https://www.zerohedge.com/news/2019-01-25/fed-could-end-balance-sheet-runoff-sooner-expected-wsj

Snip:

But according to WSJ, the Fed now expects the runoff to end much sooner, though the paper hedged that many policy makers still “don’t understand why the market has placed so much emphasis on the balance sheet lately.” When Esther George surprised markets by calling for a pause on rate hikes, she added that it’s “unclear” whether the balance sheet shrinkage had accomplished much in the way of removing accommodation.

Apparently to the residents of the Marriner Eccles building, inflating the balance sheet is a major market stimulative effect, but its shrinkage should somehow be ignored by the market. And these are the people who set the price of money for the world’s biggest economy…

Whether Powell offers a similar take during the press conference after next week’s meeting will depend on the conversations that take place during the meeting. According to WSJ, the internal debate over the proper size of the balance sheet has focused on the necessary level of reserves in the banking system. Some believe that holding a large amount in reserve would help the Fed better control volatility in short-term credit markets.

Regardless of where the runoff ends, Lorie Logan, one of the officials responsible for managing the portfolio and an executive at the New York Fed, said in a speech last May that she saw “virtually no chance of going back to the precrisis balance sheet size”, which of course is logical: by 2020 there will be roughly $2 trillion in currency in circulation (and rising) which will be the new floor of the Fed’s balance sheet. Ultimately, the Fed hopes to dump practically all of the MBS it accumulated during QE and shift toward a portfolio consisting almost exclusively of Treasurys.

“The conversation is really about the relative amount of reserves,” she said.

This is a concept that many analysts believe isn’t well-understood by investors.

The idea that the Fed won’t return to its precrisis balance sheet size isn’t well appreciated by some stock investors, creating one potential source of market confusion, said Tom Porcelli, chief U.S. economist at RBC Capital Markets. “Equity investors think the runoff is going to continue in perpetuity,” he said.

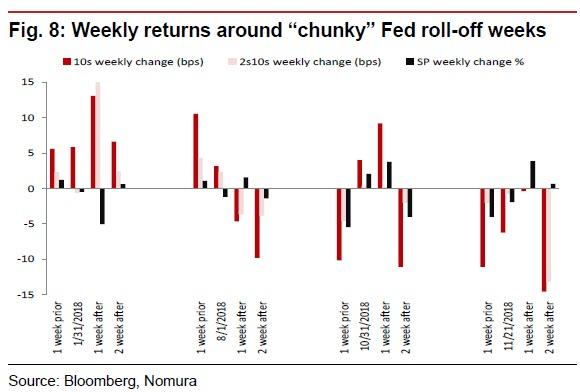

Well, no. As we discussed last week, investors are only doing what they did during QE and POMO days, only in reverse, and on days when the Fed withdraws liquidity, the market drops, in what JPM’s Marko Kolanovic explained recently has become a self-fulfilling prophecy.

Ultimately, the WSJ report could just be a trial balloon to see how markets – and maybe the president – react to signs of a more dovish take to shrinking the balance sheet. If it works, that should tell markets – and the Fed – everything they need to know. and so far, futures are solidly in the green…