“The world’s economy is growing more slowly than expected and risks are rising.”

– Christine Lagarde, IMF Managing Director

The recent market rally, which I had expected, has not surprisingly overshot many observers’ upside expectations.

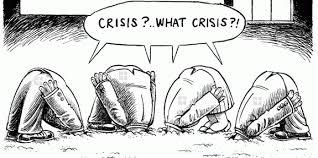

A possible explanation for the market’s extreme moves in the last two months or so is likely market structure in which the dominant force in the market (passive investors) worship at the altar of price momentum and are increasingly agnostic to balance sheets, income statements and “intrinsic values.” Indeed, in a market dominated by ETFs and quant trading (structured to “buy higher and sell lower”) and in which there is nothing like price to improve sentiment — investors seem to be ignoring the market’s shaky fundamental foundation.

The three core reasons to be bullish (and my responses) seem to be:

1. A more dovish Federal Reserve – I continue to believe the Fed, facing a disappointing domestic economy, will cease rate hikes in 2019. While many see this as positive, I think it reflects slowing growth. And with federal funds at only about 2.5% there are few monetary tools to stimulate growth going forward.

2. Confidence with regard to global economic growth – This view is unjustified based on high frequency economic data in the U.S. and by weakening growth in Europe and China. (See the quote from IMF’s Lagarde above) Even if interest rates are not increased, I don’t see it as a factor that will even stabilize U.S. growth. My baseline expectation is for +1% to +2% first half U.S. growth and a negative print in this year’s second half based on restrictive Fed policy (Quantitative Tightening), untenable debt loads, the widening national debt, political turmoil and a lapping of fiscal stimulus. The chances of a rate cut are increasing for this year (See my 15 Surprises for 2019).

3. The improving prospects for a resolution of our trade dispute with China – Over to my right, Jim “El Capitan” Cramer makes the case (which now seems to have become consensus) that China’s economic weakness improves the chance of a negotiated trade compromise with China. This is something I strongly disagree with – as I wrote in mid-January, 2019 in “An Optimistic View of Trade Talks With China May Not Be Justified”: