s

Gold and the dollar are at a crossroads in terms of relative performance.

U.S. intervention to weaken the dollar is a possibility in coming months.

Regardless, global tensions virtually assure continued strength for gold.

There’s also a definite political incentivefor the Trump administration to collaborate with the U.S. Treasury Department and the Fed at some point to weaken the dollar before the global economy becomes truly unhinged. A U.S. currency intervention would, of course, pave the way for China to accuse the U.S. of being a currency manipulator. But anything that weakens the dollar would also give additional support for the gold price due to its currency component. Between continued global market volatility and the possibility for a weaker dollar, gold stands to benefit in either case.

ipso,

“…A few months more of days like this …”

i really like the sound of that.

Kyle Bass= told CNBC’s David Faber that the Fed will follow the rest of the world’s central banks to zero.

“There is a problem with cutting rates because it shows a sense of alarm,” Nobel-winning economist Robert Shiller said Tuesday on CNBC’s “Squawk Box.”

A quarter-point drop in interest rates is a tiny adjustment, but the fact that the Fed is cutting rates at all had the opposite intended effect, sparking fears of recession.

Kyle Bass, founder and chief investment officer at Hayman Capital Management, told CNBC’s David Faber that the Fed will follow the rest of the world’s central banks to zero.

“You don’t want to use the Z word because it scares people,” Shiller said. Many Fed watchers have not only used the Z-word but predict the Fed will lower rates even further than that in the event of a recession.

The market is already giving you a glimpse into this future, with $15 trillion in negative-yielding debt around the world. The U.S. is an outlier with positive rates.

All these ideas leave the market jittery. Stocks ended down for the first time in four trading days, a sign the market could continue down the same path of volatility investors have seen since the last rate cut. Not everyone expects the worst. J.P. Morgan’s global head of macro quantitative and derivatives strategy, Marko Kolanovic, says most of the recent moves in stocks and bond yields have been driven by technical flows, algorithmic selling and poor liquidity, not fundamentals.

He’s predicting an enduring comeback. [GEE! WHAT A SURPRISE from a J.P. Morgan guy–but bring it on–gold went up with stocks also, remember?]

-END-

Ipso-Buygold-Oro–Good stuff from Murph tonight=Labor Day is less than 2 weeks away and that typically kicks off a seasonally bullish time

James Mc just in with some timely input…

Rumbling elephants back at it

Bill,

Yesterday:

“The last 3 months have signaled a big change behind the scenes. We await the next rumbling of the Crimex elephants.” (END)

We didn’t have to wait long for that rumbling. The snapback rally in silver, which for the past 7 years was unheard of, is now becoming routine trading. Also becoming routine is the relentless recapturing of big round numbers, in this case $1500 and $17.

We’re slowly but surely inching closer to another major breakout. These support levels are getting harder and harder to break down. This time around any rate cuts and QE will be MUCH friendlier than in the past. As they say there’s been a lot of water flow under this cartel bridge, and it is filled with gold dust from an eternity of suppression schemes.

The precious metals derivatives are acting like physical is on fumes. Whether it is partially Deutsche related, or otherwise, the fact is buyers are increasingly getting aggressive, and why not? These prices will look cheap after $1550 and $17.60 are convincingly taken out. Labor Day is less than 2 weeks away and that typically kicks off a seasonally bullish time. There would be no better kickoff to the season than to have Sep. silver option expiration go off well north of $17 a week from today. One thing for sure is the “malevolent force” we’ve come to know and loathe is currently getting met head on by a benevolent force- whoever the hell that may be.

James Mc

Terrific input by James, as always.

Couldn’t agree more that $1550 and $17.60 are going to look cheap before the end of the year, which is why this commentary from another financial big shot stands out:

Buy Gold ‘At Any Level,’ Mobius Says as Central Bankers Ease

********************************************************************

As always, from my position, the surprise is going to be how far and how fast gold and silver move to the upside.

Back to silver. Today’s strength in silver most unusual, especially following the new buying yesterday on the dip. Silver is now close to blowing through pivotal $17.20. Our good friends James Turk and J Johnson have been talking about option activity in the silver market, which might be particularly bullish, rather than bearish as it has been for so many years.

As James Mc noted, the September silver option expiration is a week from today. Both of our friends have speculated about the potential possibility of a silver price surge due to the option writers being forced to cover rather than rake in the premium dough as they ALWAYS do.

Virtually no one in the precious metals world is looking for such an occurrence. What a sight that would be if it kicks in. Generally, for this to be the case, it has to involve some very strong hands that will be buying up all the physical silver they can over the coming days. The physical market needs to be as strong as can be to force the JPM crowd to retreat or cover some positions. Fingers crossed!

The gold/silver ratio fell to 87.75.