Tr’ondek Hwech’in and Yukon Government Support Received for the Re-start of Golden Predator’s Brewery Creek Gold Mine, Yukon

https://ceo.ca/@nasdaq/trondek-hwechin-and-yukon-government-support-received

Tr’ondek Hwech’in and Yukon Government Support Received for the Re-start of Golden Predator’s Brewery Creek Gold Mine, Yukon

https://ceo.ca/@nasdaq/trondek-hwechin-and-yukon-government-support-received

The ADP National Employment Report (also popularly known as the ADP Jobs Report or ADP Employment Report) is sponsored by ADP, and was originally developed and maintained by Macroeconomic Advisers, LLC. The report’s methodology was revised in November 2012 by Moody’s Analytics. The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP. During the twelve-month period, this subset averaged over U.S. business clients and over U.S. employees working in all private industrial sectors.

old rally but will outperform it…I say one must throw out all the old assumptions–like gold can’t continue to rally causa cots and high rsi’s….similarly=gold can only rally so far without silver…maybe gold will have its big rally with silver lagging far behind…just let it rally first and we’ll work out the details later…LOL

Arizona Blocks Nike After Kaepernick-Complaint Sparks Virtue-Signaling Sneaker Ban

I just want to say screw Nike and screw kapernick!

PS Love that flag version.

Hey buddy can you spare some change or bitcoin for a Soya Latte and Avacado Toast?

There can’t possibility be any compromise in my view. There is only one direction or plan. More for us and less for them. There was no discussion or compromise for the USA back in the day when “they” decided to give all our manufacturing away.

I saw an article lately using the de-globalization instead of reversal of the past. Its not JUST globalization that is reversing. Many other things like allowing unfetter immigration and corruption in high places etc etc

Looks like it’s trying to play catch-up on the downside with gold.

Of course that could never happen — right?

Chuckle

Other than the scum and ridiculous COT’s, do you guys have any sense of what silver is doing or is going to do?

Almost completely detached from gold these days.

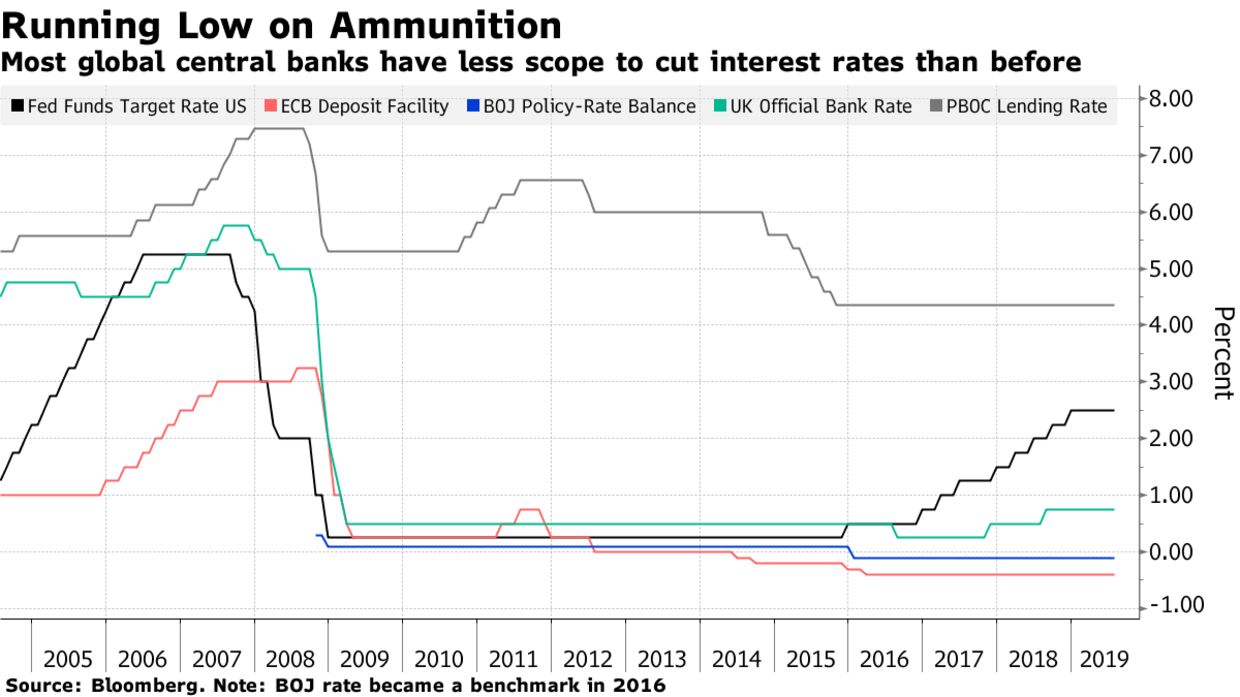

Guess what? Recession looming means rate cuts required to save the all important. stock mkt. and keep it on its journey to infinity.

Which means much higher gold!

Good to have something to agree with Roubini on. I know he’s not generally been a friend of gold.

Would be nice if yesterdays’ drubbing was the extent of the downdraft and we bounce off Maddog’s $1380

Shares look supportive this am.

it’s the most overhyped technology ever, it’s nothing better than a glorified spreadsheet,” Roubini said. “Nobody’s using it, and nobody’s ever going to use it.”

I’m no accountancy expert at all, but when I looked at Blockchain, it’s exactly as he says overhyped garbage, all it is endless duplications, as a system for checking that ain’t rocket science, it’s been around since man first learnt how to think !!!!

Speaking at a blockchain summit in Taipei, Roubini reiterated his skepticism toward cryptocurrencies such as Bitcoin.

“There’s massive, massive amounts of price manipulation” in cryptocurrency trading, he said in remarks at the conference. As for blockchain, “it’s the most overhyped technology ever, it’s nothing better than a glorified spreadsheet,” Roubini said. “Nobody’s using it, and nobody’s ever going to use it.”

10. yr. note=up 11/64ths [yield lower]—check!

The $ index down-not much but down—-check!

Gold–up 6.40=that’s 9.50 off the overnight low–check

The U.S.-China trade war and a spike in oil prices from geopolitical tensions have the potential to push the world into recession next year, according to renowned doomsayer Nouriel Roubini.

Optimism will likely collapse “like in every other recession,” he said. Further unconventional monetary policy is likely to be needed, he added.

On top of that, an oil-price shock coming from Iran tensions would raise the prospect of 1970s-style stagflation as a rise in crude prices coincides with slower growth, Roubini said.

Tks.